The UK’s ‘Mission Zero’ report offers banks a useful blueprint for measuring the gulf between ambition and policy. The report and its recommendations are useful in climate scenario planning, as well as in interpreting results from them.

In January 2023, The UK released its assessment of its own progress towards net zero by 2050…

The report – Mission Zero – offers a detailed review of the progress made towards the UK’s stated target, as well as the economic context in which net zero must be achieved. Throughout the report, it is stressed that:

- The transition to a sustainable economy involves significant disruption to the current UK model

- The transition offers as many economic opportunities, with 90% of GDP covered by the target

- The UK is in a global race to exploit ‘green’ economic opportunities, citing the US ‘Inflation Reduction Act’ (IRA) and the EU’s ‘Fit for 55’ initiative

- The UK is well-placed in the global race due to its natural abundance of renewable energy, particularly offshore wind and green finance

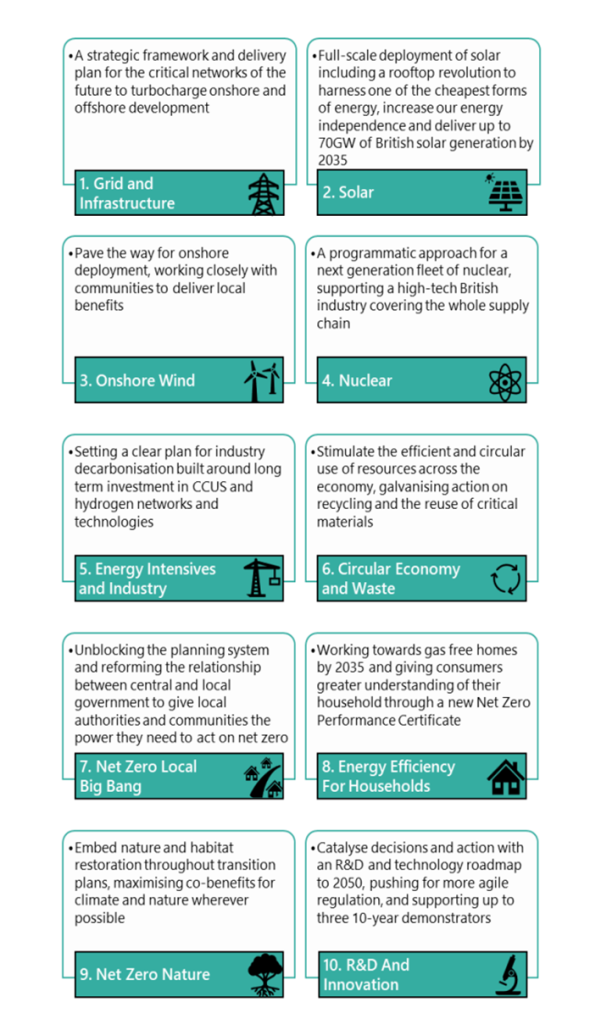

10 priority missions were identified within the report:

A key point that is made early in the report underlines just how swiftly the net zero trajectory may steepen.

The Review’s evidence points towards some basic principles of effective net zero decision making that should underpin this action. We must:

- Quickly take the decisions we know we have to. This is how we will achieve net zero in a more affordable and efficient way, at the same time as providing certainty for inward investment in the UK;

- Invest in research and development so we are ready to take decisions that we know we are going to have to make, such as rolling out demonstrator projects; and

- Prepare the ground with agile and flexible policy frameworks so we are ready for the future, resilient in the face of uncertainty, and equipped to act at speed when opportunities arise.

Further, the economic conditions that must be created for the private sector to fully engage and play its part are detailed:

The UK economy is transitioning towards net zero – with businesses decarbonising and

capturing new opportunities. But the Review has heard from the hundreds of businesses

consulted that more is needed. In many cases, cross-cutting actions is required – on skills,

support for small and medium businesses, and providing the right investment environment.

