New and agile risk management strategies are required to mitigate the financial impact of climate change

Banks will witness a dramatic shift in risk management in the coming decade…

Climate change is now forcing them to reassess the way they measure credit risk, specifically the way they incorporate the impact of climate change into their analysis.

There is a significant amount of climate-related analysis available to banks that covers core industries, from agriculture to power generation. Banks, however, need to look beyond the top-level analysis as they are exposed to the reverberant financial impact of climate change throughout entire supply chains.

Banks offer numerous supply chain financing options…

From the increased globalization of supply chains to ‘just in time’ economics, the way the world economy links together has never been so complex. To reduce any friction, the financial system has developed a number of financing tools in response to that complexity.

Traditional finance tools

- Loans – Normal commercial loans to support businesses.

- Drawdown credit facilities – Credit facilities pre-arranged to ease liquidity for firms through the general business cycle.

- Letters of credit/guarantees – Bank-banked assurances for specific payments made from the firm.

- Margin accounts – When firms hedge future inventory needs, banks provide credit facilities to pay margin calls as needed on behalf of the customer.

Supply chain specific tools

- Receivables discounting – Outstanding invoices are sold at a discount to financial institutions in order to create cash injections, often to cover seasonal liquidity variances.

- Forfaiting – Banks advance cash to sellers against invoices. These are guaranteed by the buyer’s bank.

- Factoring – Banks advance a percentage of invoices, with that percentage being based on the credit profile of both the seller and buyers involved.

- Payables financing – Banks provide the option to receive a discounted value of outstanding invoices, at a cost in line with the buyer’s credit profile.

- Loans against receivables – Banks provide loans based on future receivables.

- Distributor finance – Banks provide liquidity for manufacturers to cover periods before sales are made.

- Loans against inventories – Banks provide loans for warehousing of goods that are either pre-sold or unsold.

- Pre-shipment finance – Banks provide financing against purchase orders and pre-agreed commercial contracts.

It is clear that banks are exposed to any disruption or sudden credit impact all along the supply chain. It is equally clear, from the science and analysis that climate change will cause just such disruption.

Risk frameworks urgently need to include climate change…

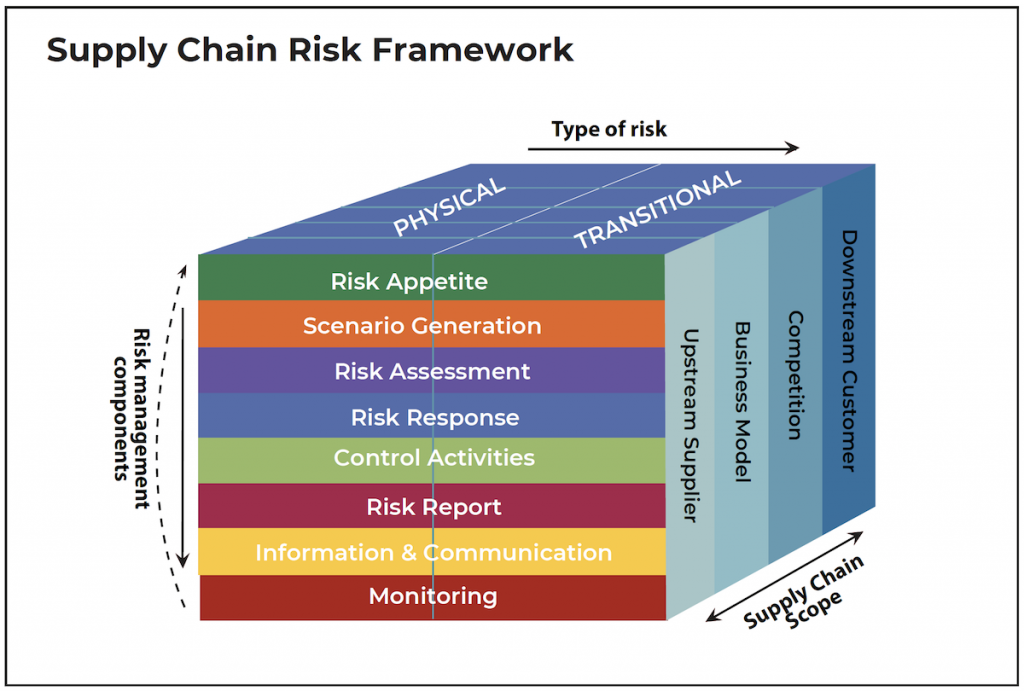

Incorporating climate risk into a bank’s risk framework and appetite is a challenge. In April, the Basel Committee on Banking Supervision (BCBS) published papers on both, the drivers of climate change related risk to banks, and emergent practices in the area. These papers are available here. What is clear from them is that credit risk associated with climate change is the principal concern for banks. This is justified as credit risk deterioration on the balance sheet will directly lead to higher RWA-based provision, and consequently to lower profitability and liquidity.

