Amid compromises, disputes, and celebrations, the Glasgow summit has laid down strong markers for the financial industry to utilize, as banks prepare for the climate challenge.

COP26 – A Report Card For The Paris Accord Commitments…

There was considerable concern when heading into the summit. Climate policies were already implemented, notably across Europe, but many Paris pledges were yet to be fulfilled. Therefore, a far more aggressive agenda would be required to create an environment that would limit global warming to 2 degrees.

The six years between the Paris and Glasgow COPs, have seen the science become increasingly certain about the extent of the potential damage, with a greater urgency developing around the exponential increase in the risk above 2 degrees. All Paris accord commitments, assuming their fulfillment, would only limit the heat rise to 2.7 degrees above 1990 levels.

Additionally, the science of climate change states that any CO2 that enters the atmosphere lasts for centuries. Consequently, the 1.1-degree increase already observed, and all of its associated effects are here to stay. This means that adaptation to climate change is as important as mitigation. In fact, for a considerable part of the world, mainly smaller nations, adaptation is by far the most important element in their fight against climate change. In that context, the failure by developed countries to make good on their $100 billion a year development funding, promised in the 2009 COP, is one of the most damaging results. The under-developed countries at Glasgow were keen that this was addressed as a matter of utmost urgency.

Developed countries were looking for stronger commitments on fossil fuel phase-out. Pledges on this topic are highly contentious as the arguments about which nations owe compensation, which ones caused the most pollution, and which ones will be left out of a ‘just’ transition, are all unavoidable in the debate.

Finally, Paris succeeded because it had set a target for agreement on an overall goal (2-degree limit) with individual countries setting their own contribution targets, and policies. Glasgow was the COP where these targets were to be reported, assessed, and strengthened.

Coal, Cars, Cash, Trees – A Rallying Cry for COP26…

The UK presidency began the summit with five high-level goals:

- Coal, used in steel manufacturing and power generation globally, was targeted with the aim of a timetable for a process to halt its usage entirely.

- Cars and the termination of manufacturing combustion engine vehicles were high on the agenda, following the UK’s own decision to set a 2030 date for its cessation.

- Cash, which includes private finance, rectifying the deficit between the needs of the developing world, and funding provided by richer nations, was to be addressed.

- Trees were highlighted as science was concluding that the terrestrial carbon ‘sinks’ were close to becoming carbon emitters, due to deforestation. Turning that dangerous positive feedback loop around was a major goal.

- Keeping 1.5 alive became a secondary mantra for the COP. Effectively, each pledge and agreement was to be scrutinized under the magnifying glass of this ambition.

In short, the plan was to build on the consensus of Paris, creating specific structures and targets that would combine to meet the most ambitious limit to combat the increase in global temperature. If Paris decided on the journey’s destination, then Glasgow was to determine the route.

Some Expectations Were Cautiously Met…

Two weeks of negotiations proceeded in a predictable parade of announcements, pledges, protests, hopeful speeches, and hard negotiations. In the end, there was considerable progress made in several areas, including:

Methane

A US/EU-led global methane pledge was signed by more than 100 countries. The pledge aims to collectively reduce global methane emissions by 30% by 2030. This is important in the way it impacts the pathways to reach the final temperature levels. Methane survives for decades rather than centuries but is many times more potent as a heating gas while it is in the atmosphere. Reducing methane quickly flattens the time spent above the critical target temperature, thereby reducing the physical impacts that occur at that higher temperature. This was viewed as a major achievement of the summit, even though three of the largest emitters did not sign this pledge.

Deforestation

Possibly the most trumpeted win was the pledge to reverse deforestation, which notably included Brazil as a signatory.

Coal

The end of the second week was dominated by discussions over the wording of the agreement on coal that would be integral to the official COP document. The first proposal was, ‘phasing out’ coal from 2030. This was watered down to ‘phasing out’ without ‘abatement’, which meant that it would be alright to use coal as long as CO2 was collected at source. Ultimately, it became ‘phasing down’ in the final text. This was a disappointment but still represented the most significant movement on coal in any COP to date.

Cash

Private finance providers were present throughout the COP, with a key announcement of a $130 trillion alignment, by Mark Carney. The delegates also agreed on doubling funding to support developing nations’ climate change adaptation. Skepticism is unavoidable about this commitment, after the failure of the 2009 promise, and the fact that it is not clear how such funding is provided. For smaller nations, the difference between loans and grants can be the difference between survival or mass migration.