The Review recommends:

- Reviewing incentives for investment: Review how HMT incentivises investment in decarbonisation, including via the tax system and capital allowances

- Protecting industries from environmental undercutting: Progress with the consultation on carbon leakage measures and speed up decision-making to enable Government to implement effective future carbon leakage mitigations from 2026

- Providing a forward look on the ETS: To provide businesses with certainty and increase the incentives to invest in new, green technologies, the government should work within the UK ETS Authority to develop a pathway for the UK ETS until 2040

- Building the skills needed for the transition: Drive forward delivery of the Green Jobs Taskforce recommendations and the commitments from the Net Zero Strategy, reporting regularly on progress starting by mid-2023

- Helping SMEs upskill: Launch a ‘Help to Grow Green’ campaign, offering information resources and vouchers for SMEs to plan and invest in the transition

The important message here is that policies are under development to support the ‘net zero’ objective, and these policies will structurally make brown companies more expensive to run, at the same time as incentivizing their green competitors. It is this market-based ‘invisible hand’ approach that will go on to fundamentally change the funding conditions that banks will contend with as they, in turn, finance the transition.

Specific industries are singled out for green wins…

Homes and home building represent a large proportion of the UK’s emissions, and naturally receive focus with specific recommendations that will have a material impact on firms building houses and the future market for private real estate. These include:

- Government must bring forward all consultations and work to mandate the Future Homes Standard by 2025 and for all homes sold to be EPC ‘C’ by 2033.

- A Net Zero Homes Standard should be considered for the future, as homes that have taken the appropriate steps to be as efficient as possible through a mixture of fabric and low-carbon heating measures will be more financially desirable to live in, buy, and sell.

- The government must urgently adopt a 10-year mission to make heat pumps a widespread technology in the UK and regulate now for the end of new and replacement gas boilers by 2033 at the latest.

- The government must urgently reform EPC ratings to create a clearer, more accessible Net Zero Performance Certificate (NZPC) for households.

The wider list of 25 industry-oriented high-level recommendations is as follows:

| Objective | Recommendation |

| 1. Cleaner, greener homes | Provide certainty by 2024 on the new and replacement gas boiler phase out date to drive industry and investor confidence. The Review recommends bringing the proposed date of 2035 forward and legislating for 2033. Set a legislative target for gas free homes and appliances by the same date, to contribute to a gas free grid in future. Legislate for all homes sold by 2033 to also have an EPC rating of C or above, with exclusions around certain properties (e.g. listed properties, on grounds of affordability). Government should mandate landlords to include ‘average bill cost’ alongside EPC (and possible NZPC) rating, when letting out a property. This will help renters understand what costs to expect, while also helping to put a premium on energy efficient homes. |

| 2. Cleaner, greener homes | Bring forward all consultations and work to mandate the Future Homes Standard by 2025 to prevent further delays by ensuring standard applies to all developments. This should include a consultation on mandating new homes to be built with solar and deliver the Net Zero Homes Standard, ensuring that the planning system is flexible enough to enable this. |

| 3. Non-domestic energy efficiency | Legislate by 2025 the minimum energy efficiency rating to EPC B for all non-domestic buildings, both rented and owned, by 2030. Legislate for EPC B rating for all new non-domestic buildings from 2025. |

| 4. Stable environment for business to plan and invest | Conduct and publish, before Autumn 2023, a review of how we should change regulation for emerging net zero technologies to enable their rapid and safe introduction, to support the net zero transition and boost growth. |

| 5. Stable environment for business to plan and invest | By the end of 2023 HMT should review how policy incentivises investment in decarbonisation, including via the tax system and capital allowances. |

| 6. Stableenvironment for business to plan and invest | Through their update to the Green Finance Strategy, BEIS and HMT should set out a clear, robust and ambitious approach to disclosure, standard setting, and scaling up green finance – including how it will meet existing commitments to implement Sustainable Disclosure Requirements across the economy; how it will provide a clear, long-term plan for attracting capital to meet net zero ambitions, and how to maintain the UK’s position as the leading green finance hub internationally and metrics for success. |

| 7. Stable environment for business to plan and invest | A new forum to coordinate across all regulators on the signals they are sending to businesses and investors across sectors about the net zero transition – including Ofwat, Ofgem, Environment Agency, Competition and Markets Authority, FCA, and the North Sea Transition Authority |

| 8. Long term funding certainty | At the next Spending Review, review options for providing longer-term certainty to a small number of major priorities for net zero – where we know that long-term policy commitment will be essential for success and provide long-term opportunities to save money. |

| 9. Stable environment for business to plan and invest | Publish an overarching financing strategy covering how existing and future government spending, policies, and regulation will scale up private finance to deliver the UK’s net zero enabled growth and energy security ambitions. This should include setting out the role of UKIB, BBB, BII, and IPA and UKEF in the transition. |

