November sees the 27th ‘Conference of the Parties’ (COP27) convened in Sharm El-Sheikh, Egypt. One year after Glasgow hosted the 26th edition, it is vital that banks note any (re)prioritization and the direction of travel regarding global climate ambition.

Each COP has a specific vision…

COP27 has laid out its vision of success, which is to substantiate progress made at Glasgow, by moving from stronger commitments to ‘specific, measurable, impactful initiatives’. The five main pillars of this vision are:

- Equitable balance between developed and developing countries in funding the global challenge of loss from mitigation and adaptation to climate change

- Basing all planned work on the Intergovernmental Panel on Climate Change (IPCC), or equally credible groups, scientific analysis of the problem

- Creating a ‘no country left behind’ mentality for all collaborative action

- Commitment to common rules and principles in tackling climate change

- Determined movement from negotiation to action

In keeping with this vision statement, specific targets of the Summit are centered heavily on the transition to action.

- Agreed work streams to implement pledges on time and at scale

- A new, science-based, adaptation agenda to protect basic and sustainable needs of vulnerable countries

- Action to support vulnerable countries where loss and damage have already occurred

- Mobilize financial flows based on needs and existing Nationally Determined Contributions (NDCs)

- Create a framework for a just transition, avoiding backsliding on commitments and pledges

This COP is clearly focused on one of the major gaps in the achievements of COP26, which was to make substantive progress in climate responsibilities between developed and developing countries.

The current position is largely tracked from the Paris Accord of COP 21…

The Paris-based COP was a milestone in climate politics. At that Summit, the global community agreed on key objectives, including:

- Hold global warming to 2 degrees above pre-industrial levels

- Make ‘best efforts’ to hold global warming to 1.5 degrees above pre-industrial levels

- Create NDCs, which act as pledges from specific countries, with targets to be set and increased regularly

This established twin ambitions – with the NDCs being local and independent, there is no strict obligation for those commitments to combine to reach the wider group ambition. It was conceived as a solution to the political impasse that had developed between the richer and weaker economies.

As a result of this agreement, progress to a sustainable global economy was regionalized, with an overriding ambition loosely guiding that progress. Such tracking is, therefore, performed against multiple targets.

- Current policies vs NDCs measuring the implementation of specific pledges by each country

- NDCs vs. 2-degree limit measuring the gap between pledges and what is generally seen as that countries’ ‘fair share’ of global ambition

Tracking the first of these is most important for those creating financial scenarios, because NDCs are benchmarks against which governments have agreed to be measured.

Direction of travel is determined by more than NDCS, though…

In addition to NDCs, there are two more elements to consider.

- Long-term low greenhouse gas emissions development strategies (LTS) – Plans, typically out to 2050, to convert regional power generation to being sustainable (preferably net zero).

- Sustainable Development Goals (SDGs) – 17 high-level goals covering ambitions of the UN for a more sustainable world. While a number of these are linked to climate change, the full set is wider in scope. The relationship between climate and SDGs is covered here

The interconnected web of complementary, and occasionally conflicting pledges and plans must be viewed in the context of building an overall pathway. NDCs may not be dependent upon LTSs and SDGs, but harmonization may delay NDC implementation. The closer aligned these plans are, when they exist at all, the more likely the NDCs are to become a reality in a timely manner.

Data is available to track progress and linkages…

Navigating these relationships can be daunting, but organizations such as Climate Watch provide details as to who has provided NDCs, updated NDCs and LTSs and how these relate to the UN’s SDGs. These datasets and analyses can then be used to modify NDCs’ costings in order to build scenarios in a more ‘real world’ context.

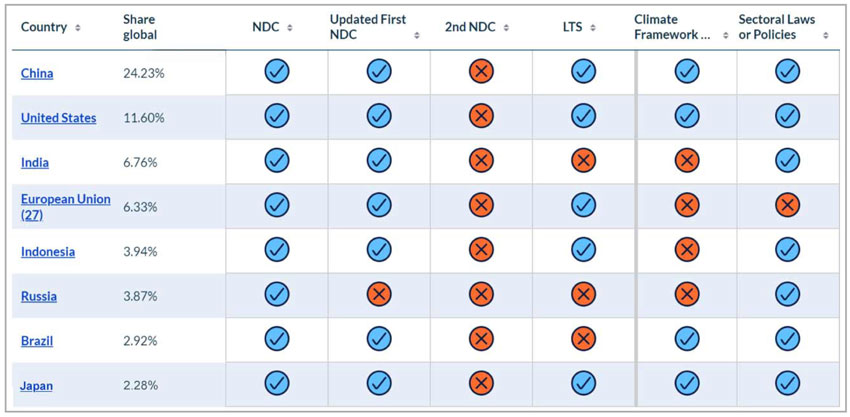

Analysis of the most recent submissions and data indicate to scenario builders, within bank risk management departments, the manner in which each country treats the transition. As an example, we can look at the highest emitters in terms of NDC and LTS submission.

