With increasing clarity on climate change, the roadmap to combat it is ever-evolving. to be a part of the solution, banks need to encode un guidance on responsible banking.

Governments around the world are making promises and commitments to limit global warming to 2 degrees (as measured against 1990 levels). Policies are being created to fulfill these promises but there is a huge funding gap that private finance must fill, measured in trillions of dollars. Banks will be the keystone in bridging it. The need to include climate change into risk frameworks of financial institutions is increasingly being accepted. Now, banks need a place to start their individual transformations.

To become an integral part of the climate solution, banks must do business in a way that upholds the spirit of the ongoing global changes, as well as align with the multitude of regulations they face locally. In 2019, to provide a framework for banks to build their future business plans, and as a part of their environmental program – ‘Finance Initiative’, the UN created 6 principles of responsible banking.

Before looking at them, it is important to understand what the UN defines as the goals that banks need to align with.

The United Nations has a list of 17 Sustainable Development Goals (SDGs)…

The UN has an agenda to support their 2030 ambition. Each member of the organization has signed up to it. This ambition can be summarized as 17 SDGs that deal with a range of interconnected issues, from poverty to climate change. The full list of SDGs is as follows:

- End poverty in all its forms, everywhere.

- End hunger, achieve food security and improved nutrition and promote sustainable agriculture.

- Ensure healthy lives and promote well-being for all at all ages.

- Ensure inclusive and equitable quality education and promote lifelong learning opportunities for all.

- Achieve gender equality and empower all women and girls.

- Ensure availability and sustainable management of water and sanitation for all.

- Ensure access to affordable, reliable, sustainable, and modern energy for all.

- Promote sustained, inclusive and sustainable economic growth, full and productive employment and decent work for all.

- Build resilient infrastructure, promote inclusive, and sustainable industrialization and foster innovation.

- Reduce inequality within and among countries.

- Make cities and human settlements inclusive, safe, resilient, and sustainable.

- Ensure sustainable consumption and production patterns.

- Take urgent action to combat climate change and its impacts.

- Conserve and sustainably use the oceans, seas and marine resources for sustainable development.

- Protect, restore and promote sustainable use of terrestrial ecosystems, sustainably manage forests, combat desertification, halt and reverse land degradation and halt biodiversity loss.

- Promote peaceful and inclusive societies for sustainable development, provide access for justice for all and build effective, accountable, and inclusive institutions at all levels.

- Strengthen the means of implementation and revitalize the global partnership for sustainable development.

While not all SDGs directly address climate change, almost half (highlighted in italics above), are highly correlated with the issue. Aligning with these is an essential part of the definition of responsible banking.

The 6 principles of responsible banking are laid out by the UN…

The guidance is detailed in 3 papers:

- The principles signature document

- The key steps to be implemented by signatories

- The reporting and self-assessment template

Together, these papers make up the Responsible Banking Framework, which has been signed up to, by 250 of the largest financial institutions, globally. The 6 principles themselves are built around the SDGs of the UN. This becomes evident as they are explored.

Principle 1 – Alignment

“We will align our business strategy to be consistent with, and contribute to individual needs and society’s goals, as expressed in the SDGs, the Paris Climate Agreement, and relevant national and regional frameworks.”

Each bank needs to select one or more of the SDGs. Once chosen by the bank, these should be built into the business plan in a way that management can monitor and enforce. This means:

- Identifying and correcting misalignments

- Building SDGs into mid- and long-term strategies

In terms of sustainability, the most obvious course correction would be to move the balance sheet towards businesses that are directly supportive of SDGs that specifically focus on climate change mitigation and adaptation. This does require a mechanism to properly quantify that correlation.

Principle 2 – Impact and target-setting

“We will continuously increase our positive impacts while reducing the negative impacts on, and managing the risks to people and environment resulting from our activities, products, and services. To this end, we will set and publish targets where we can have the most significant impacts.”

Essentially this principle directs banks to commit to responsible banking by actively setting targets against specific SDGs, and then monitoring and reporting their progress to management and external stakeholders.

The problem that banks face is that any targets in this area have to fit within existing regulatory reporting and accounting frameworks. These frameworks expect risks to be measured in specified ways, and capital to be set aside against them.

Principle 3 – Clients and customers

“We will work responsibly with our clients and our customers to encourage sustainable practices and enable economic activities that create shared prosperity for current and future generations.”

This speaks directly to the role of banks as ‘agents of change’. Banks are in a unique position to work with and incentivize corporate borrowers in a way that rewards sustainable business activities through lower borrowing rates. This should be the case as alignment with an SDG is also alignment with government aims, and therefore the expected policy. Assuming that policy follows commitment to an aim, businesses within the impacted sectors should experience an economic environment that becomes increasingly benign, as those policies move through legislation. Banks can price this expected future state into the borrowing rate for the loan.