| 10. CCUS | In 2023, government must act quickly to re-envisage and implement a clear CCUS roadmap, showing the plan beyond 2030. As part of the roadmap, government should take a pragmatic approach to cluster selection. This means allowing the most advanced clusters to progress more quickly. |

| 11. Accelerating renewables | Set up taskforce and deployment roadmaps in 2023 for solar to reach up to 70GW by 2035 and onshore wind to reach required deployment levels for 2035 net zero grid. |

| 12. Hydrogen | By the end of 2023, develop and implement an ambitious and pragmatic ‘10 year’ delivery roadmap for the scaling up of hydrogen production. Government should deliver hydrogen business models as soon as legislation allows and confirm the long-term funding envelope available for hydrogen revenue support, to incentivise timely investment |

| 13. Nuclear | Implement reforms set out in the British Energy Security Strategy to double down on achieving UK’s nuclear baseload requirement: a. Expedite the set-up of Great British Nuclear in early 2023, ensuring required funding and skills are in place; b. Government and GBN to set out clear roadmap in 2023 for reaching final investment decision in the next Parliament. Government to ensure funding is in place. As part of the roadmap, government should assess the possibility to increase the current ambitions supporting the development of supply chain to service a fleet of projects; c. Roadmap to set out clear pathways for different nuclear technologies (including small modular reactors) and the selection process. This should consider how to use programmatic approach to deliver further cost reductions in a competitive environment; d. Government to deliver on siting strategy by 2024. |

| 14. Empowering consumers | Ofgem should maintain focus on a timely implementation of its market-wide half-hourly settlement. |

| 15. Transport | Swift delivery of ZEV mandate to apply from 2024 while maintaining regulations and funding to support EV/ZEV uptake and continuing to drive emission reductions from internal combustion engines. |

| 16. Food, agriculture and nature | Publish a Land Use framework as soon as possible, and by mid-2023. |

| 17. Circular Economy | Launch a task force to work jointly with industry to identify barriers and enablers and develop sector-specific circular economy business models for priority sectors. This should have representation from BEIS, Defra, DLUHC, HMT and DIT, and include the role of Extended Producer Responsibility in promoting reuse, repair, remanufacturing, and rental alongside recycling, in line with the powers under the Environment Act 2021. |

| 18. Oil and Gas | Publish an offshore industries integrated strategy by the end of 2024 which should include roles and responsibilities for electrification of oil and gas infrastructure, how the planning and consenting regime will operate, a plan for how the system will be regulated, timetables and sequencing for the growth and construction of infrastructure, and a skills and supply chain plan for growth of the integrated industries. |

| 19. Oil and Gas | Accelerate the end to routine flaring from 2030 to 2025. |

| 20. Local and regional | Fully back at least one Trailblazer Net Zero City, Local Authority and Community, with the aim for these places to reach net zero by 2030. |

| 21. Local and regional | Reform the local planning system and the National Planning Policy Framework now. Have a clearer vision on net zero with the intention to introduce a net zero test, give clarity on when local areas can exceed national standards, give guidance on LAEP, encourage greater use of spatial planning and the creation of Net Zero Neighbourhood plans, and set out a framework for community benefits. |

| 22. Individuals | Publish a public engagement plan for England by 2023, to ramp up public engagement on net zero. |

| 23. International | Conduct a strategic review of the UK’s international climate leadership and ensure the 2030 Strategic Framework on Climate and Nature provides practical direction for the UK’s international climate and nature leadership. |

| 24. Carbon Markets | By 2024, work within the UK ETS Authority to develop a pathway for the UK ETS until 2040. This pathway should address: a. Set out a vision on the future design and operation of the ETS; b. Set out a timeline for expanding the coverage to the rest of the UK economy, as well as sectors consulted on including maritime and waste; c. Address inclusion of GGRs to incentivise early investment in new technologies and potentially nature-based solutions; d. Provide reassurance to businesses around how the Government will mitigate the risk of carbon leakage as a result of expanding the ETS. |

| 25. R&D | By Autumn 2023, create a roadmap which details decision points for developing and deploying R&D and technologies that are critical for enabling the net zero pathway to 2050. |

The UK’s estimated costs to achieve net zero are massive. From a 2022 number of 13.5 billion pounds, to an annual 50-60 billion pounds per annum by the mid-thirties are expected to come mainly from the private sector. Apart from initial investments, opportunities within the UK’s emergent green economy exist, demonstrated by specific commitments that have already been announced, within:

- Zero emission vehicles (ZEVs)

- Offshore wind

- CCUS and Hydrogen

- Clean heat

The report provides 129 highly specific recommendations to support the high-level aims…

The detailed UK roadmap to net zero is broken into six pillars.

