Pathways and promises often fail to become policies. After Glasgow, banks will have to exercise careful judgement when selecting transition scenarios.

Conference of the Parties in Glasgow (COP26) has a long lineage…

The United Nations Framework Convention on Climate Change (UNFCCC) was created in 1992 to fight ‘dangerous human interference with the climate system’. The annual COP summits started in 1995, as a forum for the UNFCCC member countries’ governments. The intention was to determine hard strategies aimed at limiting global warming to levels at which the catastrophic effects of climate change can be avoided.

While each COP is significant, there are three key points in the timeline that need to be highlighted from a policy indication perspective:

COP3 – 1997 – Kyoto, Japan

The Kyoto protocol established targets for the reduction of a range of greenhouse gases (GHGs) including—carbon dioxide (CO2), Methane (CH4), nitrous oxide (N2O), hydrofluorocarbons (HFCs), perfluorocarbons (PFCs), and sulfur hexafluoride (SF6). The protocol was designed based on ‘common but differentiated’ responsibilities. This effectively meant that more developed countries were responsible for achieving the agreed targets. The first commitment period ran from 2008 to 2012, with all targets being met by the 36 countries that carried them. It should be noted that 9 countries achieved their targets by funding GHG reduction overseas, and several of them failed to take on new targets for the second commitment period.

COP15 – 2009 – Copenhagen, Denmark

The summit in Copenhagen was intended to define the second commitment period, meaning that targets would be agreed upon, and concrete plans formulated, to hold global warming to 2 degrees above 1990 levels. This amount of heating is considered to be the level at which the worst impacts of climate change could be avoided. Ultimately, the conference ended with a non-binding agreement being ‘taken note of’, stating that actions should be taken to achieve the 2-degree limit. No actual GHG targets were set or agreed upon.

COP21 – 2015 – Paris, France

The Paris edition saw a change in direction in the global climate change response. Rather than hard targets being set by the UNFCCC, countries agreed to determine, set, monitor, and report on their own reduction targets. There was a stipulation that each target must go beyond the previous one. The accord applies to developed and under-developed countries. This agreement effectively separated the targets for each country (self-set) from the overall group’s global warming aim of 2 degrees. It is important to point out that policies enacted to achieve compliance with the accord, are insufficient to meet the 2-degree warming limit.

These examples show that the UNFCCC and the COP series of summits most certainly look at the science and also accept that coordinated action is required. It is equally clear, though, that the transition targets and policies needed within that coordinated action are extremely difficult to agree upon by all.

COP26 is held at a crucial moment…

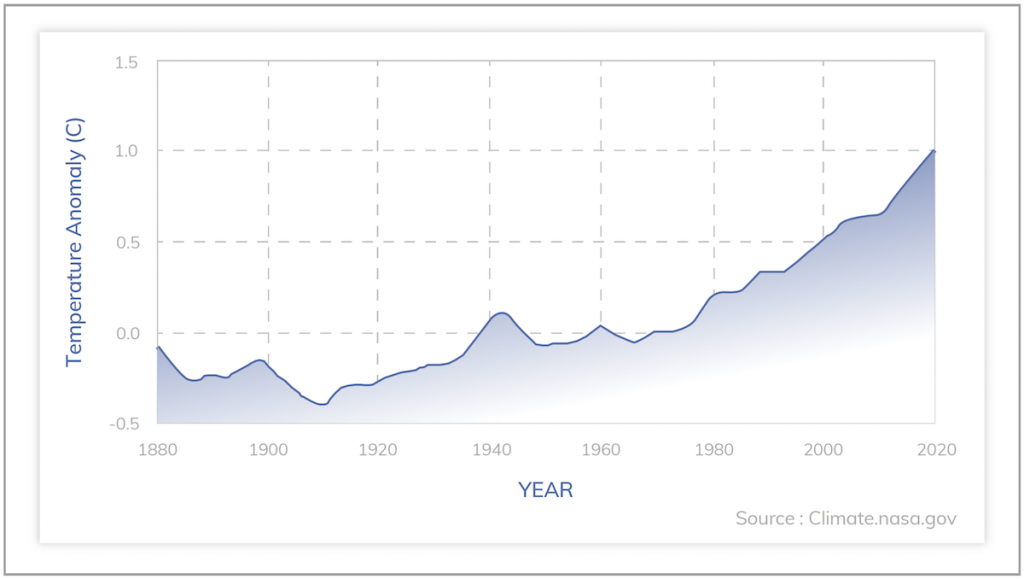

Despite protocols, targets, and pledges, the last decade has been the warmest on record, and there has been an alarming increase in both the number and intensity of extreme weather events. These events have included forest fires, floods, hurricanes, and heatwaves.

The undisputed scientific view is that GHG reduction has to accelerate to achieve:

- 2-degree global warming limit by 2100

- Carbon neutrality (net zero) by 2050

To reach carbon neutrality by 2050, policies and regulations need to be in place by 2030. This means that the conference in Glasgow must end with agreements across a range of areas including, but not limited to:

- Transition to electric vehicles

- Phasing out the use of fossil fuel

- Reforestation

- Oceanic pollution

- Agricultural practices

- Heating and cooling of buildings

Once these commitments are made, they also have to be ratified by the legislatures in the participating countries and followed by supporting policies.

