There is much discussion about the physical impacts of climate change on Africa, but the central banks of this continent are well aware of, and are preparing regulations to deal with increased credit and liquidity risks created by the physical and transitional elements of global warming. Banks in the region need to pay close attention.

Africa is disproportionately affected by climate change…

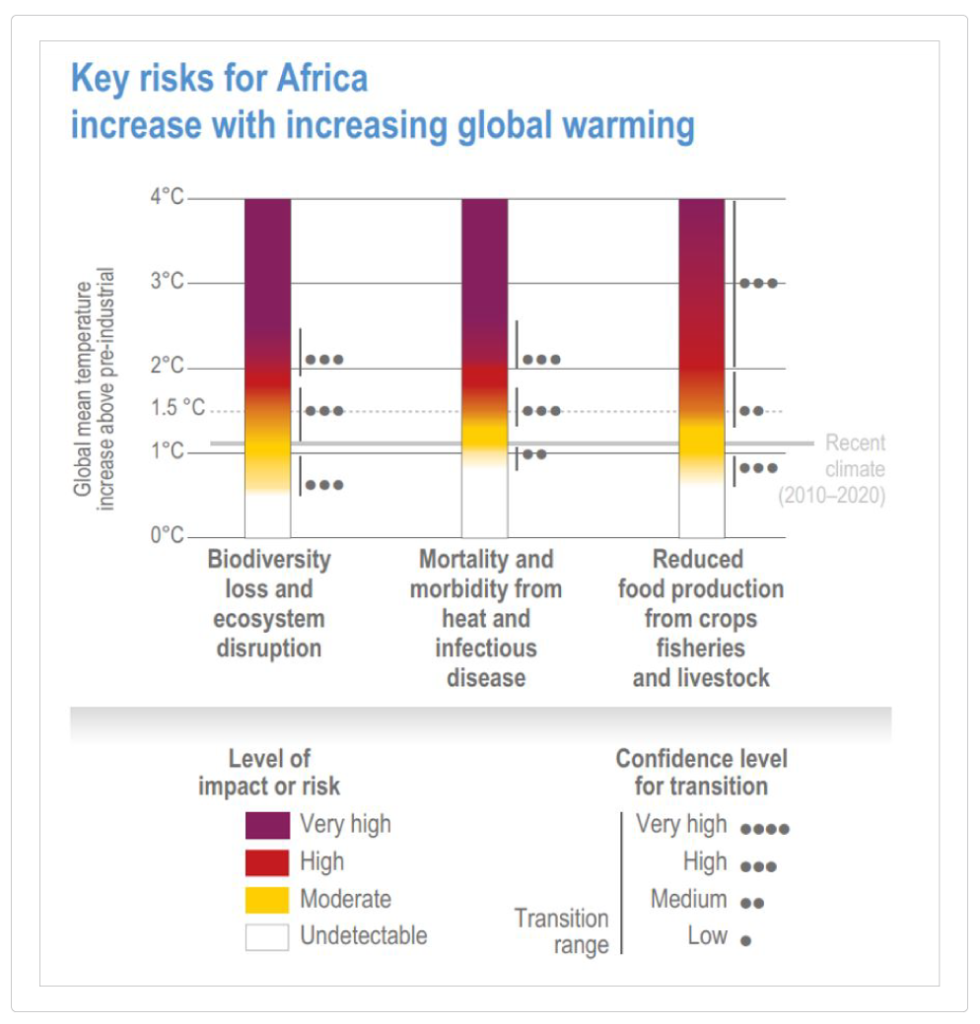

While contributing a negligible amount of CO2 to the overall atmospheric accumulation, Africa is one of the most highly exposed continents to the impacts of climate change in the world. According to the latest report by the ‘Intergovernmental Panel on Climate Change’ (IPCC), the region is expected to experience substantial negative impacts from global warming, even in and around the globally agreed targets of 1.5 and 2 degrees.

Temperature rises of 3 degrees put Africa at ‘very high risk’ across key sectors.

