Both transitional and physical climate change will deplete collateral value on the balance sheet. Banks must factor this into credit risk management.

In the context of climate change, stranded assets are defined as the ones that will be rendered economically inert, by either environmental changes or policies designed to curtail such changes. A widely used example of a stranded asset is oil that is notionally owned by a firm but ultimately loses its value, once the decision to leave it permanently in the ground has been made. The concept becomes especially important when asset valuations are made for the purpose of market value analysis or as collateral valuation for credit evaluation.

Compliance costs are related to, but different to stranded asset losses…

Policies put in place by governments in order that their economies can be restructured will create significant costs to businesses. Compliance with new regulations, from green building codes to sustainable agricultural practices will require initial investment and cause increased running costs. Certain assets, though, will become useless, which means that their valuation becomes zero for collateral valuation and resultant credit pricing.

Lowering collateral values and simultaneously increasing running costs, and the need for credit facilities creates a double bind for firms relying on banks for day-to-day liquidity. Greater borrow- ing with less collateral essentially equals a higher credit risk to the lending bank, which then needs more capital held against that risk. Stranded assets should be viewed as extreme examples of transitional risk.

Assets are also stranded by physical climate change. From rising sea levels to extreme weather such as heat and wind events, climate change will cause significant disruption to business activity in impacted areas. This element of asset stranding sets it apart from compliance, making it more difficult for policymakers to reduce or manage through orderly planning

Losses from stranded assets are already expected to be substantial…

The Carbon Disclosure Project (CDP) is a ‘not for profit’ charity that runs the global disclosure system for investors, companies, cities, states, and regions to manage their environmental impacts.

A 2019 report published by CDP detailed what 215 of the largest global companies were expecting over five years.

- Total losses due to climate change could reach $1 trillion.

- Losses due to stranded assets could reach ¼ of the total, or $250 billion.

- Opportunities in a greener economic future outweighed the predicted losses.

The above illustrates the potential dilemma faced by firms and their bankers. Taking advantage of green opportunities requires investment and credit. This is increasingly made more expensive as more liquidity is needed for day-to-day compliance, while the asset valuation underwriting the credit falls.

Assumptions around government compensation may be misplaced and risky…

The concept of stranded assets is not new, but there is evidence that investors and credit providers assume that compensation will be offered where economic policy itself reduces asset values. This assumption may be leading to this risk being ignored.

The German climate policy involves a climate levy to reduce coal-generated electricity. Suphi Sen and Marie-Theres von Schickfus (University of Munich) studied the attitude of investors to the risk of stranded assets within German utility companies.

Share prices were tracked against three policy stages.

- Levy on carbon emissions

- Compensation mechanism

- Regulatory compliance checks

The most significant negative reaction in the share prices was in the third stage.

The conclusion was that compensation is assumed to the extent that the risk of non-compensated stranding was not considered material. This is a big assumption that is not based on the reality of the policies being explored across industries. The full study can be read here.

Banks are advised to include asset stranding in any analysis of their current or planned balance sheet.

Stranded assets risks exist in every sector…

Energy and transportation garner maximum attention when transition risk is discussed, but there is substantial risk across all commodities. Agriculture, for example, is facing multiple challenges globally.

- Policies aimed at reducing Greenhouse Gases (GHGs), including Nitrogen, Methane, and Carbon Dioxide could cause Beef, Soy, and Palm producers to abandon large areas of operation due to the cost of adaptation.

- Reforestation is widely seen as an urgent requirement to create effective carbon sinks (natural removal of CO2 from the atmosphere). The economics of reforestation result in significant opportunity loss for current owners of targeted land.

- Prevention of deforestation is a corollary of reforestation, but directly prevents planned economic use of land, resulting in significant loss of value to the owner.

Agriculture is just one example where policies that are discussed at Conference of Parties (COP) level, and adopted by governments, will witness downward changes in currently ‘priced-in’ collateral values. Similar points can be made across all industrial sectors. While cost of compliance is a ‘probability of default’ or liquidity issue, stranded assets are a ‘loss given default’ or a collateral value problem.