Two principal climate change effects will impact bank obligors:

Physical impacts – These are the disruptions to customers caused by the effects of physical climate change, from changing weather patterns to flooding and coastal erosion. All of these factors have, and will increasingly have, ramifications on global supply chains across all industrial sectors.

Transitional impacts – These are policies and measures taken by governments and regulators to curb climate change. They will cause huge disruptions to business flows, orphaning assets and even cause businesses to become unsustainable.

To effectively build these into existing risk frameworks means stress-testing the book against properly costed climate scenarios. This means utilizing scenarios created by the Intergovernmental Panel on Climate Change (IPCC) and costs determined by the Net Greening of the Financial System (NGFS). The difficulty starts when we have to decide on the costs that will indirectly impact customers throughout the supply chain. For this, we can refer to the research performed by the International Energy Agency (IEA), wherein the main impacts on key industries are detailed.

Ultimately, we have a new category of risk that allows us to categorize each obligor by its underlying industrial sector and apply a benchmark correlation to the overall loss, as predicted by the IPCC/NGFS/IEA research, by scenario. This, though, is only the beginning, as firms may:

- Take adaptive action to reposition themselves.

- Be impacted by both their downstream and upstream supply chains, with little control over them.

Banks will have to consider both these factors when it comes to increasing the accuracy of a specific firm’s correlation to the impacts.

Banks have a blueprint for detailed firm-specific risk analysis…

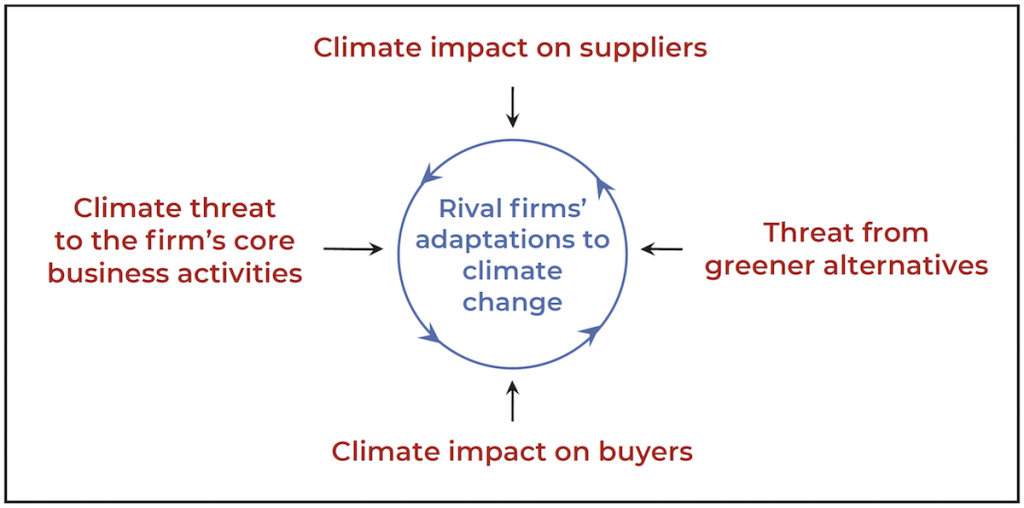

In order to analyze the impact of climate change on a firm, banks must return to a derivation of a familiar and accepted analysis model—Porter’s Five Forces. The reason for this is that there is not a large data set of scenarios and known outcomes to base correlations on. Without that, there is a need for fundamental analysis with some climate specific changes.

The forces that now need to be considered are:

- Climate impact on suppliers – Are the firm’s suppliers likely to be impacted by physical climate change or mitigation policy?

- Climate threat to the firm’s core business activities – Is climate change or policy likely to directly impact the client’s assets and areas of business?

- Rival firms’ adaptations to climate change – Are other firms in the same sector quicker to adapt to climate change?

- Threat from greener alternatives – Are alternatives that are more in line with the policies, public perception and physical reality of climate change, available?

- Climate impact on buyers – Can the firm still sell to its target market, or will climate change affect its buyers in such a way that the business model itself is unsustainable?

Using this analytic approach, banks can classify their books by loan in terms of the correlation of the obligor to the predicted loss arising from physical and transitional climate change. There is:

- A high-level loss across multiple sectors

- A benchmark loss by sector

- A scaled firm-level loss within each sector

This can also be used on new business to price climate-related effects into the credit facility effectively.

GreenCap can help…

GreenCap is a ready-to-use system, designed to assist banks in categorizing and assessing loans according to their exposure to climate change risk. The system also enables banks to price, manage, and mitigate that risk. This category of financial risk is new and will grow as we move towards 2030. GreenCap aims to ensure that banks remain profitable and on the right side of history.