- Securing net zero: A framework for a sustainable industrial strategy to deliver growth and jobs during the transition.

- Powering net zero: The gear shift we need in delivery to achieve our targets and recommends specific actions to unblock the pipeline, including a re-think of our energy infrastructure. It proposes a solar revolution and an onshore wind revolution.

- Net zero and the economy: Going further to capture the economic opportunities across sectors for businesses of all sizes.

- Net zero and the community: How we unlock local action by reforming the relationship between local and central government, making sure the planning system supports net zero and turbocharging community energy and action.

- Net zero and the individual: Role of individuals in the transition, how they can be supported to make green choices, and how government can ensure that net zero works for everyone.

- The future of net zero: Seizing the global opportunities from new technology and R&D innovation now and out to 2050. It also looks at the UK’s carbon pricing regime and how the UK can maintain its international leadership on climate.

Within these pillars, specific references are made to general concerns, which have been discussed within this series before, including:

Supply chains – covered in greening of supply chains

Green taxonomy – covered in green financing

Circular economies – covered in circular economies

Energy trading schemes (ETS) – covered in Carbon pricing schemes

International trade -covered in Carbon border agreements

All of the above are designed for policymakers to create an environment where investment in a clean energy, low-emission future becomes the default, less risky way for investors to make returns. Banks and their risk departments need to think about these planned or required changes in the context of their current risk assessment and loan pricing.

What becomes clear is that a carbon pricing scheme would significantly ease analysis of potential borrowers as it provides a common context for such work. It is easy to see how this becomes the basis of comparison when assessing future costs of compliance.

The report concludes with all 29 specific recommendations, but we have pulled out some for special consideration in terms of how they may impact borrowers’ credit profiles:

| # | Area | Owner | Timing | Recommendation |

| 65 | SME support | BEIS | 2023 | Building on the UK Business Climate Hub, Government should launch a ‘Help to Grow Green’ campaign, offering information, resources and vouchers for SMEs to plan and invest in the transition by 2024. |

| 66 | SME support | BEIS | 2023 | Government should develop an SME role models programme, which provides mentoring for micro businesses and the self-employed by 2023. |

| 67 | SME support | BEIS | 2023 | Government should establish a taskforce of suppliers, small business landlords and business groups to agree on how to cut energy use in rented premises by 2023. |

| 68 | Financial services | BEIS/HMT | 2023 | Review how the UK can become the most competitive financial centre for green and transition listings, capital raising and project financing; to include reviewing prospectus and listing regimes to encourage integrity and growth in the market for green finance instruments, exploring new opportunities arising for professional services, climate and nature data and analytics and innovative product development. |

| 69 | Financial services | BEIS/HMT | 2023 | Through its update to the Green Finance Strategy, Government should set out a clear, robust and ambitious approach to disclosure, standard setting, and scaling up green finance – including how it will meet existing commitments to implement Sustainable Disclosure Requirements across the economy; how it will provide a clear, long-term plan for attracting capital to meet net zero ambitions, and how to maintain the UK’s position as the leading green finance hub internationally and metrics for success. |

| 70 | Manufacturing | BEIS | 2024 | Government should develop a policy proposal to incentivise on-site generation in Manufacturing by Q2 2024, with options to consult on the funding formula required by the public and private sector to reach the tipping point of adoption. |

| 71 | Manufacturing | BEIS | 2023 | Government should progress its consultation on carbon leakage measures, including a carbon border adjustment mechanism (CBAM) and mandatory product standards by 2023. This will enable Government to implement effective carbon leakage mitigations from 2026. |

| 72 | Construction | BEIS | 2023 | Government to develop a public procurement plan for low-carbon construction and the use of low-carbon materials, by the end of 2023. |

| 73 | Construction | BEIS/Defra | 2023 | BEIS, DfT and Defra to develop a strategy on the decarbonisation of non-road mobile machinery by the end of 2023. |

