2021 ended with hope of a revitalized fightback against climate change. In the end, governments saw a year of inflation, European war, and struggles to regain pre-pandemic momentum. Central bankers, however, made significant climate progress. Banks need to follow these regulatory propositions carefully as they are likely to dominate the coming years.

The Basel Committee on Banking Supervision (BCBS) has climate change on the top of its agenda…

The BCBS has wrestled with encoding climate change into risk management for a while, and has released a series of consultative papers including:

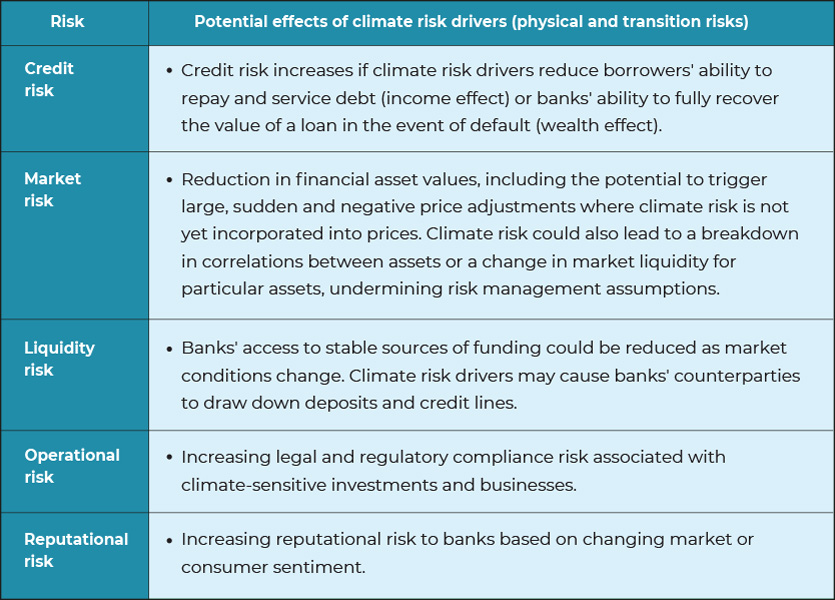

April 2021 – ‘Climate-related risk drivers and their transmission channels’

This report looks at, and defines, financial risks to banks that need to be considered in the context of climate change. While the report covers all aspects of risk management, positioning these within the overall Basel framework, it specifically considers how microeconomic, macroeconomic, governmental, and supply chain impacts need to be built into climate considerations.

Credit risk and its oversized contribution to potential climate-related losses are highlighted, as is the fact that it is the risk area that has seen the most work in terms of solution development.

In the accompanying publication, ‘Climate-related financial risks – measurement methodologies’, solution methodologies were also discussed, to the extent they were available in April 2021.

June 2022 – ‘Principles for the effective management and supervision of climate-related financial risks’

This publication details 18 principles that the committee sees as key for banks, and supervisors, to properly account for climate change within banks’ risk management divisions. Each of these principles is expanded upon, and directly linked to an existing standard principle.

Principle 1: Banks should develop and implement a sound process for understanding and assessing the potential impacts of climate-related risk drivers on their businesses and on the environments in which they operate. Banks should consider material climate-related financial risks that could materialize over various time horizons and incorporate these risks into their overall business strategies and risk management frameworks. [Reference principles: BCP 14, SRP 30, Corporate governance principles for banks]

Principle 2: The board and senior management should clearly assign climate-related responsibilities to members and/or committees and exercise effective oversight of climate-related financial risks. Further, the board and senior management should identify responsibilities for climate-related risk management throughout the organizational structure. [Reference principles: BCP 14, SRP 30, Corporate governance principles for banks]

Principle 3: Banks should adopt appropriate policies, procedures, and controls that are implemented across the entire organization to ensure effective management of climate-related financial risks. [Reference principles: BCP 14, SRP 30, Corporate governance principles for banks]

Principle 4: Banks should incorporate climate-related financial risks into their internal control frameworks across the three lines of defense to ensure sound, comprehensive and effective identification, measurement and mitigation of material climate-related financial risks. [Reference principles: BCP 26, SRP 20, SRP 30, Corporate governance principles for banks]

