By now, including climate change within banks’ risk analysis is acknowledged as an industry need. First, though, banks need to determine exactly what is being calculated, and second, how to integrate the results.

Climate change creates risks across multiple dimensions…

Climate change will cost businesses, and therefore corporate borrowers, within the real economy, significant amounts of their free cash flow. This cost will arise from:

- Transition Risk – This is the risk of costs of compliance with local policy that impacts the borrowing firm. This comes from:

- Direct costs of compliance for target industries and firms

- Indirect costs within their up and downstream supply chains

- Physical Risk – This is the risk of costly damage due to physical climate change. This comes from:

- Adaptations to avoid physical impacts

- Insurance costs against physical impacts

The net effect is that the financial profile changes, and therefore the credit profile changes. This implies that there is a potential risk in loans that is not being paid for via a basis point spread or that capitalizing the risk in the form of economic capital is more costly as it is insufficiently funded.

Building a project to estimate risk-based costs…

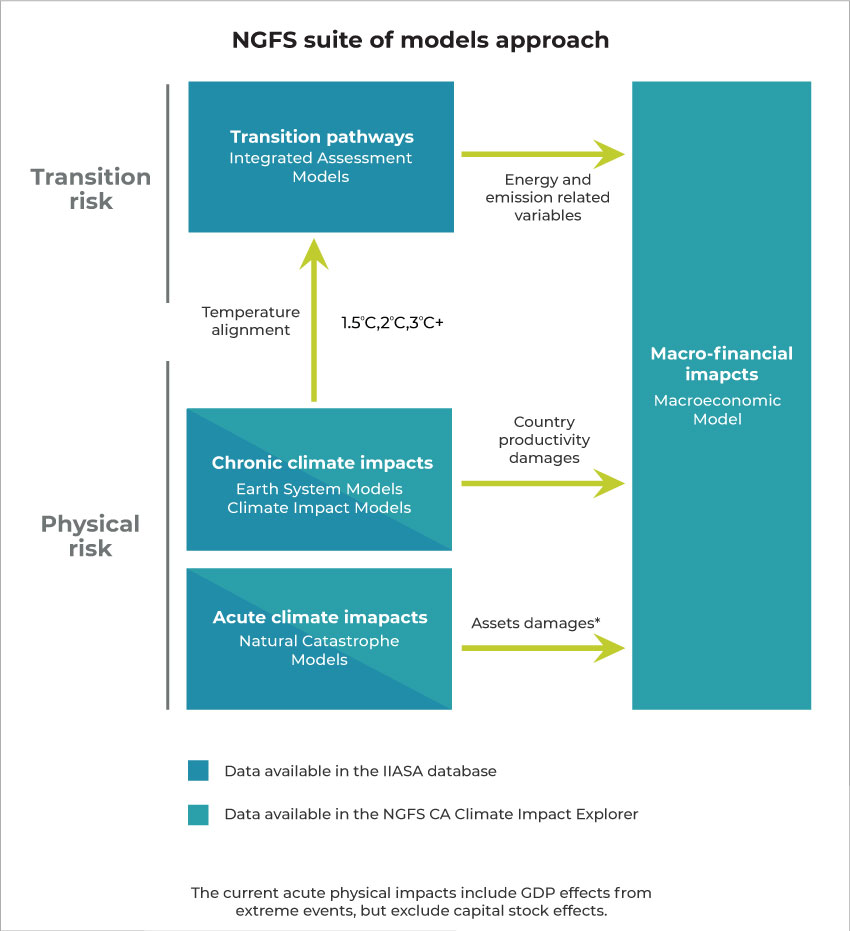

Any framework that aims to put ‘hard’ numbers against climate change risk must be multi-dimensional in its ambition. This can only be achieved by running climate pathways in the form of economic scenarios against the loan book, including

- Scenarios covering at least

- Current policy pathways – assumes full implementation of current policies on statute books

- NDCs or Nationally Determined Contributions – assumes full implementation of policies to meet ‘soft’ commitments to the UN’s COP under the Paris accord

- 2 degrees – assumes implementation of pathway policies that would be required to hold global warming to 2 degrees above pre-industrial levels

- 2 degrees delayed – the same as above but with a delayed start

- Per scenario, loan and, aggregation to balance sheet level

- Unexpected risk capital level

- Expected risk capital level

- Implied change in default probability

- Implied basis point spread per loan

These outputs provide the risk committee with the means to determine the overall climate-specific credit risk that needs to be included as every country across the world is impacted by the transition to, and the physical consequences of, a greener economic paradigm.