| 79 | Transport | Dft | 2023 | Government to swiftly deliver the ZEV mandate, to apply from 2024, while maintaining regulations and funding to support the uptake of electric and other zero emission vehicles, and continuing to drive emission reductions from internal combustion engines. |

| 80 | Transport | Dft | 2023 | Government to publish the Low Carbon Fuels Strategy in 2023 and the necessary legislation for the sustainable aviation fuels (SAF) mandate to apply from 2025.Recognising that an adequate price stability mechanism is vital for investments in SAF, government to set out evidence for barriers to SAF investments and options to address this. |

| 81 | Transport | Dft | 2024 | Government to set out options for further legislative steps by 2024 and take a leading role in International Maritime Organization (IMO) negotiations to decarbonise the maritime sector. |

| 82 | Transport | Dft | 2024 | Government should continue to work with industry to set out a clear programme by 2024 to accelerate decarbonisation of the wider freight sector through modal shift and deployment of new technologies, building on the Future of Freight Plan. |

| 83 | Transport | Dft | – | Government to reduce delays to anticipated reforms by bringing forward the delayed Future of Transport Bill this Parliament. |

| 84 | Food, agriculture, nature and land | Defra | 2023 | Government to publish a Land Use framework as soon as possible, and by mid-2023. |

| 85 | Food, agriculture, nature and land | Defra | 2023 | Government to publish full details of all Environmental Land Management Schemes and future plans by the end of 2023 – with a particular focus on how participants can take advantage of both public and private finance. |

| 86 | Food, agriculture, nature and land | Defra | 2025 | By 2025, Government to ensure that 50% of UK-based food and drink businesses measure and report their scope 3 emissions against a government- and industry-agreed standard. Defra and UKRI research should prioritise innovations that support on-farm measurement and processes to accurately collect the remainder by 2030. |

| 87 | Food, agriculture, nature and land | Defra/ Natural England | 2023 | Deliver accurate monitoring of carbon across broader range of ecosystems, with a view to bringing more habitats into the inventory to drive habitat creation and restoration efforts. |

| 88 | Food, agriculture, nature and land | Defra (and delivery bodies) | 2023 | In line with wider thinking on voluntary carbon and ecosystem markets, ensure a pipeline of investable nature- based solutions projects is available. |

| 108 | Energy efficiency | 2023 | Government should bring forward all consultations and work to mandate the Future Homes Standards by 2025 to prevent further delays by ensuring the standard applies to all developments. This should include a consultation on mandating new homes to be built with solar and deliver the Net Zero Homes Standard, ensuring that the planning system (discussed in Pillar 4) is flexible enough to enable this. | |

| 113 | Energy efficiency | 2024 | Government should provide certainty by 2024 on the new and replacement gas boiler phase out date to drive industry and investor confidence. The Review recommends bringing the proposed date of 2035 forward and legislating for 2033. Government should set a legislative target for gas free homes and appliances by 2033, to contribute to a gas free grid in future. Government should legislate for all homes sold by 2033 to also have an EPC rating of C or above in line with the aforementioned NZPC, with exclusions around certain properties (e.g. listed properties, on grounds of affordability). Government should also mandate landlords to include ‘average bill cost’ alongside the EPC (and possible future NZPC) rating, when letting a property out. This will help renters understand what costs to expect, while also helping to put a premium on energy efficient homes. | |

| 125 | Energy efficiency | BEIS,HMT | 2024 | By 2024, Government should work within the UK ETS Authority to develop a pathway for the UK ETS until This pathway should: a. Set out a vision on the future design and operation of the ETS. b. Set out a timeline for expanding the coverage to the rest of the UK economy, as well as sectors consulted on including maritime and waste. c. Address inclusion of GGRs to incentivise early investment in new technologies and potentially nature-based solutions. d. Provide reassurance to businesses around how the Government will mitigate the risk of carbon leakage as a result of expanding the ETS. |

| 126 | Carbon markets | BEIS | 2024 | Government should endorse international VCM standards as soon as possible and consult on formally adopting regulated standards for VCMs and setting up a regulator for carbon credits and offsets by 2024. |

| 127 | Carbon markets | BEIS | 2024 | Government should set up a programme for offsets and carbon credits, providing guidance to businesses looking to invest in carbon credits and offsets, for businesses looking to provide carbon credits and offsets, and explore the opportunities to create a market in the UK for offsets through energy efficiency measures |

| 128 | International trade | DIT | 2024 | Government should establish baseline environmental and climate protections in Free Trade Agreements (FTAs) and for removal of trade barriers to environmental goods and services. |

Banks need to consider what this report is telling the market…

It is important to note that this report does not change the UK environmental targets as much as it does redefine the roadmap to reach them. This is important intelligence for banks considering how to meet the requirements for credit risk reporting. These have been evolving as the Basel Committee has considered how best to reflect climate risk in the standard bank risk calculations.

