Climate change awareness and rising concerns have directed focus on sustainable agriculture. The Environmental Defense Fund (EDF) has been exploring the role of banking in agricultural sustainability (Financing Resilient Agriculture.)

Its major findings are:

- The farming sector is at the front-line of climate change from the perspective of cause and effect – from contributing to temperature rise to facing the consequences: droughts and fires; and extreme rainfalls, storms, and flooding.

- These risks are particularly acute for smaller farmers.

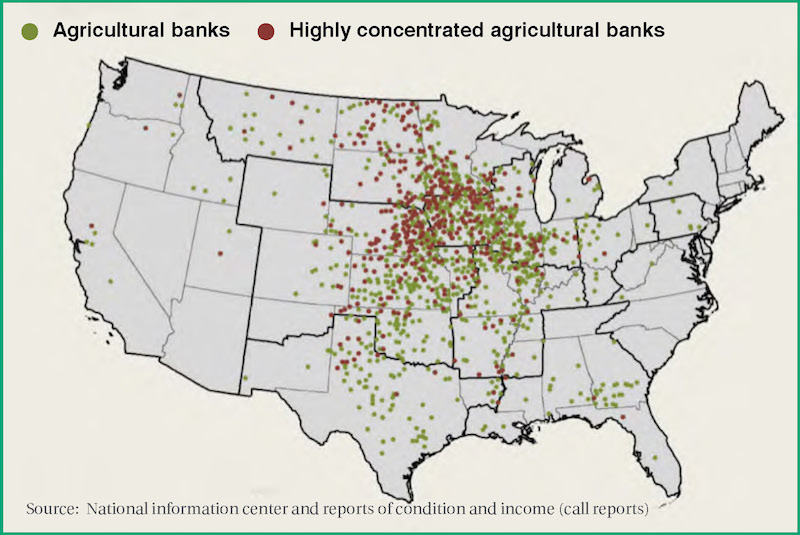

- 50% of lenders and banks to the sector have over 25% of their loan portfolio exposures to farming.

- Agricultural lending is local, leading to high geographic risk correlation.

A structured and systematic financial backbone for a climate-sustainable future will contribute towards:

- Stabilizing crop yields and long-term financial viability in the face of climate change.

- Enhancing water quality and quantity, biodiversity, reduction in greenhouse gas emissions, and carbon sequestration (climate change mitigation).

There are three key recommendations:

- Assessing climate risk at the bank/lending institution-level.

- Understanding the role of resilient agriculture in managing climate risk.

- Designing lending programs or products that support farmers in building climate resilience.

• Climate change issues facing agricultural banks in the US

The idea of including climate change into banking is not new. Internationally, several bodies including the Task Force on Climate-related Financial Disclosures (TCFD) have developed reporting frameworks for banks to audit their financing of CO2 emissions, referred to as scope 3 disclosures. However, their focus is on CO2, and it leaves the agricultural lending sector with a unaddressed areas including;

- Farms are exposed to the physical risks of climate change. This includes the impact of climate risk mitigation policy measures that will affect their capacity to conduct business.

- Sustainability issues facing farms and their lenders are highly complex, involving irrigation, water quality and greenhouse gasses such as methane – one of the main issues with beef farming.

- Lenders to the agricultural sector are exposed to much more than physical risks to their farms. They are typically involved in the entire supply chain financing, from equipment to processors and transportation.

The report makes it clear that banks are an integral part of the farming ecosystem and will play a vital role in creating financing and lending frameworks and products to enable the US agricultural sector to transition towards a greener, more viable future.

• Response to the emerging crisis

This decade is critical for changes in energy production and usage as well as agricultural production. Banks must be able to predict where risks would change across the supply chains. In effect, this would radically transform the risk profile of their balance sheets

Unfortunately, this is underway at the tail end of the regulatory responses to the 2008 credit crisis, whose measures include:

- Increased liquidity ratio reporting

- Liquidity Coverage Ratio (LCR)

- Net Stable Funding Ratio (NSFR)

- Introduction of liquidity simulations

- DFAST/CCAR

- Forward looking credit-based accounting provision

- Current Expected Credit Losses (CECL)

The result is clear – capital requirements as a buffer for systemic risks have become extremely onerous for banks. These regulations also imply that deteriorating credit exposures in their loan portfolios will be significantly costlier for banks. Banks are not only part of the local ecosystem, but they are facing the same risks as the farming sector.