Principle 5: Banks should identify and quantify climate-related financial risks and incorporate those assessed as material over relevant time horizons into their internal capital and liquidity adequacy assessment processes, including their stress testing programmes where appropriate. [Reference principles: BCP 15, BCP 24, SRP 20, SRP 30]

Principle 6: Banks should identify, monitor, and manage all climate-related financial risks that could materially impair their financial condition, including their capital resources and liquidity positions. Banks should ensure that their risk appetite and risk management frameworks consider all material climate-related financial risks to which they are exposed and establish a reliable approach to identifying, measuring, monitoring, and managing these risks. [Reference principles: BCP 15, SRP 30]

Principle 7: Risk data aggregation capabilities and internal risk reporting practices should account for climate-related financial risks. Banks should seek to ensure that their internal reporting systems are capable of monitoring material climate-related financial risks and producing timely information to ensure effective board and senior management decision-making. [Reference principles: BCP 15, SRP 30, Principles for effective risk data aggregation and risk reporting]

Principle 8: Banks should understand the impact of climate-related risk drivers on their credit risk profiles and ensure that credit risk management systems and processes consider material climate-related financial risks. [Reference principles: BCP 17, BCP 19, SRP 20, Principles for the management of credit risk]

Principle 9: Banks should understand the impact of climate-related risk drivers on their market risk positions and ensure that market risk management systems and processes consider material climate-related financial risks. [Reference principles: BCP 22]

Principle 10: Banks should understand the impact of climate-related risk drivers on their liquidity risk profiles and ensure that liquidity risk management systems and processes consider material climate-related financial risks. [Reference principles: BCP 24, Principles for sound liquidity risk management and supervision]

Principle 11: Banks should understand the impact of climate-related risk drivers on their operational risk and ensure that risk management systems and processes consider material climate-related risks. Banks should also understand the impact of climate-related risk drivers on other risks and put in place adequate measures to account for these risks where material. This includes climate-related risk drivers that might lead to increasing strategic, reputational, and regulatory compliance risk, as well as liability costs associated with climate-sensitive investments and businesses. [Reference principles: BCP 25, Principles for the sound management of operational risk, Principles for operational resilience, SRP 20, SRP 30]

Principle 12: Where appropriate, banks should make use of scenario analysis to assess the resilience of their business models and strategies to a range of plausible climate-related pathways and determine the impact of climate-related risk drivers on their overall risk profile. These analyses should consider physical and transition risks as drivers of credit, market, operational, and liquidity risks over a range of relevant time horizons. [Reference principles: BCP 15, Stress testing principles]

Principle 13: Supervisors should determine that banks’ incorporation of material climate-related financial risks into their business strategies, corporate governance, and internal control frameworks is sound and comprehensive. [Reference principles: BCP 9, BCP 14, BCP 26, SRP 20]

Principle 14: Supervisors should determine that banks can adequately identify, monitor, and manage all material climate-related financial risks as part of their assessments of banks’ risk appetite and risk management frameworks. [Reference principles: BCP 15, SRP 20, SRP 30]

Principle 15: Supervisors should determine the extent to which banks regularly identify and assess the impact of climate-related risk drivers on their risk profile and ensure that material climate-related financial risks are adequately considered in their management of credit, market, liquidity, operational, and other types of risk. Supervisors should determine that, where appropriate, banks apply climate scenario analysis. [Reference principles: BCP 17–25, Principles for sound liquidity risk management and supervision, Principles for the sound management of operational risk, Principles for operational resilience]

Principle 16: In conducting supervisory assessments of banks’ management of climate-related financial risks, supervisors should utilize an appropriate range of techniques and tools and adopt adequate follow-up measures in case of material misalignment with supervisory expectations. [Reference principles: BCP 8, BCP 9, SRP 10, SRP 20]

Principle 17: Supervisors should ensure that they have adequate resources and capacity to effectively assess banks’ management of climate-related financial risks. [Reference principles: BCP 9]

Principle 18: Supervisors should consider using climate-related risk scenario analysis to identify relevant risk factors, size portfolio exposures, identify data gaps, and inform the adequacy of risk management approaches. Supervisors may also consider the use of climate-related stress testing to evaluate a firm’s financial position under severe but plausible scenarios. Where appropriate, supervisors should consider disclosing the findings of these exercises. [Reference principles: Stress testing principles]

The overriding message is that the existing framework of risk management principles is sufficient to include climate change, as long as climate-specific scenarios and factors are included in the overall risk package. Principle 12 (scenario analysis) explicitly makes this point. It is an important point to emphasize, as it effectively means that the responsibility for including climate risk lies with the banks themselves and supervisors to judge.

