Direct and indirect subsidies into sustainable projects enable banks to recognize the focus and speed of climate change mitigation/adaptation.

The gap that exists between the funding requirement of the transition to a greener global economy, and the budgeted plans from world governments, is currently estimated to be in trillions of dollars. Private finance is expected, and needed, to fill this gap, and banks will be the main conduit for the flow of funds.

Individual projects represent an increased credit risk. This can be a difficult determination for banks to make, as the success or otherwise of green projects is largely dependent upon the support provided by government funding. This ‘de-risking’ of specific projects is vital to attracting private funds, particularly those where the returns are expected over a longer timeframe, such as the many city infrastructure projects that are requiredto underpin the sustainability transition.

Regional and national governments are already putting down these ‘market markers’…

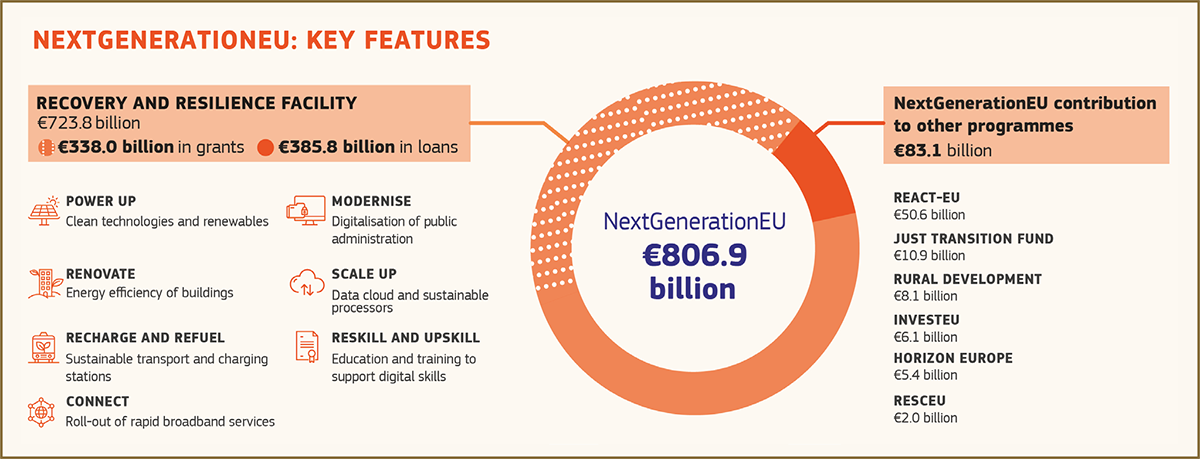

The EU, as an example, has developed its ‘NextGenerationEU’ (NGEU) and ‘Recovery and Resilience Facility’, which are designed to stimulate a sustainable recovery across the bloc.

The NGEU represents the regional ambition across its core sustainable objectives as specified in the ‘Green New Deal’ which is:

- No net emissions of greenhouse gasses by 2050

- Economic growth decoupled from resource use

- No person and no place left behind

The NGEU aims to mobilize 800 billion euros of funding in the form of grants and loans to make the EU Green Deal a reality.

The ‘Recovery and Resilience Facility’ (RRF) is a major offshoot of the NGEU, aiming to fund the following areas of the EU’s long-term growth:

- Power up – Greening the energy mix of the union

- Renovate – Greening the built environment

- Recharge and refuel – Greening European transport

- Scale-up – Greening the cloud facilitation

- Connect – Rapid broadband availability

- Modernize – Digitalization of the EU administration

- Reskill and upskill – Skills for a modern greener economy

As can be seen, the RRF supports two growth ambitions within the EU – climate neutrality and digital transition. It is a temporary facility, wherein commitments have been made regarding investment allocation, to assist member states in kick-starting their individual investment plans.

