The Recent Un Climate Meetings in Bonn did Little To Remove Uncertainty from the Needed Green Transition, but They did Highlight the Need for Banks to Prepare for a Number of Possible Outcomes.

Bonn, the bridge between Scotland and Egypt…

The June UN Framework Convention on Climate Change (UNFCCC) climate convention in Bonn was both the first major UN climate event since COP 26 in Scotland, and the staging event to set up COP 27, to be held in Egypt in November. The plan was to begin negotiations for the implementation stage, but that ambition was seriously dimmed by the shadow of six months of the war in Ukraine and its impact on food and energy supply chains.

Instead of seeing a post-pandemic ‘build back better’ commitment to strengthen national plans to meet the more aggressive targets on global warming (limiting that rise to 1.5 degrees above pre-industrial levels by 2100), there was a return to traditional areas of dispute between the developed and developing nations.

The status of national commitments is such that if all were met, as they stand, the 2100 average temperatures would be 2.4 degrees above pre-industrial levels, missing both the 1.5 and 2- degree targets. This climate route would inevitably see a switch of funding to be imperative from mitigation to adaptation.

While the details are complex, the unresolved points between the developed and developing countries include, at a high level:

- Loss and Damage – This is the cost of dealing with the effects that climate change has already caused in some poorer countries. The main contention is that this damage has been caused by developed countries and their industrial revolution but borne by those states that did not contribute to or benefit from it.

- Adaptation – Assistance in funding the adaptations that will be needed to supply energy and infrastructure in the developing world has long been included in COPs, as these countries are effectively required to build their economies and transition to a greener future simultaneously.

- Mitigation – This is the extent to which the burden of CO2 reduction falls differentially on the two brackets (developed and developing). This is contentious and can lead to perceived anomalies such as China and India, both being prominent emitters and sitting in the group of countries being asked to further reduce those emissions.

The Bonn convention highlighted consistent areas of difference and did not act as the intended bridge between the Scottish and Egyptian COPs. At the same time, the climate policy ‘ratchets’, where each country strengthens its national targets by November 2022, are still in place, and these will become the real acid test as to how much damage has really been done to climate milestones for 2030, 2050 and 2100.

Steepening the ramp…

If the Bonn outcome is indicative of what can be expected at COP27, then it is likely that:

- National targets will be notionally strengthened, but not to the extent needed for the 1.5 or 2-degree targets

- The commitment to a 2-degree limit will be reaffirmed with promises to increase policy ambitions again in 2023