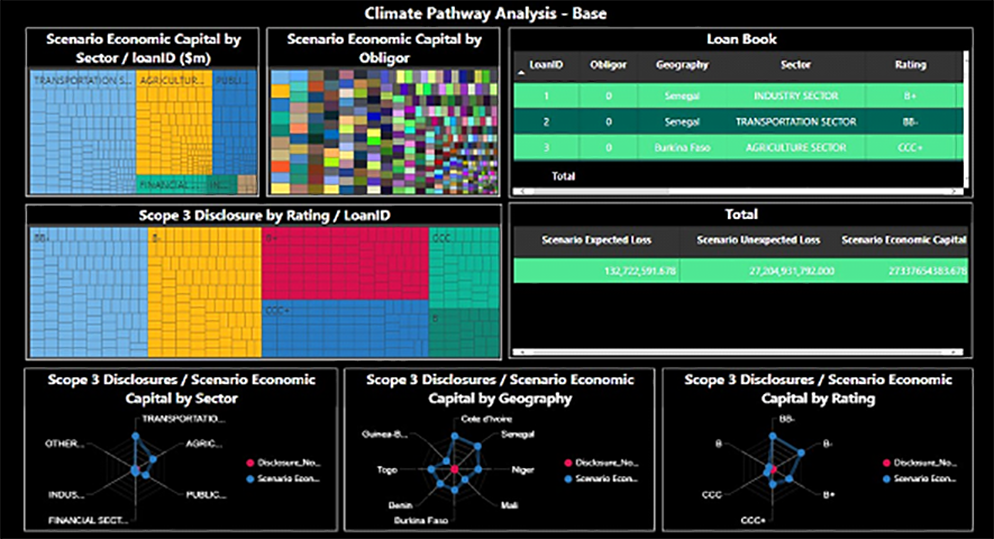

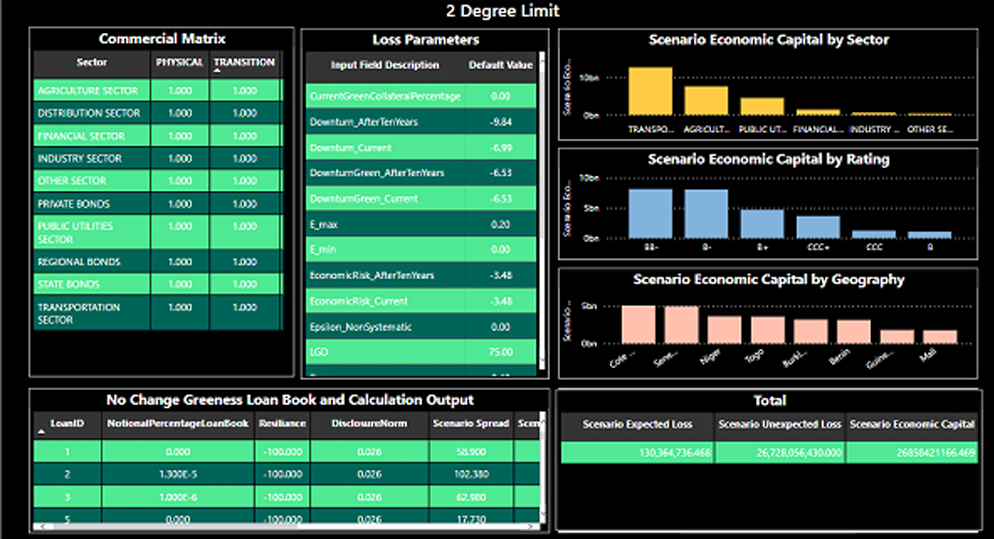

In short, the most likely end point is that banks use scenario analysis to determine the potential increases in credit risk and associated economic capital against multiple possible climate pathways.