• The banking sector is critical in the green transformation of the agricultural sector

With all the possibilities and unknowns inherent in the climate change challenge, it is simplistic to assume that very little can be done until reliable data is available to make rational decisions. The agricultural sector needs financial backbone and support now. This implies creating new lending frameworks and products and actively working with the agricultural sector to price farming loans to encourage sustainability.

Banks should price evolving changes in creditworthiness in the agricultural sector:

- Positively, by farms adopting practices that adhere to climate and environmental policies, as well as ensuring protection from physical effects.

- At the same time, they must not ignore potential regulations until enforcement is imposed on them and fail to act to protect against physical impacts.

Banks need a system to build climate change into their credit and pricing policies. This needs to be within their current frameworks for calculating the underlying risks. To state this in banking terminology – there needs to be appropriate basis point adjustment on loans that supports climate risk mitigation and supports the agricultural sector to survive and flourish.

• Greening the credit framework

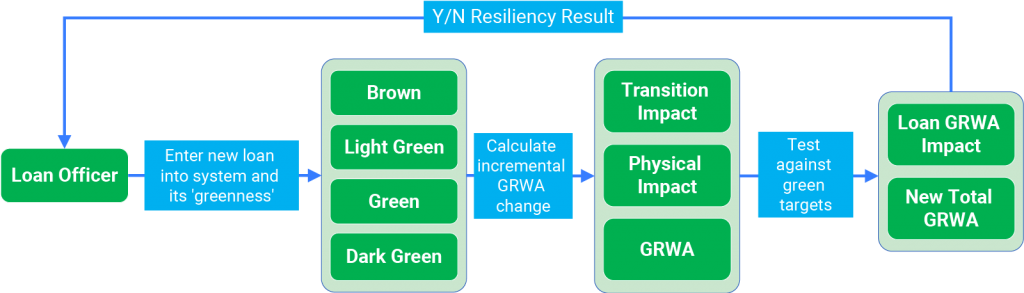

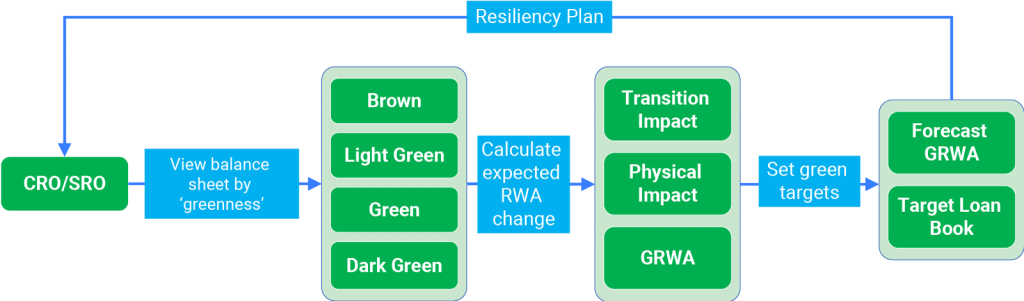

Greenpoint has built a framework that allows banks to calculate the transitional and physical risks into the credit-based capital (GRWA – Green Risk Weighted Assets) of the banks’ balance sheets. Ultimately, this also allows pricing to be adjusted at the loan level to reflect sustainability efforts by the farm, creating a bottom-up approach to local banking.

By calculating and pricing resiliency into the rates, banks can work with their clients on an advisory level, bringing banking to the heart of environmental efforts.

From a top-down approach, banks can look at the whole supply chain, applying correlations to the impact. They can then adjust their strategies to avoid a ‘brown’ concentration that could be disastrous for banks if the crisis deepens along the worst predicted climate pathways.

Working with the data that is available and the best practices as advocated by the EDF, banks can structure their loan books and credit facilities to be fully prepared for the green future that lies ahead.

The system itself has been designed to be completely turnkey for Finastra clients and extremely simple to use for non Finastra banks.

Summary

There is a growing global and national interest in resolving the climate change challenge. We are already feeling the impact and US farmers are at the forefront of that change. Agricultural and community banks have to be active and integral to the system as it changes. To achieve this, they must maintain stability by using the optimal processes, the applicable data as it become available and by encouraging best practices. GreenCap has been designed and built with the goal to assist every bank in achieving those goals.