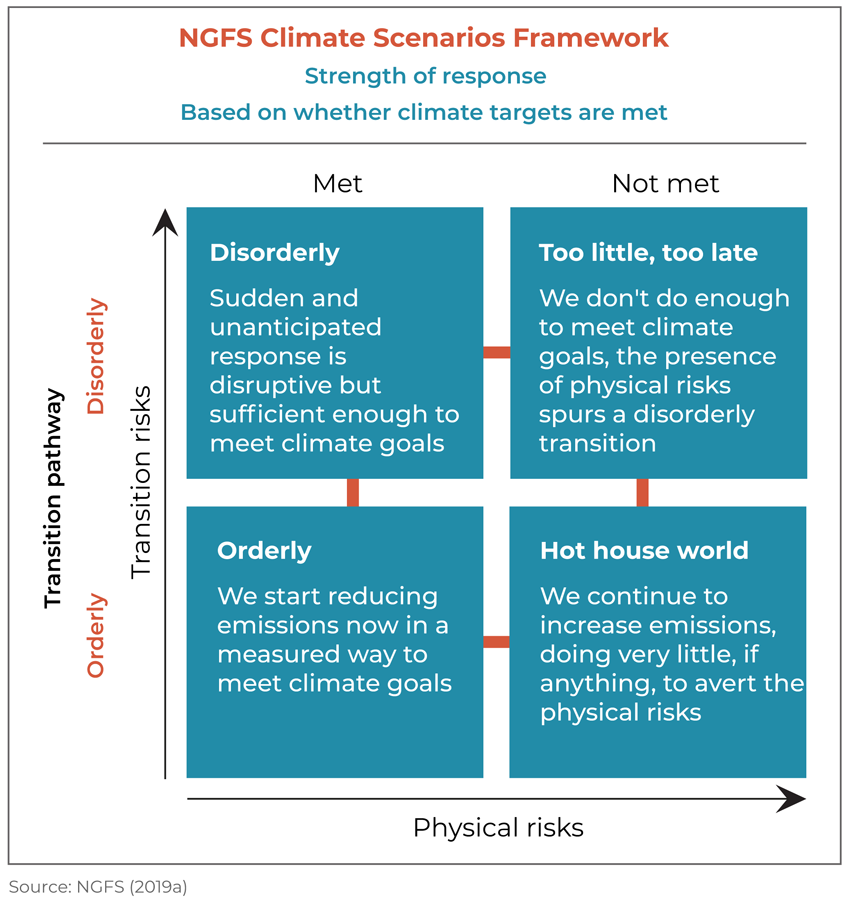

The effect of this from a banking risk management perspective is that we are moving into a higher probability of a ‘disorderly’ transition. Orderly and disorderly can be defined as:

- Orderly – The transition from a brown to a green economy is proactive, with clear, agreed targets at an international and national level, where governments, people, and companies have time to adapt to the transition in a way that avoids sudden draconian measures that derail corporate planning and business models.

- Disorderly – Climate planning is more ad-hoc and reactive, forcing firms to comply with sudden regulatory changes and severely impacting their ability to align their corporate strategy with a well-laid-out transition plan.

As unfortunate as the situation is, work has been done by the ‘Network for Greening the Financial System’ (NGFS) group and bodies such as the ‘International Energy Agency’ (IEA) to put dollar costs at the GDP level against current policies and various Intergovernmental Panel on Climate Change (IPCC) climate pathways. These include orderly and disorderly approaches.

This data is available and can be used as the basis for a range of risk scenarios, providing banks with a number of outcomes that can be used to plan for credit and liquidity events that may occur as a result of the final policy pathways in each jurisdiction.

The key is the fact that while the high-level commitment stands at 2 degrees, with every delay in putting national policies in place that could make it a reality, the ramp is just getting steeper.

Risk management is designed to quantify uncertainty…

To build a set of climate scenarios that can be used for credit pricing and risk capital estimations, banks must think about:

- Potential climate endpoints (expressed as degrees above pre-industrial levels by 2100)

- Milestones for those targets (typically CO2e levels by 2030, 2050, and 2100)

- Target economic sectors (energy, agriculture, infrastructure, etc.)

- Supply chain impacts from sector targets

- Adaptations already made by borrowers, in anticipation of regulation

- Impacts on the bank (expected and unexpected losses)

