Border Carbon Adjustments (BCAs) alter the impact of carbon pricing on credit risk management. Banks must understand these nuances to properly manage their balance sheet risks.

Carbon pricing increases the risk of carbon leakage…

The ultimate goals for reducing CO2 and other Greenhouse Gases (GHGs) are agreed upon at a global level, at the Conferences of Parties (COPs). Importantly, in 2015, at the Paris COP, one of the most celebrated outcomes was the establishment of nationally self-determined targets. This meant that rather than have limits imposed upon them, each government would decide what it could commit to, and monitor that target accordingly.

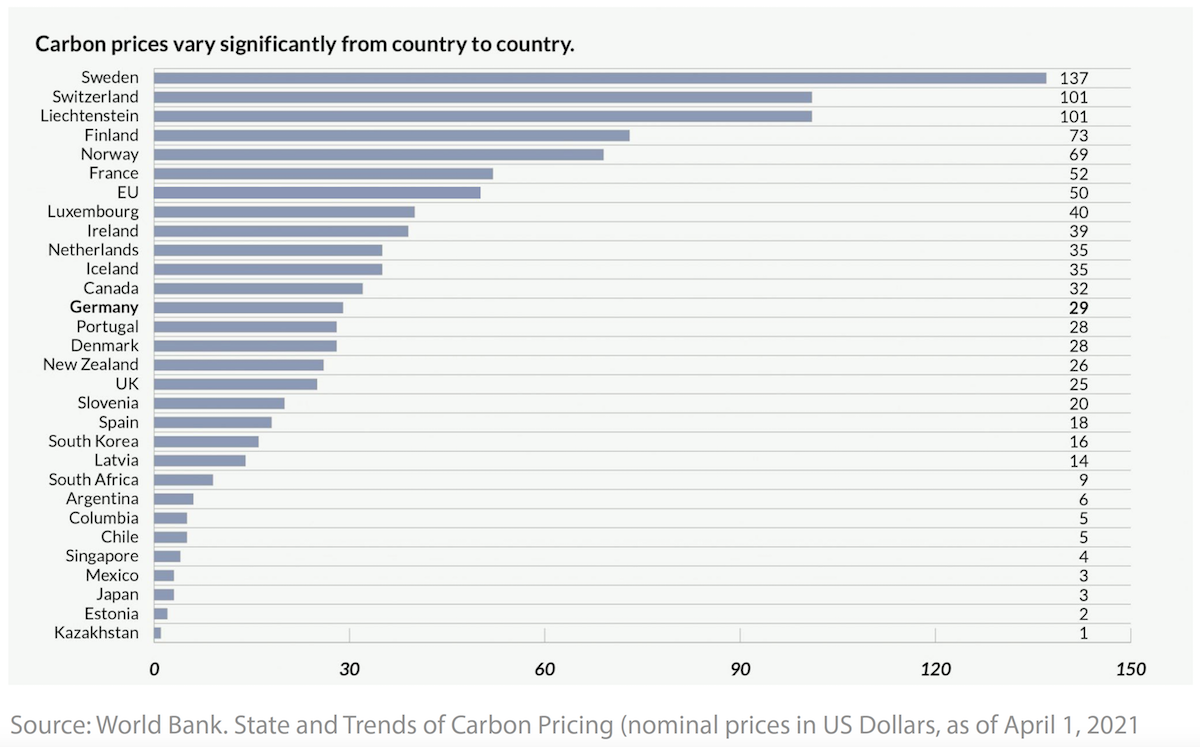

Once individual governments have set their own targets and systems to monitor them, they will typically create policies that are designed to meet those goals. The two most common policy tools are carbon taxes, whereby a price is imposed on per tonne of carbon produced, or, the development of an Emission Trading Scheme (ETS). Differential GHG policies around the world create a situation where there is a very wide range of carbon ‘prices’.

One unintended consequence of these regional carbon pricing schemes is carbon leakage.

Carbon leakage refers to the tendency of companies to move high GHG emitting production between regulatory regimes to avoid paying higher costs associated within the region with more aggressive climate changemitigation targets. In effect, such activity creates two problems:

- Economic damage to countries with ambitious climate goals

- Targets being met regionally, but an overall increase in GHG emissions globally

BCAs are designed to remove this risk…

BCAs, sometimes referred to as Border Tax Adjustments (BTAs) or Carbon Border Adjustment Mechanisms (CBAMs), are taxes aimed at ensuring that goods entering a carbon-regulated country are charged an equivalent amount as though they are produced in the country.