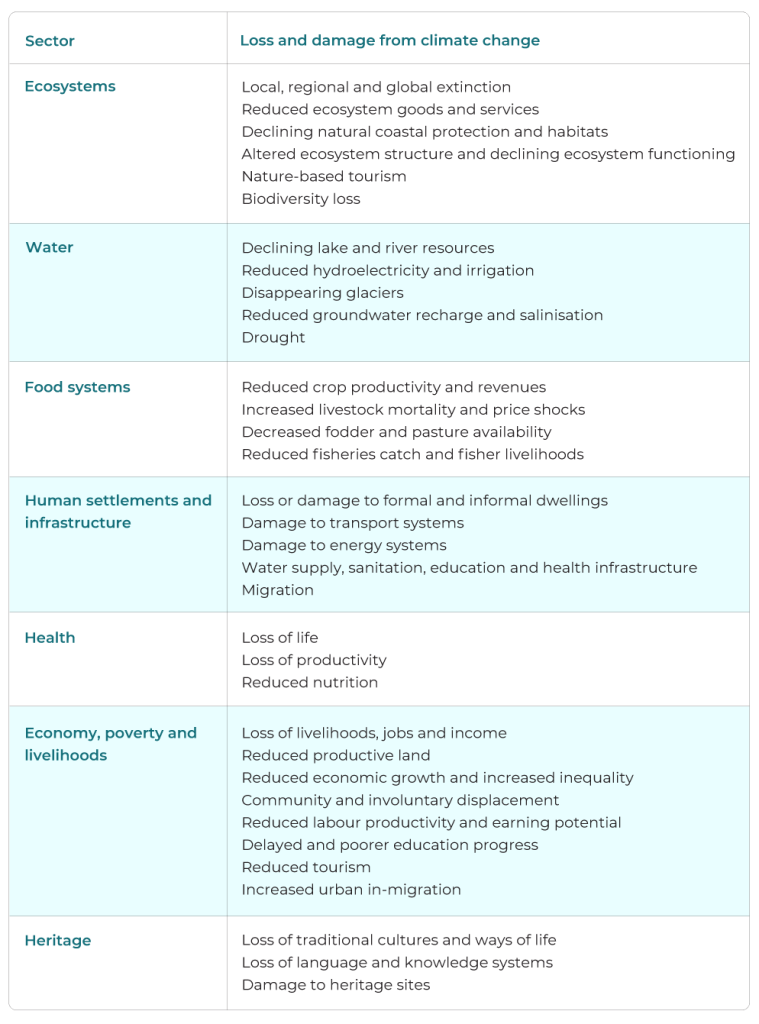

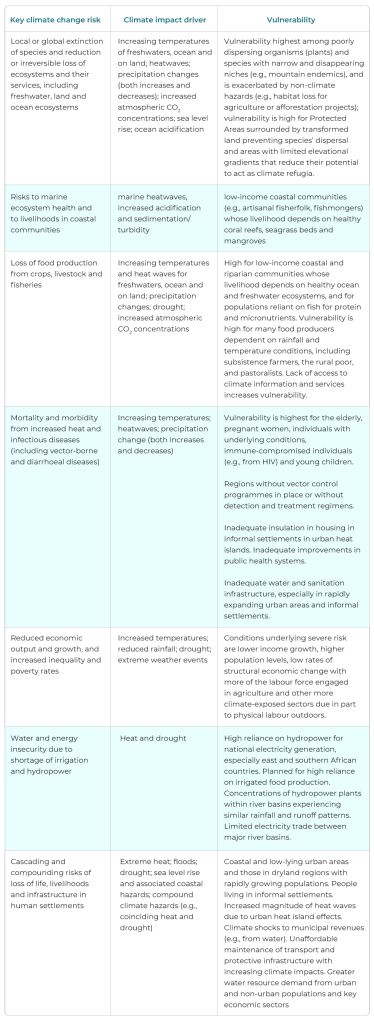

The report highlights more details on the sector with specific ‘key risks’ as follows:

With specific vulnerabilities within the following areas:

A result of already being a relatively low ‘Greenhouse Gas’ (GHG) and its ‘frontline’ position against physical climate change, African countries are directing their climate-related commitments and policies as much towards adaptation than mitigation.