December 2022 – ‘Frequently asked questions on climate-related financial risks’

In this document, which builds on the 18 principles of the previous one, it is emphasized that climate change impacts on counterparties’ capacity to cover their obligations, can, and should be, reflected in the Risk-Weighted Asset (RWA) calculations – ‘Climate-related financial risks can impact banks’ credit risk exposure through their counterparties. To the extent that the risk profile of a counterparty is affected by climate-related financial risks, banks should give proper consideration to the climate-related financial risks as part of the counterparty due diligence. To that end, banks should integrate climate-related financial risks either in their own credit risk assessment or when performing due diligence on external ratings.’

There is an unmistakable growth in strength in the messaging that banks and their supervisors need to:

- Work climate risk into their existing risk management frameworks

- Transparently show exactly how climate risk is being captured and transformed into financial risk

- Be flexible in the way that climate scenarios are parameterized

- Ensure that climate change specificalities are included at all levels and ‘lines of defense’

- Pay particular attention to how climate risks are manifested in impacted credit profiles and resultant economic capital charges

US regulatory bodies are creating frameworks based around the Basel concepts…

While the Basel Committee creates guidance, regulators within the US are building up their own sets of risk management requirements that either draw from or mirror the BCBS thinking.

The US has several bodies responsible for various parts of the financial system, and 2022 has seen progress from each of them.

October 2021 – Financial Stability Oversight Council (FSOC) releases its ‘Report on Climate-Related Financial Risk’.

This report assessed the entire landscape of the US financial market, with the aim of deepening the understanding of potential impacts and creating mitigation processes to protect the system from them. Sections included:

- Regulatory and Supervisory Engagement with Climate-related Financial Risk – Reviews the work underway across FSOC members on climate-related financial risks and financial stability.

- Climate-related Financial Risk – Data and Methods highlight the data and methodological challenges associated with the measurement of climate-related financial risks and potential approaches to meeting these challenges.

- Climate-related Disclosures – Discusses the critical role of consistent, comparable, and decision-useful climate-related disclosures for investors, financial institutions, regulators, and the public in the measurement of climate-related financial risks.

- Implications for Financial Stability Assessments – Presents key issues for assessments of the effect of climate-related financial risks on financial markets and institutions, emphasizing the need for measurement tools to assess such risks and the important role that scenario analysis can play in the development and deployment of these critical assessments.

- Council Recommendations – Synthesizes the analysis of the report through a set of recommendations that begin to address the challenges and needs identified throughout the reports

December 2021 – The Office of the Comptroller of the Currency (OCC) launched its ‘Draft Principles’, and sought comments from its members.

This document recognized the unique impact that climate change would have on financial institutions. The general principles dealt with physical and transitional risk, specifically in the areas of:

- Governance

- Policies, procedures, and limits

- Strategic planning

- Risk management

- Data, risk measurement, and reporting

- Scenario analysis

Importantly, these principles drew a clear distinction between how risks are typically managed, using historic data as the basis for forecasting, and climate risk’s dependence upon forward pathways. To this point, scenario-based analysis was specifically mentioned as the core tool for analysis. It is also notable that credit and liquidity risk were highlighted as key areas of concern when assessing climate change risk.

March 2022 – The SEC Proposes Rules to Enhance and Standardize Climate-Related Disclosures for Investors

These extensive and detailed rules are designed to be in line with the Task Force on Climate-Related Financial Disclosures (TCFD) and GHC protocol rules. They would effectively require US Securities and Exchange Commission (SEC) listing firms to disclose a range of climate-related information, including:

- Material impacts

- Carbon offsets or renewable credits as applicable

- Maintained internal carbon pricing

- Details of any scenario analysis

- Strategies for risk identification and mitigation

It is interesting for banks to note the kind of disclosures being mooted as these would go a long way to fill in the gaps left by top-down scenario analysis. Mitigation of impacts that would otherwise impact credit profiling and pricing are vital ingredients for a meaningful analysis to be performed.