This principle requires an understanding of the underlying business and likely direction of future climate policy. Banks can be valuable advisors as well as business partners in this area, making this principle one that is not only built into strategy but arguably defines it.

Principle 4 – Stakeholders

“We will proactively and responsibly consult, engage, and partner with relevant stakeholders to achieve society’s goals.”

This principle expects banks to use qualified third parties to ensure that their knowledge of the SDGs and firms impacted by them is as complete as possible. Activity in terms of advisory, target-setting, and strategy alignment should be based on the best possible information in the area of climate change transition, and adaptation.

Principle 5 – Governance and culture

“We will implement our commitment to these principles through effective governance and a culture of responsible banking.”

This principle expects a bank to not only set targets that support specific SDGs, but make these targets a core part of management reporting and concern. This top-down approach must also be augmented by empowering, if not encouraging, a bottom-up approach of meeting these targets on a loan-by-loan basis. Cultural change requires a whole-bank approach to the goal.

Principle 6 – Transparency and accountability

“We will periodically review our individual and collective implementation of these principles and be transparent about, and accountable for our positive, and negative, impacts to society’s goals.”

This principle calls on banks to make their sustainability targets public, report on progress against them, and be fully transparent to external stakeholders about how the goals are being achieved.

These principles can be viewed as extending an existing risk management framework towards the area of climate change and sustainability. There are specificities in adopting the principles, requiring metrics and KPIs to be defined against SDGs. These principles should act as signposts to opportunities for banks to thrive in a greening economy, rather than as more ‘red tape’ to hamper growth.

Banks need to be mindful of existing regulations…

Selecting SDGs and setting targets can be misleadingly simple. Since the 2008 crisis, a series of regulations have been imposed on banks from liquidity stress testing to IFRS9/CECL accounting standards. These require them to hold significantly more capital in High Quality Liquid Assets (HQLA) to cover credit risks that may materialize in the future. If proper planning is not applied to SDG selection or target-setting, the bank may find itself financing activities that are seen as speculative or risky. Increasing risk in this way would lock up capital and ultimately decrease profitability.

This can be avoided by simultaneously applying a forward-looking credit risk approach, to the greening of the world economy, and actively adjusting risk weightings to reflect the most likely future economic conditions. A forward-looking credit approach to climate change takes more time to implement, but ultimately creates a truly sustainable business model and strategy that puts the bank firmly on the right side of history.

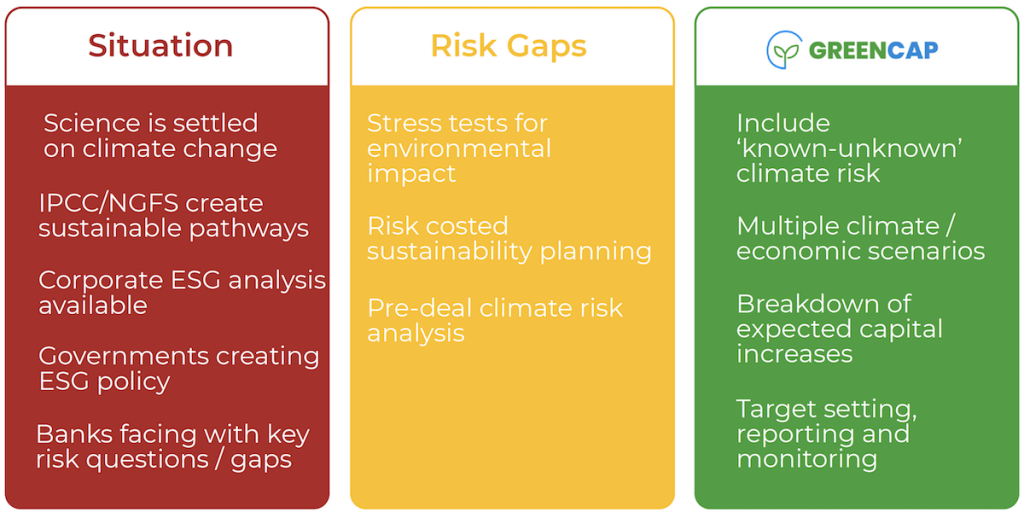

GreenCap can help…

GreenCap is a risk system that is purpose-built to:

- Assist banks in creating and monitoring sustainability targets.

- Bridge the gap between traditional banking credit risk measures and climate change risk management.

- Enable banks to work directly with customers to incentivize sustainable business practices.

Using GreenCap as the risk engine, banks can adopt the UN’s principles of responsible banking, and create opportunities to finance a sustainable future for themselves and their customers.