Banks need to include collateral value falls in their stress tests…

As banks create risk frameworks that are designed to include climate change as a factor, they must include the potential credit impacts from stranded assets.

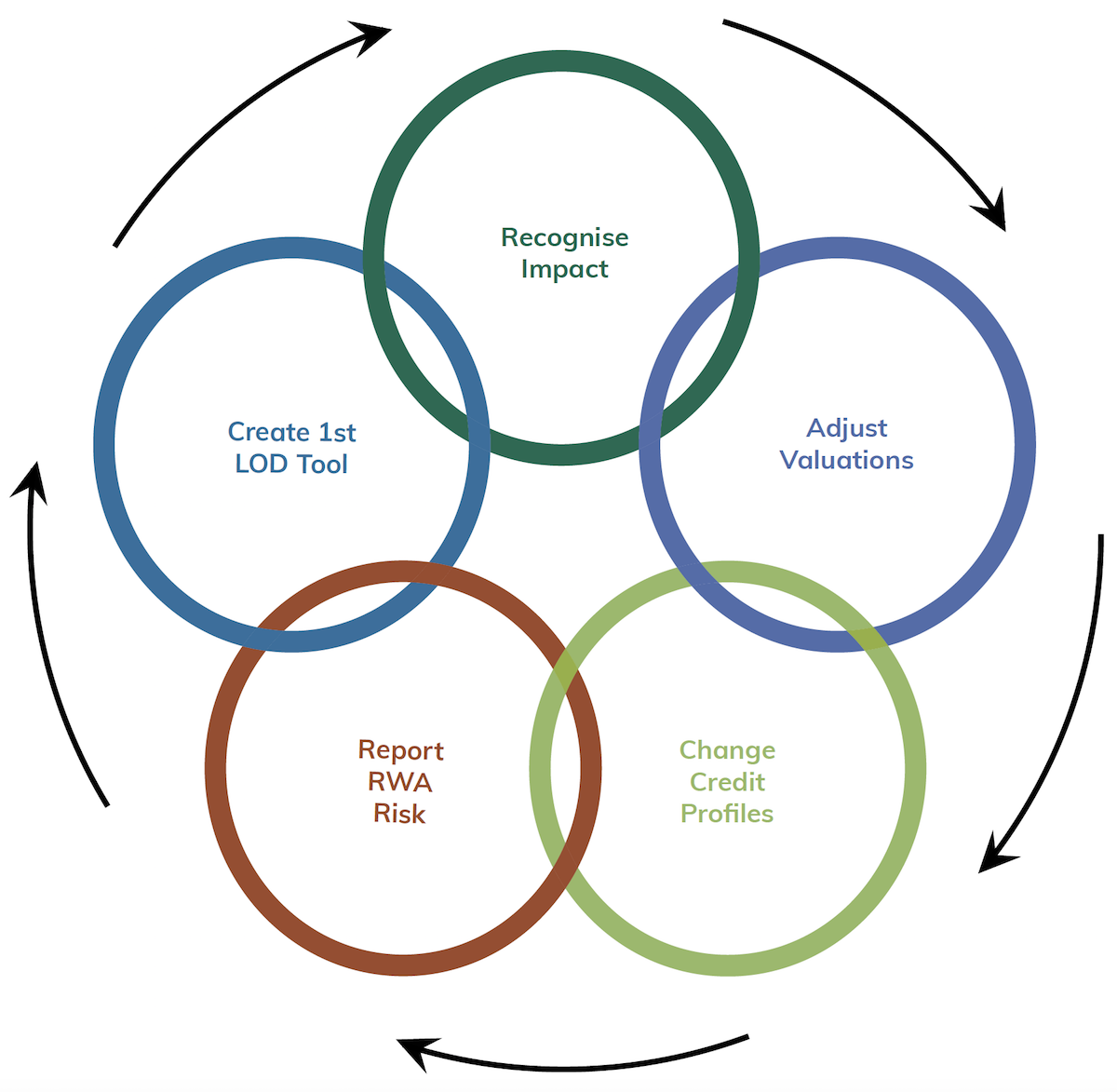

Building asset stranding into risk management involves:

- Recognizing the impact of climate change and climate policy on obligors’ assets.