December 2022 – Federal reserve releases in consultation document ‘Principles for Climate-Related Financial Risk Management for Large Financial Institutions’

This publication is the same as the OCC version above, but aimed at banks with $100b or more in assets.

The US systemic preparation for managing climate change is running behind its EU counterpart, but the direction of travel is clear. Banks will be increasingly expected to:

- Incorporate climate risks into their existing risk frameworks

- Isolate climate-specific impacts, including physical and transitional, on counterparty credit

- Use forward-looking climate scenarios based on evolving science

- Create strategies to mitigate long-term, specified, climate risks

- Set limits specific to climate risks

- Create climate risk reporting and governance throughout the organization

Europe has also increased the cadence on climate resiliency within banks…

The European Central Bank (ECB) has been publishing active guidance for a number of years,

November 2020 – ‘Guide on climate-related and environmental risks’, which detailed the supervisory expectations relating to risk management and disclosure. This had the same expectations as the BCBS guidance, specifically asking for – ‘Institutions are thus expected to comprehensively analyse the ways in which climate-related and environmental risks drive the different risk areas, including liquidity, credit, operational, market, and any other material risk to capital or any of its sub-categories that it is or might become exposed to.’

The 13 specific expectations of financial institutions are:

- Institutions are expected to understand the impact of climate-related and environmental risks on the business environment in which they operate, in the short-, medium- and long-term, in order to be able to make informed strategic and business decisions.

- When determining and implementing their business strategy, institutions are expected to integrate climate-related and environmental risks that impact their business environment in the short-, medium-, or long-term.

- The management body is expected to consider climate-related and environmental risks when developing the institution’s overall business strategy, business objectives, and risk management framework, and to exercise effective oversight of climate-related and environmental risks.

- Institutions are expected to explicitly include climate-related and environmental risks in their risk appetite framework.

- Institutions are expected to assign responsibility for the management of climate-related and environmental risks within the organizational structure in accordance with the three lines of defense model.

- For the purposes of internal reporting, institutions are expected to report aggregated risk data that reflect their exposures to climate-related and environmental risks with a view to enabling the management body and relevant sub-committees to make informed decisions.

- Institutions are expected to incorporate climate-related and environmental risks as drivers of existing risk categories into their existing risk management framework, with a view to managing, monitoring, and mitigating these over a sufficiently long-term horizon, and to review their arrangements on a regular basis. Institutions are expected to identify and quantify these risks within their overall process of ensuring capital adequacy.

- In their credit risk management, institutions are expected to consider climate-related and environmental risks at all relevant stages of the credit-granting process and to monitor the risks in their portfolios.

- Institutions are expected to consider how climate-related and environmental events could have an adverse impact on business continuity and the extent to which the nature of their activities could increase reputational and/or liability risks.

- Institutions are expected to monitor, on an ongoing basis, the effect of climate-related and environmental factors on their current market risk positions and future investments, and to develop stress tests that incorporate climate-related and environmental risks.

- Institutions with material climate-related and environmental risks are expected to evaluate the appropriateness of their stress testing with a view to incorporating them into their baseline and adverse scenarios.

- Institutions are expected to assess whether material climate-related and environmental risks could cause net cash outflows or depletion of liquidity buffers and, if so, incorporate these factors into their liquidity risk management and liquidity buffer calibration.

- For the purposes of their regulatory disclosures, institutions are expected to publish meaningful information and key metrics on climate-related and environmental risks that they deem to be material, with due regard to the European Commission’s Guidelines on non-financial reporting – Supplement on reporting climate-related information.

In keeping with the BCBS and US guidance that followed, the ECB does make specific points about longer-term horizons, the need for climate pathway-based scenarios, and the need to monitor credit impacts from transitional and physical factors in particular.

