Product and Services

GreenCap Services

GreenCap’s products and services enables banks to accurately and systematically classify climate risks and apply them to their loan portfolios along potential climate scenarios.

GREENCAP has capacity to represent NGFS and local climate pathways. Banks can add their own scenarios or modify those that are already populated. Our team also

- Works with banks on methodologies to build climate scenarios.

- Conducts scenario design workshops to continually align and enhance system design and workflows.

- Builds additional parameters as requirements evolve.

Data Mapping

- GREENCAP provides capabilities and solutions to institutions to map their loan portfolios in accordance with universally accepted climate change definitions and parameters.

- The underlying transition and correlation matrix is based on MSCI ratings that are seamlessly mapped and integrated.

Loan Portfolio Mapping

- This service helps banks analyze and map their loan portfolios for resiliency, along with screening for ‘green-washing’.

- Besides determining resiliency scores, GREENCAP’s expert teams consult and assist banks to analyze their loan portfolio resiliency to climate change.

Economic Impact

- GREENCAP’s analytical models are regularly updated to incorporate evolving emission control regulations and their economic impact.

- GREENCAP’s dynamic industry matrices and data tools help project and evaluate possible future events utilizing financial and scenario analysis that assist institutions take future-proof decisions.

GREENCAP is a turnkey solution, designed to address five key needs of banks for sustainable lending and risk management

- Create multiple meaningful climate scenarios for assessing and projecting loan portfolio risks.

- Analyze existing loan portfolios to assess changing risk metrics against transitional and physical climate change.

- Price loans with incorporation of "green" risk factors.

- Intuitive, comprehensive, and seamless reporting for internal and external stakeholders.

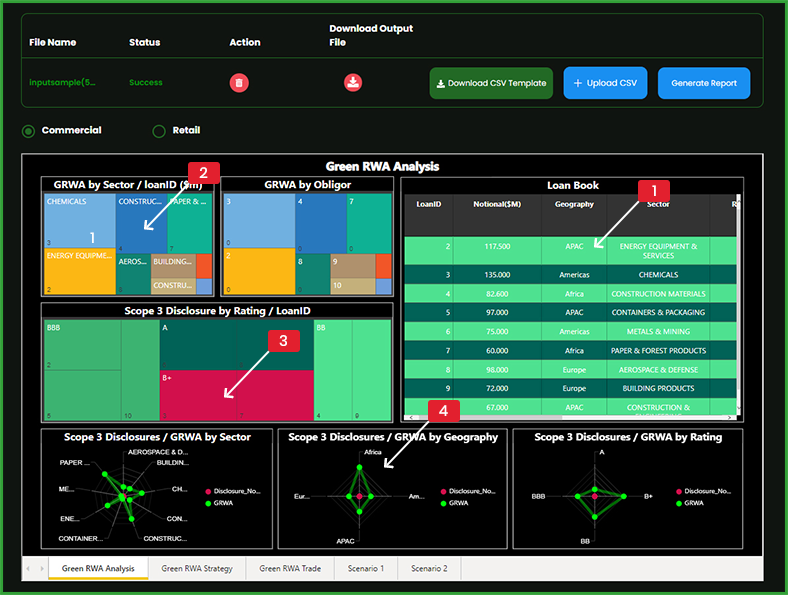

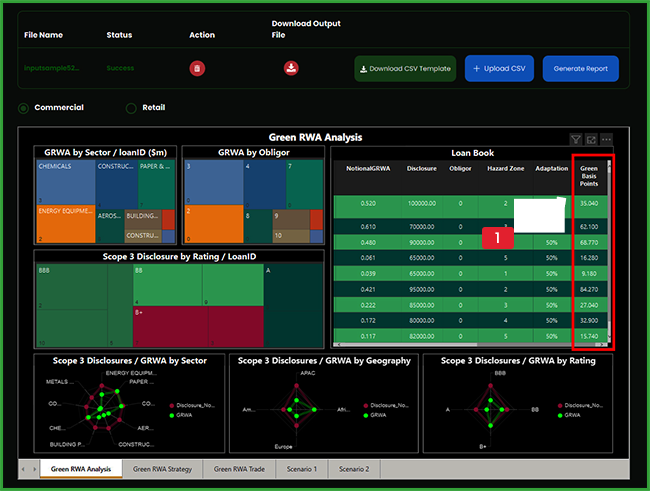

Commercial Loan Portfolio Report 1

- Balance Sheet details, including green risk value.