Specific data is needed to run climate scenarios…

The required outputs for any climate-based risk assessment must include:

- Loan details, including

- Geography

- Industry

- Current rating

- Adaptations already in place

- Scenario data

- Target industries for transition

- Industry-level adaptations/regulations

- Supply chain impacts from transition

- Costs associated with transition and physical climate change

Loan details

Core loan systems should hold basic details of the loans themselves. Specific data on business model adaptations must also be kept in order to assess how far along the sustainable journey each obligor has gone. This information has a material impact on the extent to which new regulations will impact the profitability and resultant credit profile.

The geographic location and jurisdiction of a corporate borrower is of paramount importance in assessing both its exposure to climate policy (transition risk) and climate events (physical risk). Without a policy in place to actively force a change to the business model/costs, there is little incentive for a firm to invest in adaptations to reduce its impact on the environment. Similarly, each industry has either its own set of climate adaptations or is associated with one that does, via its place in the overall supply chain. Examples of adaptations by industry can be found in reports such as the World Economic Forum’s ‘Net-Zero Tracker’ report.

The current rating of the obligor is also required data. Ratings are, at least in part, reflections of the free cash flow that covers the expense of covering current debts and outgoings. Expenses related to transitional adaptations must be seen as additional costs to continue in business and, therefore, directly reduce such coverage. Before and after applying climate pathway scenarios, the overall credit profile must take all of the above into consideration.

Scenario data

Climate pathways are complex and written as ‘real world’ adaptations that must be made across areas such as:

- Buildings

- Agriculture

- Transportation

- Industry

- Infrastructure

- Tourism

While the Intergovernmental Panel on Climate Change (IPCC) has produced high-level pathways that would result in average global warming increases (relative to pre-industrial levels) of various levels, the majority of countries have also submitted at least an initial NDC. These need to be scrutinized and used as the basis for aspirational targets for each, juxtaposed with policies currently in place in each region.

- NDCs are constantly updated by the UN and can be accessed here

- Current policies are generally detailed on each government website

- Costs associated with the transition and implied physical damage are broken down by country and region on the NGFS site

Once this data is sourced, bank analysts must look beyond specifically targeted industries into their supply chains in order to create a more complete picture. There are a number of options available to climate teams in this area, including looking at idiosyncratic stock market returns by sector and correlating these to the core target sectors. This provides reasonable insight into the overall supply chain impacts.

Bringing the data together…

Banks are ultimately concerned with credit, market and liquidity risks arising from climate change. The most pressing category, though, is credit risk. Trillions of dollars are needed per annum to meet the wider investment goals of the 2-degree targets, and banks must ensure that they are in a position to act as the funding conduit for that monetary flow. The most significant threat to that positioning is a sudden increase in default likelihood, coming from borrowers using more of their revenue in meeting new regulations, leaving themselves less able to service their debts properly.

With this in mind, the following calculations are required per scenario, loan and aggregation to balance sheet level:

- Unexpected risk capital level

- Expected risk capital level

- Implied change in default probability

- Implied basis point spread per loan

This is explicitly recognized by the Basel Committee on Banking Supervision (BCBS), as is illustrated in its 2021 review of considerations and methodologies for measuring climate-related financial risks.

From best practice to policy…

This analysis is being picked up by central bankers in countries such as Mauritius, where, guidance to its banks was issued in April of 2022, and action plans for bringing climate change into their core risk analysis are now a requirement.

An important aspect of the Mauritius guidance is that it expects climate change to sit within but be clearly differentiated from banks’ standard risk management. Three lines of defense are explicitly mentioned, and analysis must include:

“Financial institutions shall have a framework for measuring and monitoring material, climate-related and environmental financial risks, which as a minimum, will:

- include the development of relevant risk indicators to categorize counterparties, sectors, and geographical locations based on the extent of climate-related and environmental financial risks;

- comprise an adequate risk monitoring process, which includes usage of qualitative and quantitative analytic tools and metrics to monitor relevant risk indicators and climate-related and environmental financial risk exposures against the overall strategy and risk appetite for climate-related and environmental financial risks and to support decision making;

- ensure that the risk appetite framework incorporates relevant risk exposure limits and thresholds for the risks and;

- encompass measures to encourage counterparties to provide relevant disclosures on climate-related and environmental financial risks.”

A win-win situation…

Banks that implement a system of risk management that clearly identify climate risks, quantifying the extent to which financial resiliency is at risk, will not only put themselves in a position to benefit from the transition to a greener economy, but also place themselves ahead of the regulatory wave that will, in short order, require them to do so.

GreenCap can help…

GreenCap is a Risk as a Service (RaaS) solution that enables banks to:

- Identify financial risks arising from climate change

- Measure

- Increases in default probability per loan per scenario

- Changes in economic capital that can be expected at loan and balance sheet level, per scenario

- Re-price loans in basis point terms to ensure that green businesses are incentivized while non-green credits are charged appropriately

- Report risks by stress test and climate pathway to

- Management

- Stakeholders

- Regulators