Annual Target Meetings

It was noted that the criticality of the coming decade was not reflected by five-yearly intervals between progress reports and target revisits. Perhaps the most important outcome of all was the establishment of annual meetings for that purpose. These provide an opportunity to fine-tune the activity over the first 10 years, keeping the most desired consequence as a possibility.

1.5

Alive, but not looking good would be one description. 1.5 as a possibility does survive, but not because of any specific agreements. Rather, the ability to increase the ambition of each nation’s targets annually, and the start that was made, means that there is a very narrow window of possibility of meeting that limit.

To conclude, COP26 met some of its initial goals and missed others, as is normal. The success, or otherwise, of the event as a whole, largely depends on perceptions and expectations at the start of the two weeks.

One unavoidable conclusion, though, is that the final agreement would still see a temperature rise of around 2.2 degrees. The only certain conclusion is that far more aggressive targets must be developed and applied in the short term.

All COP Agreements Must Be Viewed By Banks, In Context…

Throughout our ‘Code Red’ series, this context has been financial impacts as predicted by:

- Intergovernmental Panel on Climate Change (IPCC) – The group of scientists who constantly reset the starting point and create pathways that would, if followed, achieve specific temperature rises by 2100.

- Network for Greening the Financial System (NGFS) – The group of central bankers and economists who put costs against the pathways relative to GDP, global and local.

- International Energy Agency (IEA) – The group that breaks down the impacts and costs by industry and tracks progress against them.

It is also imperative to decide whether the pathway being considered is:

- Orderly – A transition that begins quickly in the cycle, with a smooth path to its final objective, policy-wise.

- Disorderly – A transition that starts late, requiring additional stringent policies to be implemented without allowing impacted economies to adjust.

All agreements in the final COP document have to be viewed keeping the above in mind, as they are indicators to which pathways are likely to be followed, and the speed of transition.

Banks, in particular, will be stewarding most of the private sector capital through their balance sheets, into the fight against climate change. They must view the outcome of the summit extremely carefully, to determine which industries and firms are likely to represent a greater risk, as their business models are disrupted by environments created by the direction of climate policy. Conversely, there will be sectors and firms that are currently viewed as speculative but will eventually become mainstream, and therefore, less risky, as the pathway develops.

All this requires the development of a toolkit, specifically designed to measure climate change-related credit risks.