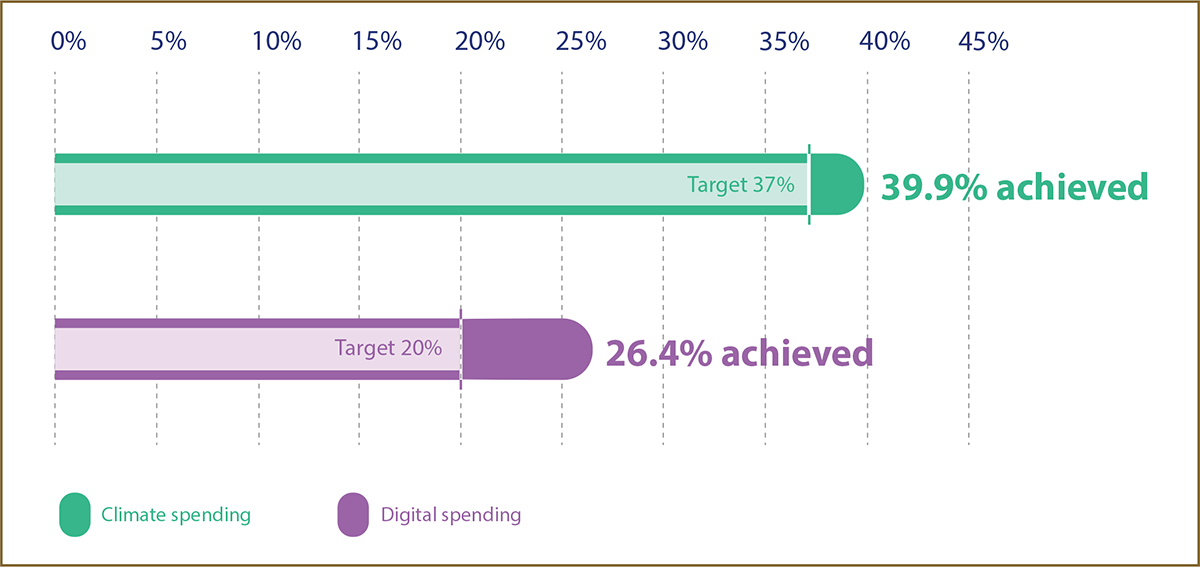

Across the 27 states that form the European Union, 22 have submitted resiliency plans. Targets set by the EU for climate mitigation and digitalization include 37% and 20% allocations within these plans, respectively.

The top-down planning is already paying dividends, with the 22 plans collectively allocating above the target levels in both ambitions.