- Graphical breakdown of portfolio by green risk.

- Graphical breakdown of portfolio by scope 3 disclosures.

- Intuitive comparison between green financial risk and scope 3 disclosures.

Commercial Loan Portfolio Report 2

- Target greeness by geography, industry and rating.

- Graphical breakdown of portfolio vs target greeness.

- Target greeness by time to maturity.

- Target limit monitoring across sectors.

Commercial Loan Portfolio Report 3

- New deal impact on specific green targets and limits.

- Graphical breakdown of new deal effect on targets, before and after.

- Ability to add new loans or remove existing packets of loans.

- Easy navigation around GreenCap system outputs.

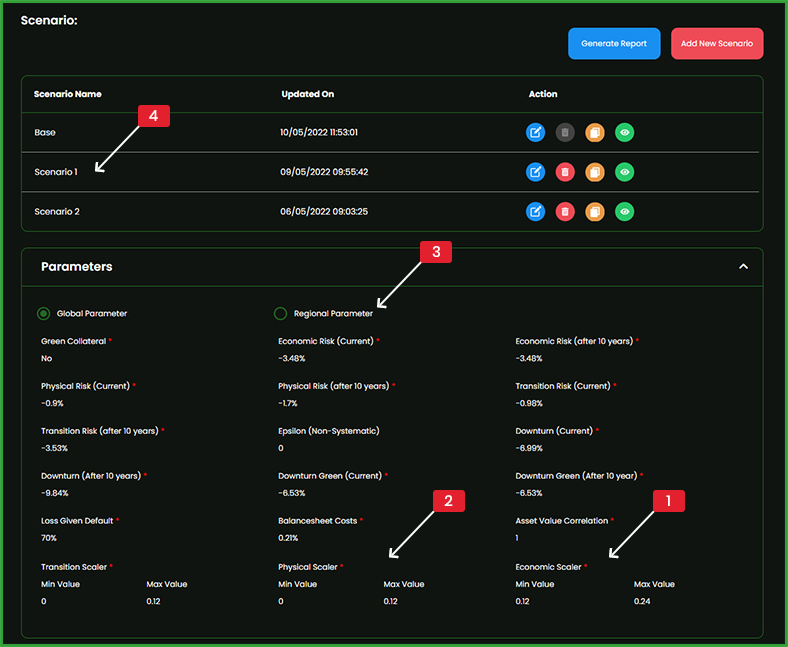

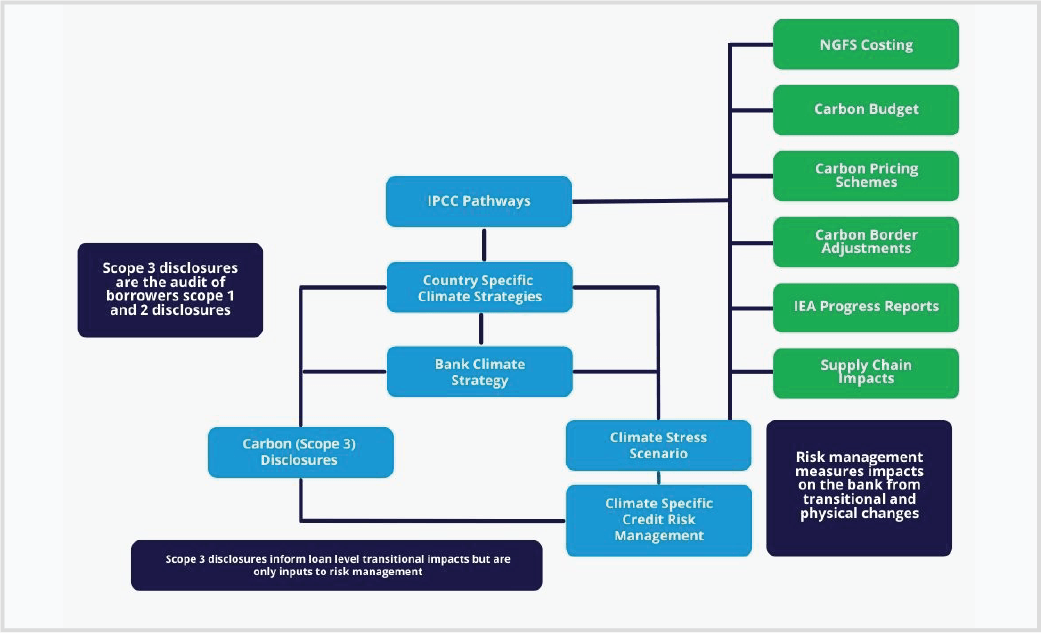

Meaningful Climate Scenarios

Climate change data is evolving at a rapid pace with global bodies such as Intergovernmental Panel on Climate Change (IPCC) creating pathways for arresting climate change. These pathways have been recreated and costed by the NGFS, along with regional government policy plans.