BCAs have proponents and critics. Proponents argue that they are required to ensure that the result of progressive climate policies in developed countries avoid:

- Exporting emissions to less-developed nations and destabilizing industries in the regulated country

- Creating systems where the effective price, including free carbon credits and subsidies, is too high to act as a disincentive to GHG emitters

Meanwhile, critics point to the possibility of BCAs:

- Disproportionately impacting less developed countries

- Negating COP15’s introduction of individual nations setting and monitoring their own climate targets

- Violating existing trade agreements

There is a blueprint for constructing BCAs…

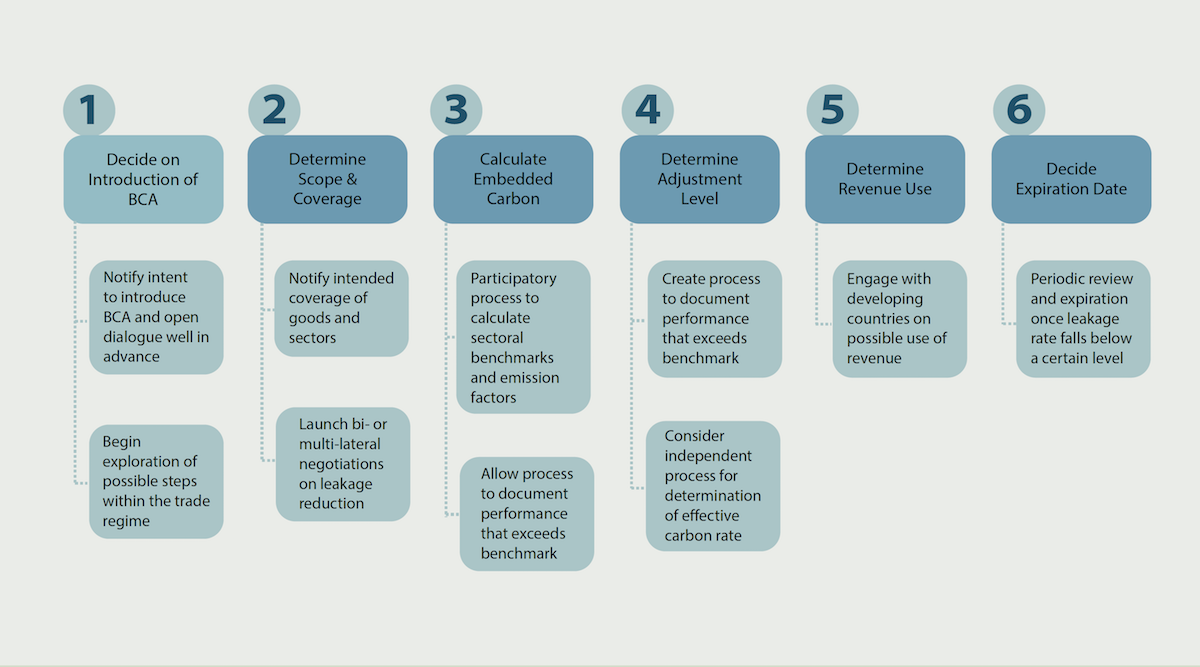

Climate Strategies, an international, not-for-profit research network published a guide to BCA design and implementation, which can be read here. The report recommends specific steps and considerations that must be taken into account for a scheme to be fair and effective.

The crucial point is that, if the overall goal of reducing GHG emission is to be reached in a globally fair manner, then the resultant carbon price must be carefully monitored. In this scenario, the harder hit countries must become stakeholders rather than victims of the scheme.

Governments are exploring BCAs…

Currently, California runs the only active BCA, but in 2021, the EU introduced legislation for its own CBAM to support the EU Green Deal. The bloc states that ‘the CBAM will equalize the price of carbon between domestic products and imports and ensure that the EU’s climate objectives are not undermined by production relocating to countries with less ambitious policies’.