Individual countries’ plans may go deeper with their green market markers…

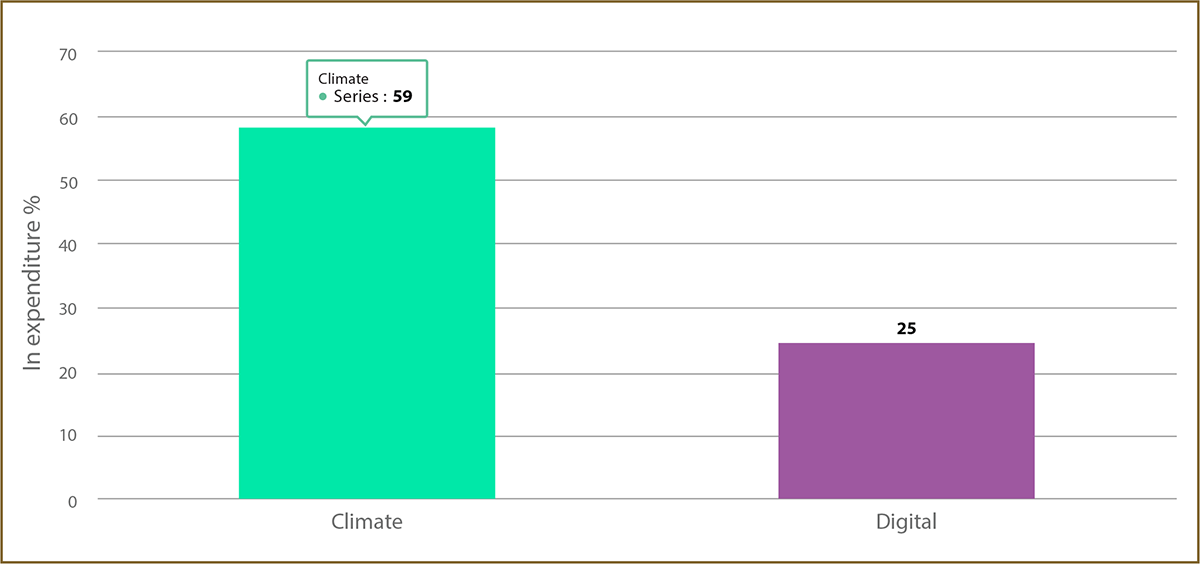

Denmark’s plan is a specific example of a resiliency plan, wherein 59% (or 923 million euros)represents green investments.

This includes:

- Green tax reform

- Reprioritization of the registration tax of vehicles

- Research program in a green solution

- Carbon-rich soils

- Energy-efficient measures

These are all geared to act as incentives rather than complete solutions. An example is the green tax reform, which initially increases taxes based on a business’s energy consumption but will ultimately become a Greenhouse Gas (GHG) emission tax.

Environmental resiliency plans are emerging globally…

The examples cited in this paper are just a small sample of the policies and initiatives underway across the world. Each region has aims, policies, public funding, and private investment plans. The uniting characteristic is de-risking of the green transition.

Banks need to monitor plans to gauge the rate of green transition…

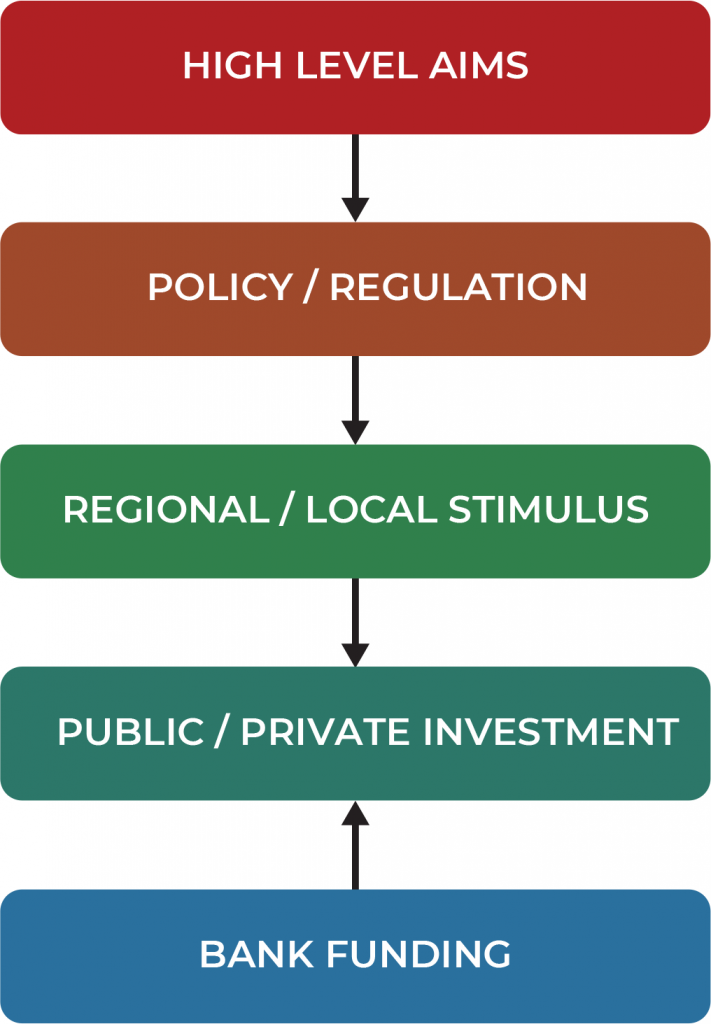

The overarching aim of resiliency plans is to stimulate growth and de-risk private investments. The top-line ambition is translated into specific targets and plans, which lead to public-private ownership of the transition and the capital required to make it real.