Above are the countries whose contribution to global emissions is greater than 2% of the total, and their status in terms of submission of NDCs and LTSs.

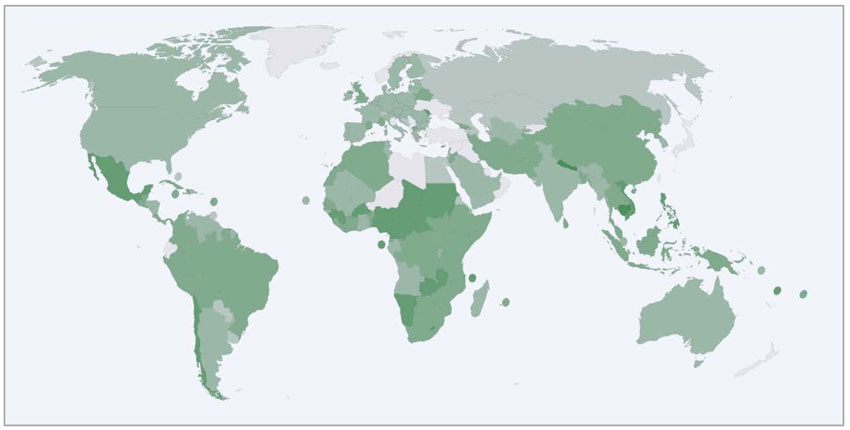

Above is a heatmap indicating the level of linkage between regional climate NDCs and the specific UN SDG exclusively covering climate change (number 13/17).

Data such as this shows that there is work to be done to meet various promises and commitments from the preceding decade. Most notably:

- Key emitters need to update their NDCs

- NDCs need to be harmonized with LTSs

- NDCs need to be harmonized with SDGs

One way of looking at these problems is that the ‘cone of uncertainty’, which spans the different outcomes from ‘current policies’ to the ‘2-degree limit’ has to be reduced by adjusting and implementing more ambitious NDCs. Not only will this put much-needed energy into the fight against climate change, but it will also be the natural next phase of this journey that started in Paris at COP15.

Egypt’s COP can be viewed as the most political since Paris…

The 27th COP takes place against a dramatic global backdrop. The war in Ukraine has put a strain on worldwide food and energy security. The interconnectedness of the global supply chain highlights not just the need for a unified approach, but also the growing disparity between rich and developing economies in terms of how they deal with these core security issues.

Coupled with the fact that developing nations are also on the front line of physical climate change, COP27 is aiming to finally achieve agreement on the long-discussed ‘fair transition’. In broad terms, this means directly supporting countries facing direct climate damage in terms of adaptation, and wealthier countries providing more funding to countries as they ‘catch up’ in the most sustainable way.

If Paris provided a neat route past a unified approach, and Glasgow acted as the five-year checkpoint, Egypt must see political convergence. The ever-shrinking carbon budget is the ticking stop clock that looms large over negotiations, and it is imperative that discussion becomes action before 2025 if 2030 goals are to have any chance of being met.

Banks’ risk departments must take careful note of the details…

Transitional policy changes on the scale that are being discussed will have massive impacts on economies across the world. These impacts will fundamentally change the credit risk landscape within those countries. And if banks are unprepared, then they will find themselves on the wrong side of the transitional balance sheet, with rising economic risk costs tying up capital in brown assets rather than funding the journey to a greener future.

GreenCap can help…

GreenCap is a turnkey ‘Risk as a Service’ solution that allows banks to model economic climate pathways, including current policies, NDCs, and 2-degree limits. With the financial risks of each being calculated from the banks’ perspective, climate change risks can be included within the wider scope of risk management. CROs and lending officers will then be in a position to manage balance sheet strategy in a way that is entirely in keeping with its sustainability ambitions