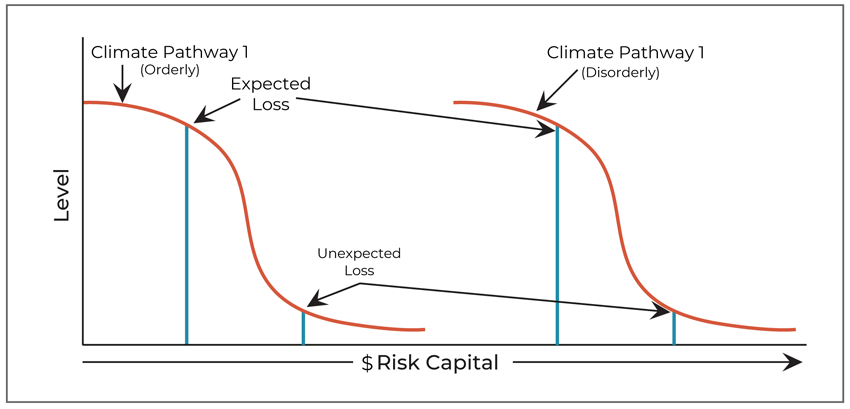

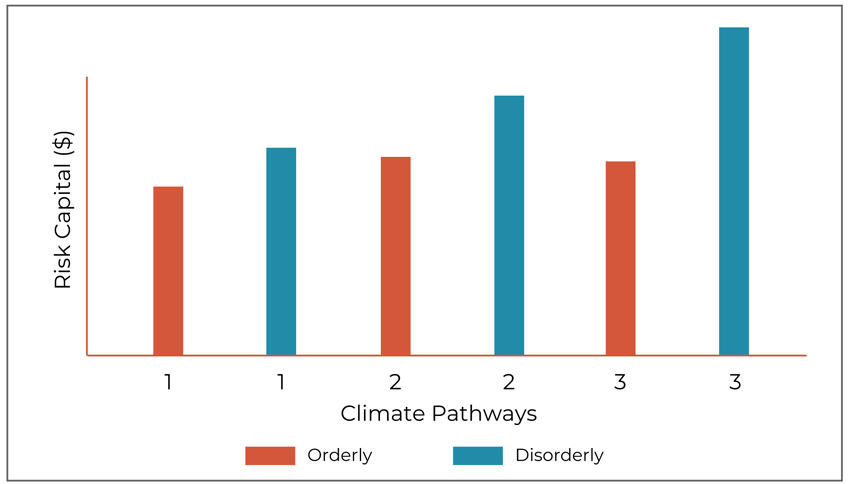

These become the parameters that define what is reported and how that information can be used. When we think about estimating expected and unexpected losses, it is helpful to visualize these on a scale where each progression from a low target pathway to a higher one, or from an orderly to a disorderly approach to that pathway moves the loss distribution further up the cost line.

Ultimately, providing a range of losses by an approach that can then be used to price credit facilities according to expected changes in risk profiles, as well as form part of contingency liquidity planning within the bank, as per the BASEL liquidity guidelines.

Once the range of outcomes is computed, it has to be kept up to date with policy announcements and the drift towards the ultimate pathway to be followed. The fact that this uncertainty will remain for some time means that banks will have to present a number of possible impacts and indicate where they believe the most likely route lies, both to senior management for liquidity strategy and external stakeholders as a core part of their sustainability planning. The fact that there is so much uncertainty also means that risk planning ought to focus on the period to 2030, and the first real CO2 milestones to remain in line with the policy makers’ agendas.

GreenCap can help…

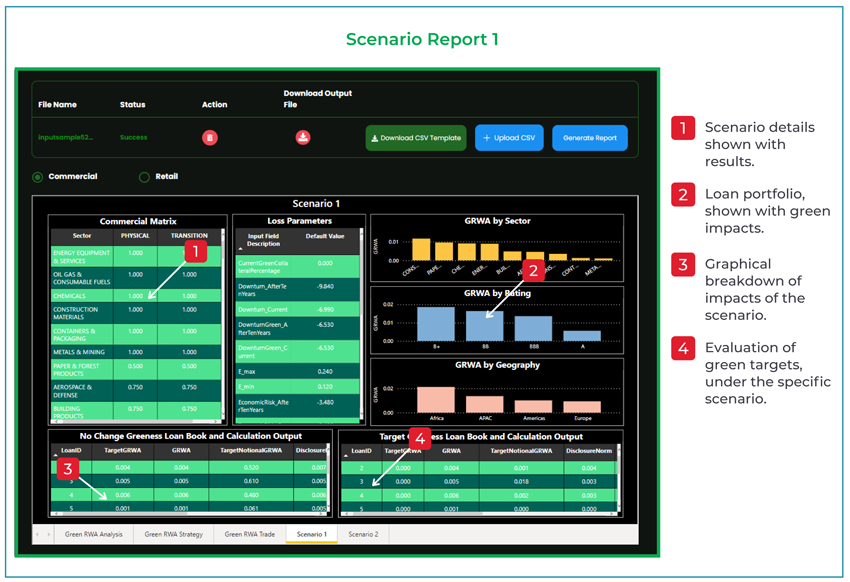

GreenCap is a ‘Risk as a Service’ (RaaS) solution that provides banks with the capacity to assess the impact on their balance sheets, of a range of climate pathways and scenarios. The solution:

- Allow scenarios to be expressed in terms of cost and targeted sectors

- Adaptations already in place to be reflected at loan level

- Increases in risk capital to be estimated by loan and scenario, as well as aggregated across the balance sheet

- Borrowers throughout the supply chain to be included in the analysis

- Loans to be repriced to take account of the most likely impacts

GreenCap is designed for quick implementation and to provide an intuitive user experience that allows banks to include the credit risks inherent in climate change to be reflected appropriately at all levels of the bank, in order that they can become a major factor in strategic planning.