GREENCAP enables banks to represent multiple climate pathways segregated by:

- Impact and losses by country and targeted industries.

- Associated losses from upstream and downstream supply chains for specific/targeted industries.

Scenario Creation Dashboard

- Economic impacts of Transition risk.

- Economic impacts of physical risk.

- Specific geographic settings within scenarios.

- Multiple scenarios available to the user.

Supply chain impacts are calculated within GREENCAP by

correlating non-targeted and targeted industry returns.

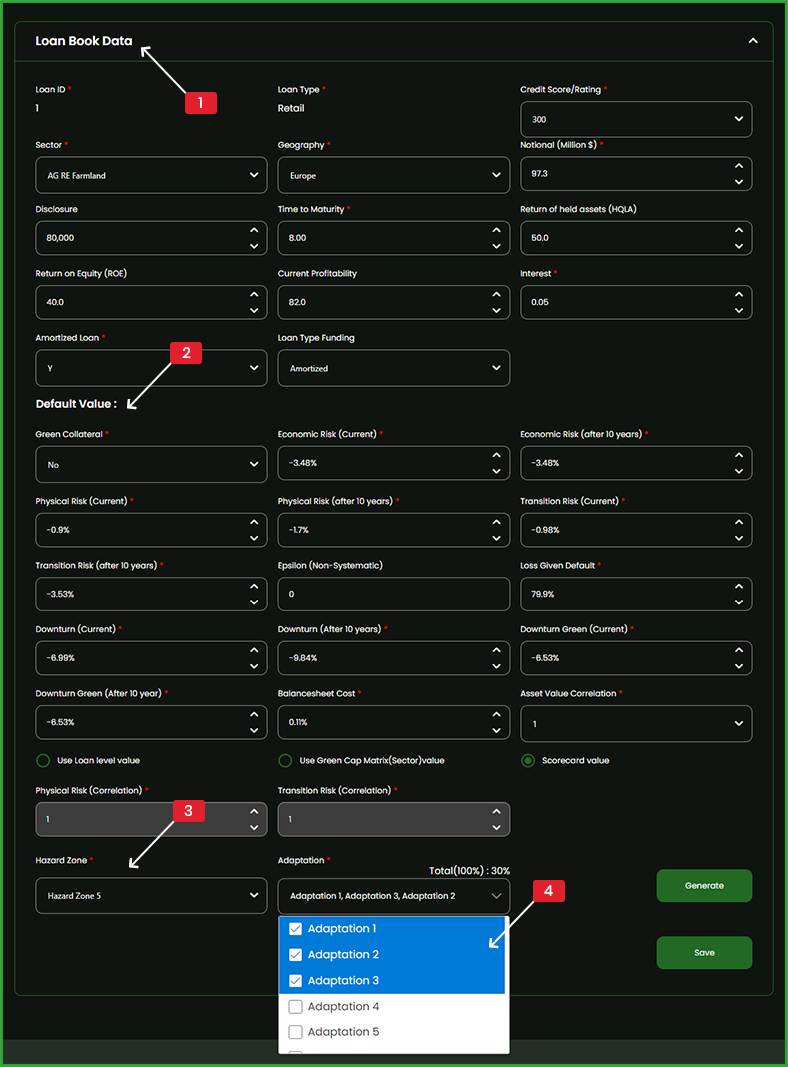

Loan Portfolio Analysis

Transitional plans from the IPCC and governments around the world will impact most sectors of banks’ loan portfolios. Once scenarios that reflect real world plans have been designed in GREENCAP, they are applied to commercial and retail sectors of the respective loan portfolios.

GreenCap’s loan portfolio services analyzes each loan individually from the following perspectives:

- Transitional impact on the sector.

- Specific climate adaptations made by each obligor to mitigate transition impact of climate change.

- Relative exposure of the obligor to physical climate impact.