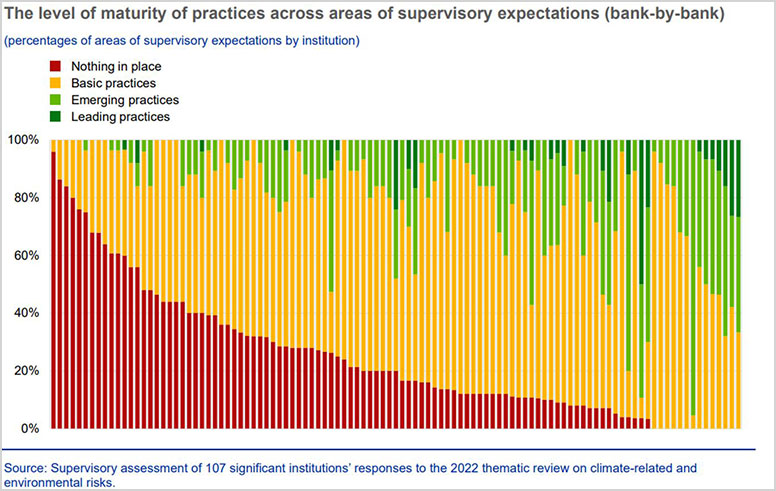

November 2022 – ‘Results of the 2022 thematic review on climate-related and environmental risks’ – The ECB published findings of its 2022 climate risk assessment involving 186 large banks. These findings included:

- The European Central Bank (ECB) has concluded its thematic review on climate-related and environmental risks of 186 banks with total combined assets of €25 trillion, which is aimed at fostering the alignment of the banking sector with its supervisory expectations.

- There is broad acknowledgment within the banking sector of the materiality of physical and transition risks within the current business planning horizon.

- Most institutions have now devised an institutional architecture to address climate-related risks, having clearly built up their capabilities compared with 2021.

- Some institutions have started to use transition planning tools, along with targeted client engagement, to enhance the resilience of their business model over longer time horizons, but a wait-and-see approach is still prevalent.

- Virtually all the institutions need to make far-reaching and enduring efforts to develop consequential, granular and forward-looking approaches to manage climate-related and environmental financial (C&E) risks.

- Institutions need to make further efforts to attain an acceptable degree of coverage of key portfolios, geographies, and risk drivers.

- Notwithstanding the progress made by many institutions on their implementation plans, the ECB expresses significant supervisory concern regarding the execution capabilities of around half of the institutions.

- The ECB’s remediation timelines require the institutions to ensure full alignment with all expectations by the end of 2024 and include the deployment of further supervisory instruments to instigate decisive actions where needed.

- On a more positive note, the good practices observed in numerous institutions demonstrate how the sector can harness innovation to address the prevailing challenges.

- The ECB also observed good practices being deployed in relation to broader environmental risks, with institutions leveraging existing climate-related risk approaches.

While progress is clearly being made, the central bank is still concerned that the banking sector may be left struggling with unmanaged risks as a transition to a greener economy progress.

November 2022 – ‘Good practices for climate-related and environmental risk management’ was published as a guide to banks, built on the findings of the stress tests earlier that year.

These best practices are centered on materiality, business strategy, governance and risk appetite, and risk management. Once again, the drive is for banks to identify material risks and encode these into their existing frameworks and lines of defense. Notably, an example of best practice includes –

“In order to reflect the forward-looking nature of risks, one institution leverages scientific climate pathway scenarios (e.g., Network for Greening the Financial System (NGFS) and Intergovernmental Panel on Climate Change (IPCC)) to assess physical risks and transition risks. These scenarios are then used to simulate the stress impact on the institution’s portfolios. For this, the institution employs a simulation tool that uses external data (e.g., asset-level data, price data) and client data to estimate the impact of the scenarios. Using this tool to model expected change to earnings before interest, taxes, depreciation, and amortization (EBITDA), the institution can estimate the PDs at the client-level under the various scenarios by 2030 (taking into account the longer time horizon associated with C&E risks). These stressed client-level probability of default (PDs) are then aggregated to the sector portfolio level, which allows the institution to generate sector-level heatmaps to identify which sectors are most impacted by C&E risks.

As the next step, the institution calculates the difference between stressed portfolio PD and baseline portfolio PD, which is the exposure at risk due to C&E risk. As the calculated difference surpassed the materiality threshold, the institution decided to allocate a dedicated economic capital buffer for that amount of exposure at risk, addressing both transition and physical risks.”

Other regions are developing supervisory approaches to climate risks…

In addition to the US and EU, central banks around the world are creating expectations for their regulated institutions to analyze, manage and report climate specifics risks. The vast majority of these can be linked to the BCBS guidance in direct ways.

One such example of this is Mauritius, where the stress test-based guidance is detailed in – ‘Constructing a feasible approach to estimating climate-related credit risk’.