The EU’s CBAM will use a system of certificates that cover the cost of ‘embedded carbon’ in imports into the bloc. EU importers will need to purchase the certificates, whose pricing will be based on the EU’s ETS carbon price. Areas where it can be shown that a carbon price has already been paid, this cost will be deducted from the importer outside of the EU.

Other leading economies looking closely at BCAs include Japan and Canada. In the US, BCA legislation was also introduced to the Congress in July 2021 that was substantially similar to the European plan.

Banks need to keep track of BCAs…

Policies designed to mitigate climate change through the regulation of GHGs create additional costs for firms in impacted industries. These costs have a knock-on effect on the business models and credit profiles of the firms. Lending officers and risk managers must ensure that any risk-related effects are understood and built into the risk management systems and processes.

Including climate change risk within the risk frameworks of financial institutions involves a number of steps, which include:

- Building scenarios based upon IPCC climate pathways, which cover global and regional routes to net-zero economies

- Costing of the scenarios using Network for Greening the Financial System (NGFS) estimates, which are given as GDP impacts

- Determining the speed at which the scenarios may become a reality

- Applying the fully-costed scenarios to the existing assets to ensure that impacts on the Risk-weighted assets (RWA) of banks are estimated

- Pricing new loans to incorporate the climate risk ‘spread’

BCAs mean that carbon pricing schemes in one regulatory jurisdiction will impact regions with different prices, plans, and goals. This means that banks must include additional nuances within their scenarios to reflect the new export tax.

GreenCap can help…

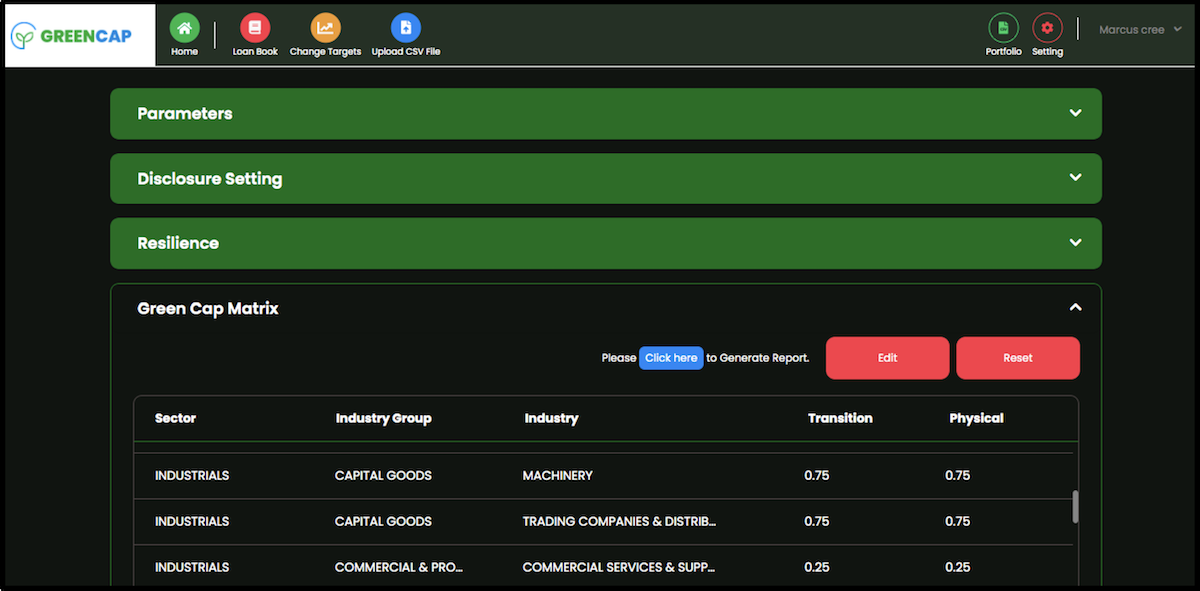

GreenCap is a ‘Risk as a Service’ (RaaS) solution that enables banks to construct climate pathways as scenarios to be applied to their balance sheets. Industry and firm-level exposure to the policy routes is reflected within matrices that represent each scenario.

The system allows scenarios to be fine-tuned in a way that captures the full spectrum of exposure, including the cross-border effects of BCAs, and hence provides a full 360-degree view of the financial risks that banks will needto deal with as we move through the green economic transition.