53 (of 54) African countries have submitted NDCs to the UN…

Governments from the continent have submitted ‘Nationally Determined Contribution’ (NDC) to the UN. These documents were created as a result of the Paris-based ‘Conference of the Parties’ (COP) 21. This conference was seen as a breakthrough moment in the history of climate change because of the agreements in several specific areas:

- Attendees agreed to limit global warming to 2 degrees above pre-industrial levels.

- Attendees agreed to make best efforts to limit global warming to 1.5 degrees above pre-industrial levels.

- Attendees agreed to create local plans within their own countries that would specify targets and actions to achieve them. These NDCs would then be ratcheted up over time.

The key to success was that the NDCs were separate from overall ambitions. This was a political device that allowed high-level ambitions to be agreed upon before the means of delivering it were decided. There has been, and continues to be, a disagreement between countries as to what constitutes ‘fair share’ in terms of economic disruption. The nexus of this argument is that Africa has the most to gain from reaching the target heating limits, while it contributes the lowest amount of GHG.

53 of the 54 African countries have submitted their NDC documentation. The breakdown of all NDCs can be accessed at the African NDC Hub. As examples, below are three of them, along with the ambitions, targets and target sectors.

GHG Reduction:

- 20% (unconditional) and 45% (conditional)

- 40% energy efficiency target by 2030

- 2% energy efficiency improvement per year

- End gas flaring by 2030

Targeted Economic Sectors:

- Energy & Efficiency

- Agriculture

- Infrastructure & Housing

- Waste

Adaptation Commitment:

- Efficiency standards for new cars

- Housing standards for CC adaptation

- Climate-smart agriculture and reforestation

GHG Reduction:

- 15% below ‘Business as Usual’ (BAU) (unconditional), and 45% (conditional)

- Double energy efficiency improvement to 20% in industrial facilities by 2030

- Scale up access and adoption of 2 million efficient cook stoves up to 2030

- Scale up renewable energy penetration by 10% by 2030

- Increase solar lantern replacement in rural non-electrified households to 2 million

- Double the current waste-to-compost installed capacity of 180,000 tons/annum by 2030

Targeted Sectors:

- AFOLU

- Energy

- IPPU

- Transport

- Infrastructure (climate-proofing)

- Waste

Adaptation Commitment:

- City resilient infrastructure

- Solar home systems (incl. lantern)

- Efficient cook stoves

- Mass transportation

- Methane recovery increased to 60% of landfills by 2030 (40% in 2025)

- Biogas

- Compost

- Phase-out of HFCs in AC (green cooling)

South Africa

GHG Reduction:

- Targeted trajectory – peak, plateau and decline

- Decarbonized Energy system by 2050

Targeted Sectors

- AFOLU

- IPPU

- Energy & Efficiency

- Waste

Adaptation Commitment

- Energy-efficient lighting

- Efficient motors + appliances

- Solar water heaters

- Electricity + hybrid vehicles

- Advanced bioenergy

- Carbon Capture & Storage

- Implementing regulatory standards & controls

All NDCs across the continent can be segmented in the same way, providing a broad view of regional climate-related policy areas and economic ambitions.