It should be also noted that the UK, Brazil and China have all made progress on climate risk from within their financial regulation during 2022.

Financial risks depend, in large part, on government policy on climate change…

Perhaps the most difficult aspect of stress testing the financial impact of climate change is the interrelatedness of credit risk, transitional speed, and physical climate change. In short:

- A faster transition to a greener economy creates additional compliance costs for firms all along supply chains, increasing the short-term credit risk of ‘brown’ companies and their suppliers

- A slower transition increases the likelihood of worse physical impacts in the mid- to long-term, impacting collateral values and business models

- Increased physical climate change impacts increase the need for adaptation spend, which diverts money from mitigation investment, potentially creating a vicious cycle of ever-worsening physical conditions to contend with

For these reasons, and to properly capture the co-dependency of risk factors, banks must model specific, researched climate pathways into their stress testing, taking care to include existing mitigations already in place at the borrowers’ business. This was covered in – ‘Creating Meaningful Climate Change Scenarios in a Changing World’

The recent COP, held in Egypt, had grand ambitions to build on the 2021 Glasgow edition, covered in – ‘COP27 has a challenging agenda that banks must follow carefully’. In many ways, the aims were unfulfilled, but some progress was made regarding the long-running funding disagreement between developed and developing countries, covered in ‘COP27 – What must financial firms take away?’.

2022 in summary…

2022 was a challenging year for policymakers. The aftermath of the pandemic, along with the Russian invasion of Ukraine, meant that, in many ways, fighting climate change took a back seat. That did allow, however, central banks to make up some ground in terms of guidance and regulation.

While climate scenarios themselves evolve at the pace of policy inaction, the need to run and include them in risk appetites, strategy and management are more pressing than ever. Central banks are increasingly asking for this within standard risk reporting, and there is pressure for risk frameworks to have clearly set out climate limits and monitoring.

2023 will only see this trend accelerate.

GreenCap can help…

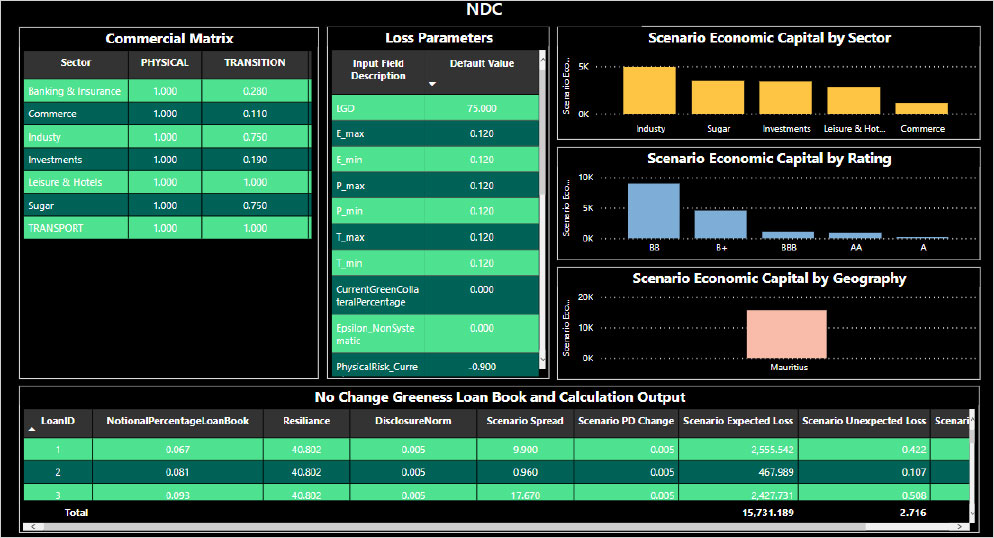

GreenCap is a turnkey Risk as a Service (RaaS) solution that allows banks to model multi-jurisdiction, multi-sector climate pathways as stress tests. This enables analysis at the loan level with results including:

- Changes in unexpected losses

- Changes in expected losses

- Changes in PD

The system is granular enough to give banks the capacity to include borrower-level mitigations and adaptations, providing a uniquely top to bottom analysis that can be used to:

- Report financial risk implications of climate change

- Create climate-based limits that can be used by the ‘second line of defense’

- Evolve strategies to meet high-level environmental commitments over longer timeframes