Timing is key to environmental policies…

The commitments required at COP26 are guided by scientific work undertaken by the Intergovernmental Panel for Climate Change (IPCC). This results in numerous pathways to achieve various levels of global warming abatement over the 21st century. The 2- and 1.5-degree pathways detail the amount of GHGs that need to be cut and by when, to hold the world to the levels aimed at and committed to (1.5 degrees is an aim, while 2 degrees is a commitment). The most significant part of the pathway is the first decade, to 2030.

Governments can choose to undergo the green transition at whatever speed they like, but environmental economists refer to two distinct rates:

- Orderly – This refers to planning the transition, announcing policies, and managing the expected disruption in a way that avoids economic collapse in specific geographic areas.

- Disorderly – This refers to leaving policy-making until the latter part of the 2020s when dramatic changes would need to be implemented quickly to meet the GHG reduction targets.

The Net Greening of the Financial System (NGFS) is a group of central banks and economists who put costs against the orderly and disorderly transitional pathways created by the IPCC, and as such, provide the base for industry-specific analysis.

Banks must include policy speed in their stress testing…

Assuming that agreements are made and ratified, there will be a great deal of economic disruption over the next decade, due to this transition from a brown to a green global economy. Firms in all industries will be faced with onerous regulations that will severely impact their business models, profitability, and credit profiles.

Banks will be in the center of the transition, managing the investment flows and liquidity of both the outgoing economic model and the new, low GHG version. This role has to be fulfilled in the context of modern banking regulations; this means managing the resultant credit risks that such a wide-ranging economic switch will create.

Specifically, banks will need to:

- Analyze their current book of business to understand any additional credit risks it will face as the transition happens.

- Price new business appropriately to incorporate new regulations and adaptation costs that the underlying borrowers are facing.

- Stress test orderly and disorderly transitions to generate worst-case liquidity plans.

In many ways, this represents best practice risk management, simply applied to a new risk class—climate change.

Scenario data is available…

As mentioned above, between the IPCC and the NGFS, costed scenarios exist and are used to guide policymakers at the COP summit. Additionally, the International Energy Agency (IEA) tracks the progress of various sectors, serving as an indicator as to whether we are looking at an orderly or disorderly transition.

Using this data as the starting point, banks have to begin the work of constructing frameworks that can deal with climate change risks, and allow them to chart their transition course themselves. Without a full plan in place:

- Credit deterioration across brown industry borrowers will spike the (Risk Weighted Assets) RWA calculations, negatively affecting the bank profitability.

- Opportunities to fund green innovation will be lost.

- Liquidity stress tests will not include potentially devastating impacts of a disorderly transition, putting the bank itself at risk.

GreenCap can help…

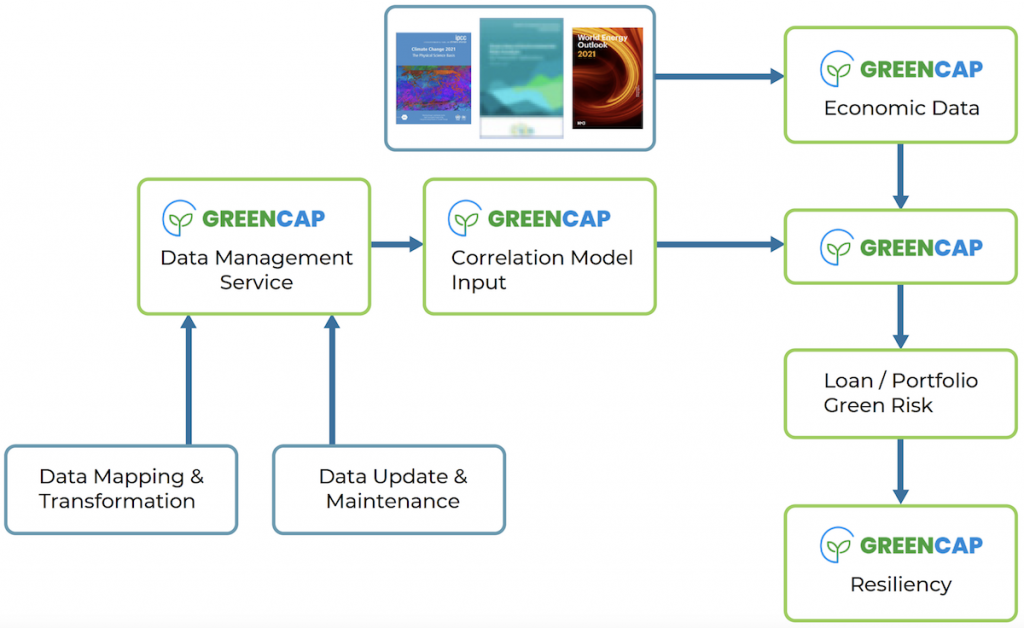

GreenCap is a risk system designed to analyze the credit impact of climate change on a bank’s loan book.

The system maps data to the loan book, and calculates credit deterioration, and the increase in RWA. This is then used to calculate climate-related spread by facility and resiliency of the loan or balance sheet.

Working at loan through to full balance sheet level, GreenCap has functionality to help banks build finance-based advisories as well as long-term transition strategies that can be communicated to stakeholders and used as sustainability reporting metrics.