Costs associated with NDCs have been estimated…

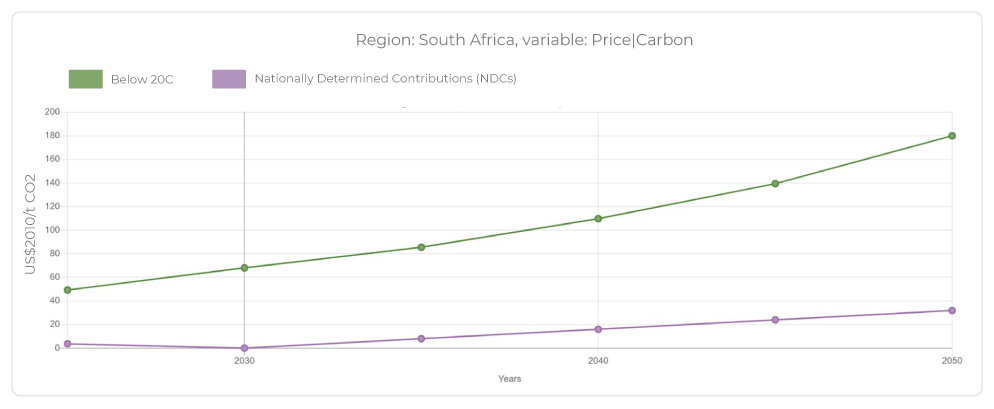

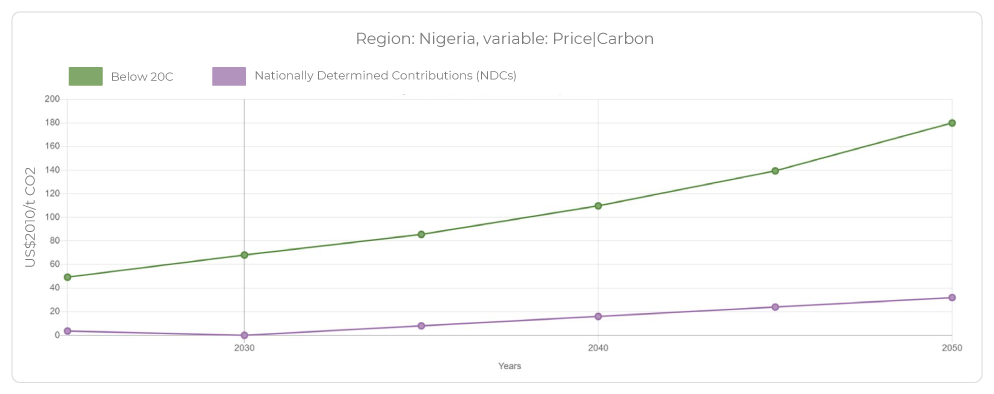

The ‘Network for Greening the Financial System’ (NGFS) is an international collective of central bankers and economists who analyze climate policies and pathways with a view to putting costs against them. The NGFS view the issue in myriad ways, including:

- No action.