The evolution of these rules is discussed in – Banking view of

climate risk

The problem that banks have is that the specific industrial targets for regulatory pressure can be difficult to determine and make meaningful scenarios hard to design and run. A report such as ‘Mission Zero’ provides missing detail that can be used to specify borrower-level adjustments by industry. Combined with pathway cost data, which can be gleaned from the ‘Network for Greening the Financial System’ (NGFS), risk departments can build scenarios that:

- Are costed by reliable sources

- Impact specified industries as per governmental planning

- Match scenarios from ‘current policies’, through ‘Nationally Determined Contributions’ (NDCs), to ‘1.5- or 2-degree limited’ pathways

- Provide meaningful, defensible results for regulatory and stakeholder reporting

GreenCap can help…

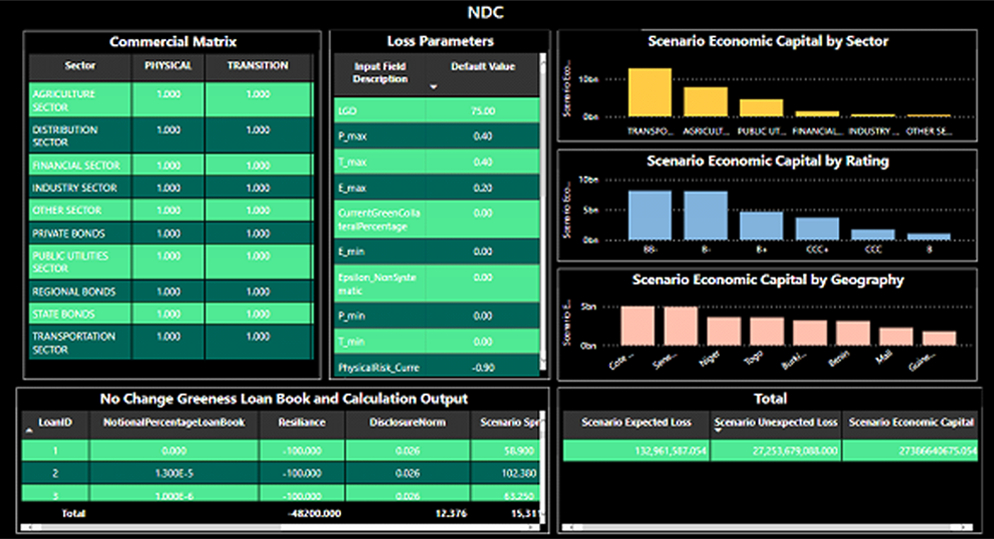

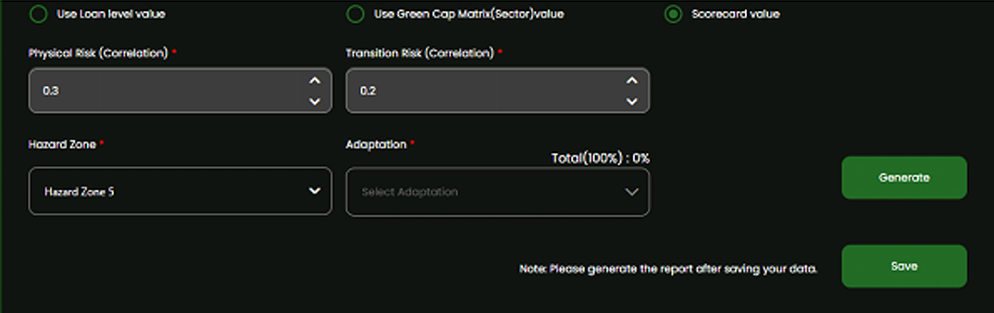

GreenCap is a turnkey ‘Risk as a Service’ (RaaS) solution that enables users to build scenarios based upon reliable data that can be applied to the entire loan book/balance sheet and recalculate per scenario:

- Loan to portfolio level changes in expected and unexpected losses (Economic Capital)

- Changes in probability of default per loan

- Repricing of loans in terms of basis point spreads

The system provides an intuitive balance sheet analysis

Multiple scenarios can be designed to match climate pathways

Loan level adjustments can be made to fine-tune analysis and ensure that early adopters of expected policy changes are rewarded.

GreenCap was designed for banks that want to arm themselves with the information needed to navigate the transition to a more sustainable economy.

Visit greencap.live for more resources on the financial aspects of climate change, and more insights into how best to build a futureproof balance sheet in the current time of climate-based uncertainty.