- Adjusting the recoverable value of loans and credit facilities to reflect that impact.

- Ensuring that expected credit profiles change accordingly, through climate stress tests.

- Making resultant Risk Weighted Asset (RWA) provisions reportable metrics from the stress tests.

- Creating ‘first line of defense’ tools that allow the risk to be priced correctly into new and rolling credit facilities.

GreenCap can help…

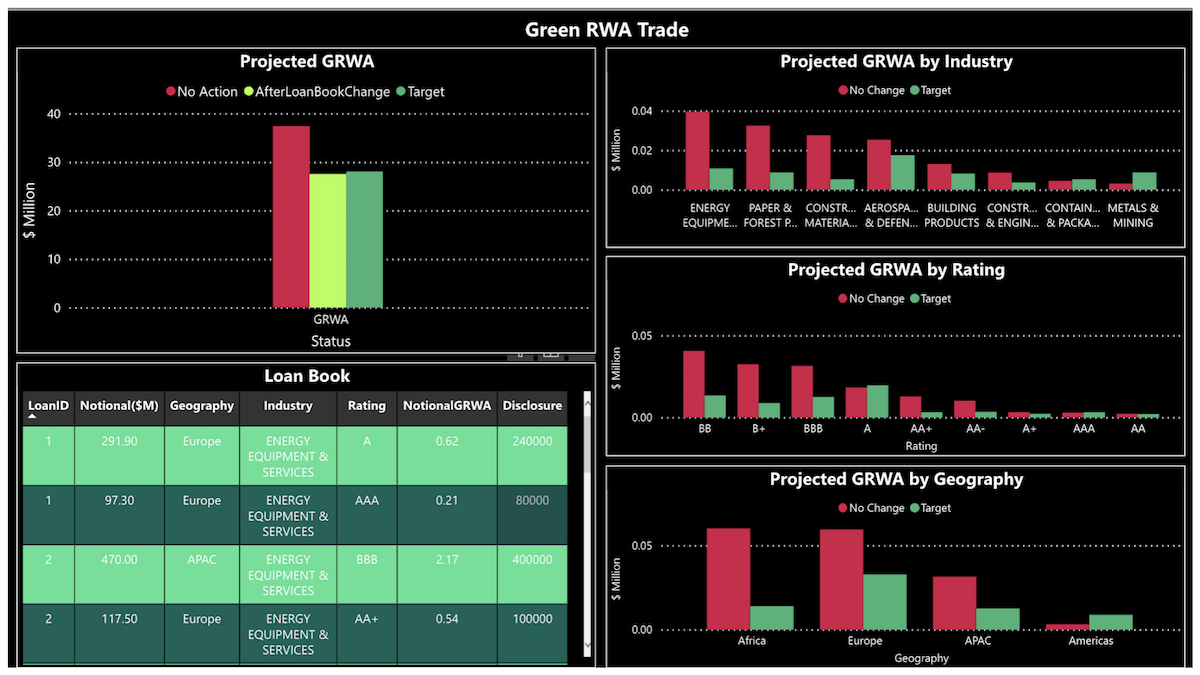

GreenCap is a ‘Risk As A Service’ (RAAS) solution that allows banks to assess the climate change risk to their loan books and balance sheets. Explicitly, this system incorporates the ability to repay and the recoverable value of collateral from the borrower, as key drivers of the financial risk faced by banks as lenders.

Banks can set and track risk-based targets against specific climate pathways with GreenCap. The calculation includes:

- Expected global and local losses by climate pathway.

- Sector-based benchmark correlation to expected losses.

- Loan level adjustments from mitigation investments and adaptations.

- Liquidity and asset valuation inputs.