- 1.5-degree limit

- 2-degree limit

- Delayed transition

- NDC

- …

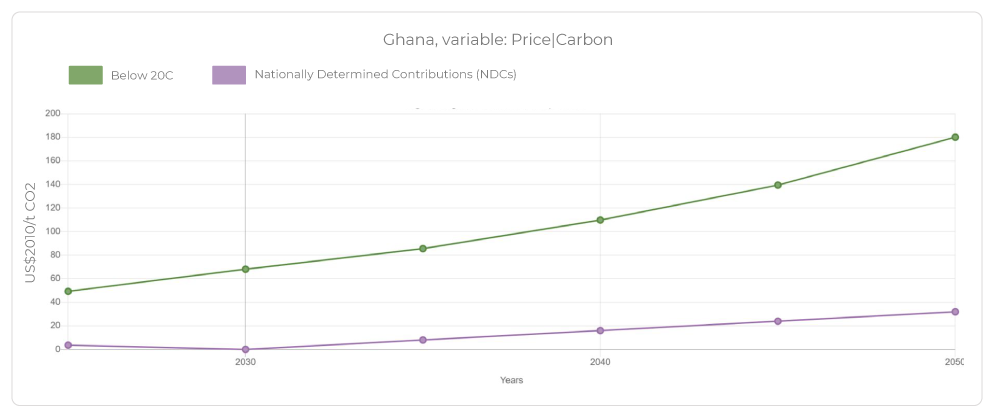

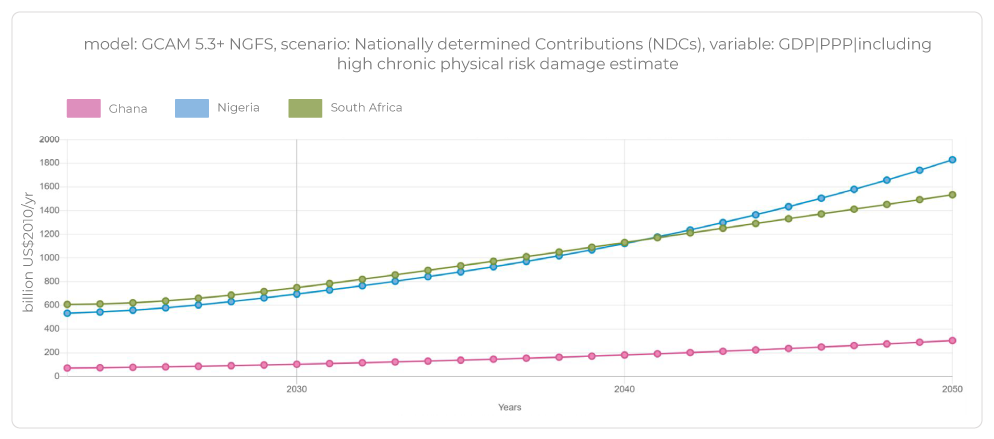

This analysis provides the means to increase the dimensionality of African climate initiatives, from target sectors and actions, to costs, along multiple scenarios. There are two strong alternatives for the costing of policies – the first is to use the estimated GDP impacts, with the second using the implied cost of carbon that is calculated locally and can be used in the context of stated targets. Both are reasonable starting points for putting dollar values against NDCs.

The combination of researched policy outlines, along with analyzed costs to their affected economies, provides enough data for banks to estimate how countries, sectors and industries they lend to may be impacted by these additional costs. Once those impacts are estimated, they can be translated into impacts on borrower credit riskiness, economic capital and the rise in potential liquidity risk.

African Central Banks are taking notice and moving towards regulatory reporting…

Increasing climate-related risks to banks cover all areas, but the most concerning to central banks and regulators across Africa are credit and liquidity risk amplifiers. This mirrors the analysis emerging from the ‘Basel Committee on Banking Supervision’ (BCBS), which published, in June 2022, ‘Principles for the effective management of

climate-related financial risks’.

The paper’s 12 key principles are as follows:

Principle 1: Banks should develop and implement a sound process for understanding and

assessing the potential impacts of climate-related risk drivers on their businesses and on the

environments in which they operate.

Principle 2: The board and senior management should clearly assign climate-related

responsibilities to members and/or committees and exercise effective oversight of climate-related financial risks.

Principle 3: Banks should adopt appropriate policies, procedures, and controls that are

implemented across the entire organization to ensure effective management of climate-related

financial risks.

Principle 4: Banks should incorporate climate-related financial risks into their internal control

frameworks across the three lines of defense to ensure sound, comprehensive and effective

identification, measurement and mitigation of material climate-related financial risks.

Principle 5: Banks should identify and quantify climate-related financial risks and incorporate the

ones assessed as material over relevant time horizons into their internal capital and liquidity

adequacy assessment processes, including their stress testing programs where appropriate.

Principle 6: Banks should identify, monitor and manage all climate-related financial risks that

could materially impair their financial condition, including their capital resources and liquidity

positions. Banks should ensure that their risk appetite and risk management frameworks consider all material climate-related financial risks to which they are exposed and establish a reliable approach to identifying, measuring, monitoring, and managing those risks.

Principle 7: Risk data aggregation capabilities and internal risk reporting practices should

account for climate-related financial risks.

Principle 8: Banks should understand the impact of climate-related risk drivers on their credit risk profiles and ensure that credit risk management systems and processes consider material

climate-related financial risks.