The industries and projects that attract support through tax incentive schemes, direct grants, or subsidized loans will enjoy an increasingly benign business environment and lower credit risk on any additional private investment.

These are the indicators that allow banks to construct matrices that map out the correlation between ‘brown to green’ transition pathways (scenarios) and the impact on individual sectors, firms and projects.

Once this is built, green funding, or at least loans into clearly supported areas can be made at interest rates that reflect the lower risk they represent to the bank. From the amount that needs to be held as risk capital, the risk can be quantified and translated into an appropriately lower spread on the interest rate.

- Assess the loan in terms of the borrower’s current credit profile

- Calculate the risk capital requirement of the loan

- Adjust the profile to reflect the correlation to established green transition planning

- Calculate the green risk capital adjustment

- Adjust the interest rate spread that is required

Banks can use this to either improve the monitoring of climate-related risks on their balance sheets or establish internal centers of expertise in green lending.

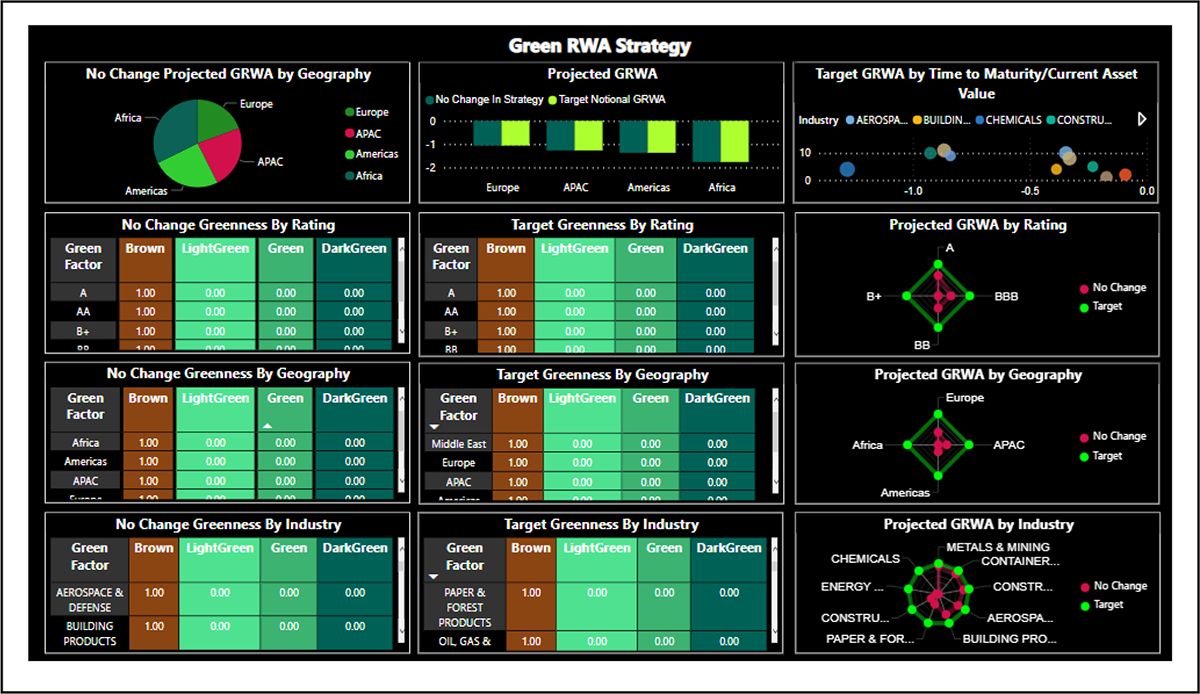

GreenCap can help…

GreenCap is a climate-specific ‘Risk as a Service’ (RaaS) that enables banks to build climate pathway-specific risk analysis for their current and future balance sheets. The system is designed to work as a calculator to assist in risk management and specific green finance pricing.