Loan Book Editing Dashboard

- Loan details taken from the portfolio.

- Economic settings taken from the scenarios.

- Hazard zones attributed for local ‘physical risk’.

- Adaptations to reduce the impact of ‘transition risk’.

GREENCAP quantifies change in risk capital that can be expected by loan and sector. This is identified and highlighted in the system, including all contributing scenario details.

Potential Climate Scenarios

Scenarios Within Climate Risk Management

Sample Scenario

Scenario Report 1

- Scenario details shown with results.

- Loan portfolio, shown with green impacts.

- Graphical breakdown of impacts of the scenario.

- Evaluation of green targets, under the specific scenario.

Climate Strategy

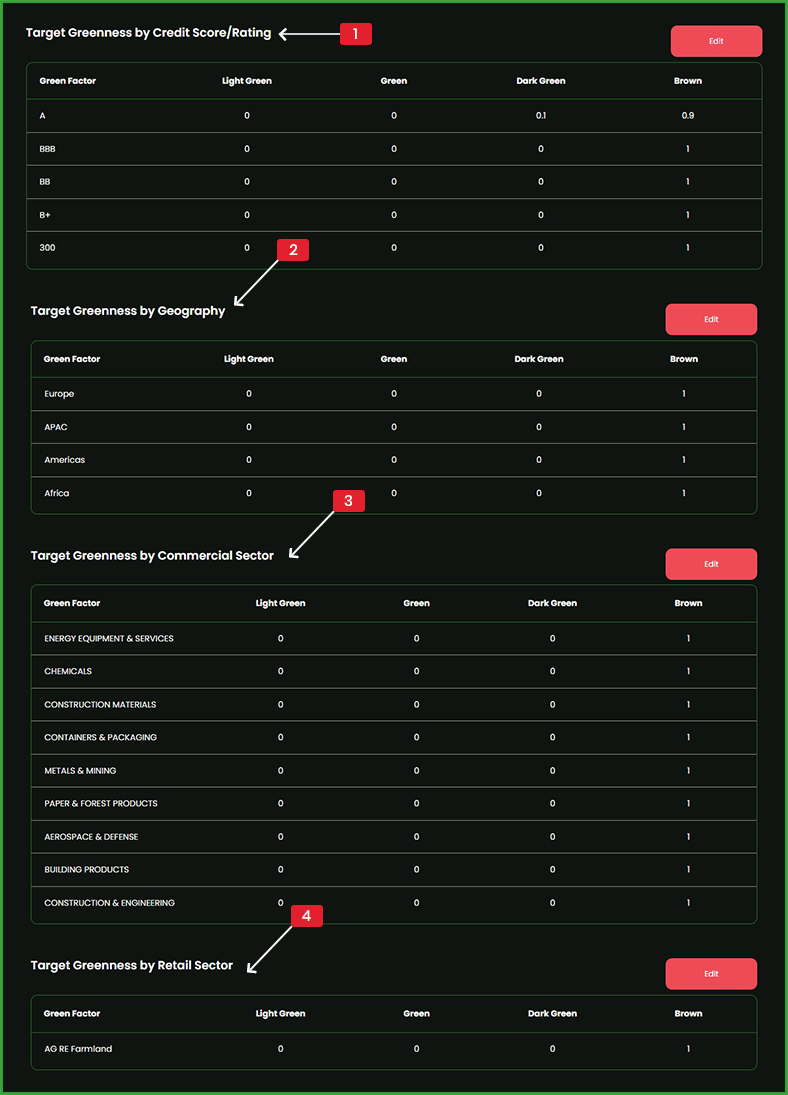

Target Modification Dashboard

- Green impact targets set by current credit rating.

- Green impact targets set by geographic region.

- Green impact targets set by commercial sector.

- Green impact targets set by retail sector.

Green RWA Strategy Report

- Target greeness by geography, industry and rating.

- Graphical breakdown of portfolio vs target greeness.

- Target greeness by time to maturity.

- Target limit monitoring across sectors.

Loan Pricing

Climate risk creates incremental capital requirements for the bank. The consequent capital and funding increases are converted into basis-point changes in loan spreads.

GreenCap provides comprehensive loan portfolio pricing models that compute spread changes at loan level scenarios.

- Additional risk capital requirements are converted into a spread on each loan.

Loan Pricing Basis Point Report

Intuitive System Design

GreenCap Products & Services Brochure