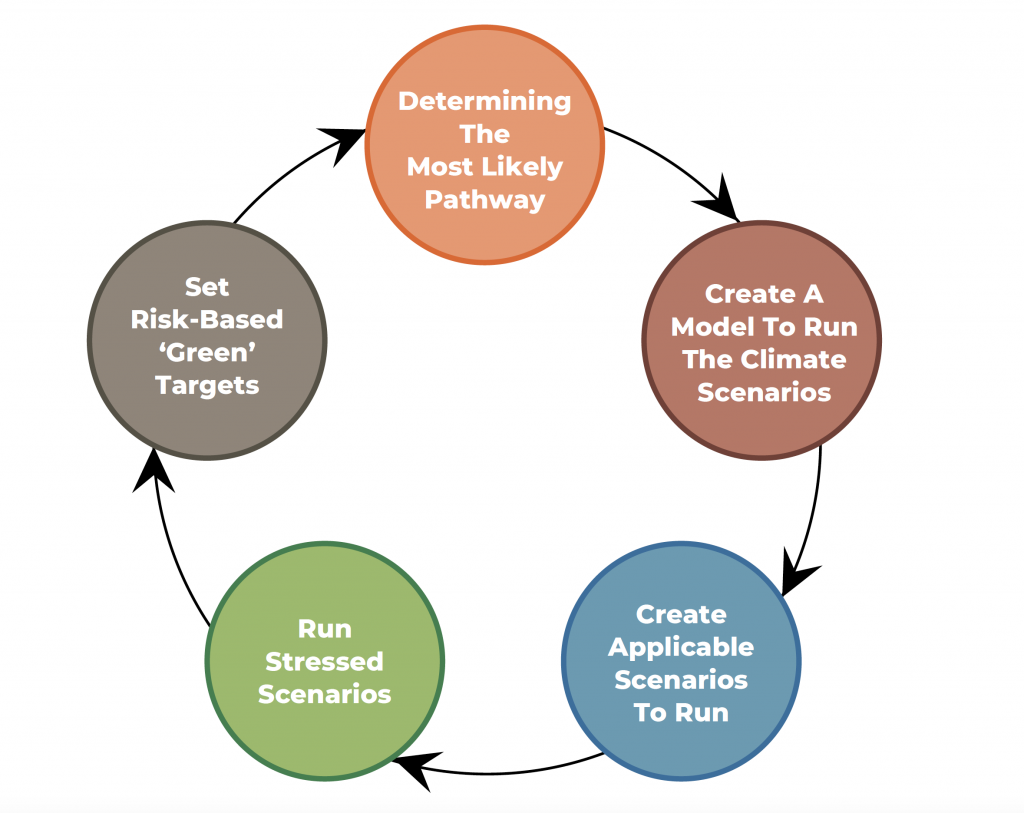

Banks Need A Systematic Approach To Climate Risk Stress Testing…

Fundamentally, the climate risk to banks is one of liquidity, caused by high volatility in the credit risk of its loan book. As the post-2008 risk rules are applied (including the new forward-looking accounting standards and liquidity stress testing), banks must avoid a situation, where an economic switch from a brown to a green economy causes credit re-evaluation that effectively freezes the bank’s capacity to do business.

In many ways, this mirrors best practice liquidity risk management and involves:

- Determining The Most Likely Pathway – The number of possible pathways to a specific target decline considerably as the time left to complete the transition reduces. Banks can use the IPCC/NGFS analysis to choose an ‘expected’ climate scenario.

- Create A Model To Run The Climate Scenarios – Any impact on the credit worthiness of a borrower that results from either physical or transitional climate change will directly impact how it is accounted for, on the balance sheet. By adjusting that calculation, banks can estimate the amount of excess capital they would need to hold in unproductive cash. This translates directly into an opportunity cost to the bank.

- Create Applicable Scenarios To Run – The bank now needs to apply the methodology to the book. At this point, it must run multiple relevant scenarios/pathways and specifically include the impact of an orderly/disorderly transition. Once run, the bank has an idea of the capital impact of each pathway.

- Run Stressed Scenarios – Similar to the Dodd-Frank Act Stress Testing (DFAST) or European Central Bank (ECB) liquidity stress testing, the bank must now run transition-specific scenarios to determine the point where liquidity issues become a crisis and threaten the institution’s survival. This allows the bank to build climate change into its risk appetite.

- Set Risk-Based ‘Green’ Targets – To match its risk appetite, the bank must develop a series of short/mid-term targets where it can structure its loan book in a way that it can remain liquid and profitable, and fund the businesses that will actively benefit from the transition. This restructuring should align with the bank’s public statements on sustainability, creating a virtuous spiral of sustainability and profitability.

With the above in place, banks will have a climate risk policy that can be set, monitored, and reported against, and will support its sustainability goals, including potential adoption of the UN Responsible Banking code.

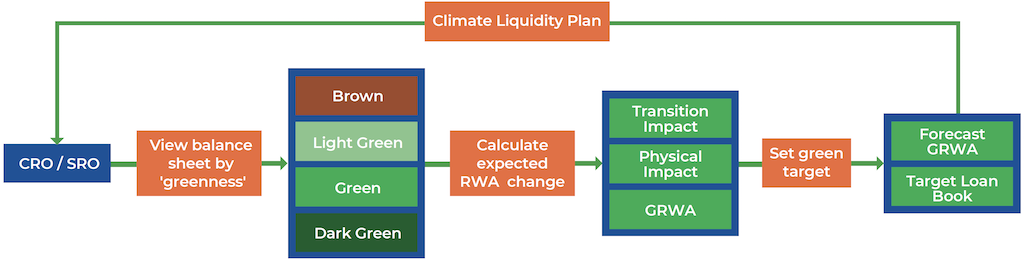

GreenCap can help…

GreenCap is a ready-to-use system that adjusts credit pricing within the portfolio, from an individual loan to the entire balance sheet. Additionally, GreenCap will advise on scenario selection and individual loan adjustment through its sector-specific sustainability research.

Using GreenCap, banks can:

- Apply applicable scenarios and see the additional costs to the balance sheet that can be expected.

- Adjust individual loans to reflect firm-specific adaptations or stranded assets.

- Toggle the specific impact of transition policy and physical climate change.

- Create target loan book strategies and work out the final climate risk cost of each.

GreenCap was conceived with banks in mind and developed to specifically enable them to navigate the coming decade of economic upheaval as smoothly as possible. Banks must remain viable while fulfilling their vital role as gatekeepers and managers of private sector finance that is central to any chance of preventing the worst impacts of climate change.