Principle 9: Banks should understand the impact of climate-related risk drivers on their market

risk positions and ensure that market risk management systems and processes consider material climate-related financial risks.

Principle 10: Banks should understand the impact of climate-related risk drivers on their liquidity

risk profiles and ensure that liquidity risk management systems and processes consider material

climate-related financial risks.

Principle 11: Banks should understand the impact of climate-related risk drivers on their operational risk and ensure that risk management systems and processes consider material

climate-related risks.

Principle 12: Where appropriate, banks should make use of scenario analysis to assess the

resilience of their business models and strategies to a range of plausible climate-related pathways and determine the impact of climate-related risk drivers on their overall risk profile.

Examples of the incorporation of the BCBS paper can be seen across Africa, with Mauritius, a ‘Small Island Developing State’ (SIDS) that is highly vulnerable to climate change, being an example. Its own April 2022 ‘Guideline on Climate-related and Environmental Financial Risk Management’ expects climate change to sit within banks’ standard risk management. Climate-specific analysis and reporting must:

- Include the development of relevant risk indicators to categorize counterparties, sectors, and geographical locations based on the extent of climate-related and environmental financial risks.

- Comprise an adequate risk monitoring process, which includes usage of qualitative and quantitative analytic tools and metrics to monitor relevant risk indicators and climate-related and environmental financial risk exposures against the overall strategy and risk appetite for climate-related and environmental financial risks, and to support decision making.

- Ensure that the risk appetite framework incorporates relevant risk exposure limits and thresholds for risks.

- Encompass measures to encourage counterparties to provide relevant disclosures on climate-related and environmental financial risks.

The message is very clear: climate change increases credit and liquidity risks from both its physical effects and the costly transitional policies created to halt its progress. African banks need to expand their current risk frameworks to explicitly include these risks.

Africa has other incentives to move quickly on climate-related financial risk regulation…

In 2022, Egypt hosted COP 27, where the major accomplishment was forward movement on the long-discussed ‘Loss and Damage’ fund. This concept is that high GHG emitting countries, where their economic development has been based, at least partly, on fossil fuels, pay into a fund to be used to assist highly impacted, low emitting countries. In Egypt, the fund was agreed upon in principle, but how it will be funded was left for analysis and reporting at COP28.

This becomes important in the context of regulation as it creates a new incentive for Africa to be seen as leading the way in terms of building green economies. As one of the most highly climate change impacted areas of the world, it must become the example of ‘green’ best practice to make a case for funding the ‘Loss and Damage’ fund inarguable.

The time for banks to take action is now…

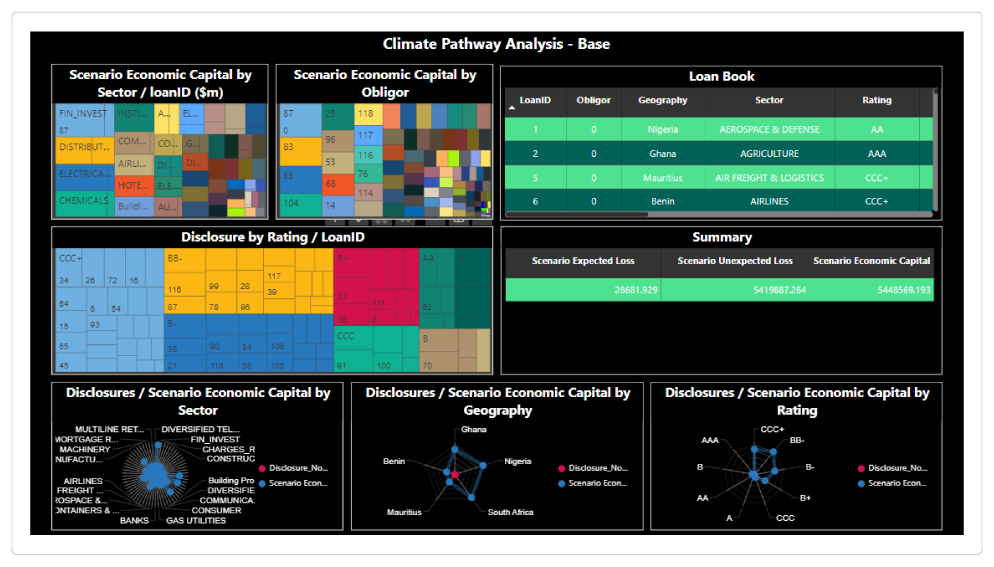

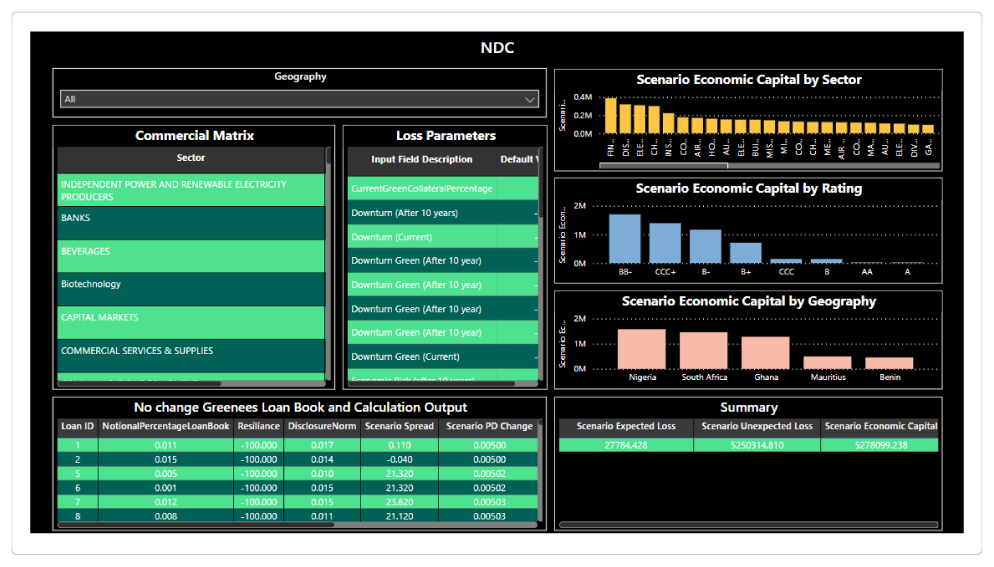

African banks must include climate-related risks within their standard risk management frameworks and risk appetites. This means:

- Creating forward-looking scenarios that mirror published climate pathways, including physical and transitional elements.

- Applying these scenarios to loan books and balance sheets.

- Creating climate-influenced ‘shadow’ changes credit profiles and ratings.

- Calculating changes in economic capital and implied loan spreads.

- Incorporating these results into credit risk reporting and ‘Contingency Liquidity Planning’.

This will not only bring them into line with the regulatory trend towards specific climate-related risks, but also provide risk departments and governance committees with insights into emergent risks, which will allow them to prepare and strategize accordingly.

The recent changes in the global approach to climate-related financial risk has been covered in:

Climate scenario building within banks has been covered in:

GreenCap can help…

GreenCap is a ‘Risk As A Service’ (RaaS) solution that enables banks to run transitional and physical risk assessment against their balance sheet that reports individual loan and portfolio level, providing:

- Implied PD changes across multiple climate pathways

- Economic capital changes – Broken into expected and unexpected losses

- Implied spreads on climate-impacted loans

The system supports multiple scenarios and pathways and allows bottom-up adaptations to be added at the customer level for fine-tuning risks and exposures. As a cloud service, GreenCap is extremely fast to implement and use for exactly the type of analysis that is being, or about to be, asked for by Central Banks across Africa.

Africa system main page

Scenario

Scenario

GreenCap is designed to be used by banks of all sizes.

Visit GreenCap.live for more insights and resources designed to assist banks in navigating the challenges posed by climate change and policies introduced to mitigate it.